Greek debt crisis: Eurozone leaders mull demands as Athens imposes new laws and commits to privatisation

German chancellor warms Greece must re-established trust with creditors as heads of state take over talks from finance ministers

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Eurozone leaders are considering demands that Athens enact reforms to re-establish 'lost trust' before talks on a new rescue package can get under way.

Angela Merkel, the German chancellor, warned that talks would be tough, saying that "the most important currency has been lost: that is trust and reliability".

The proposed conditions include putting in place new laws by Wednesday; tough labour market and tax reforms; and a commitment to privatisation, according to Alex Stubb, the Finish finance minister.

He said the eurogroup ministers had drafted a "very ambitious proposal and report" for the leaders to debate.

The proposals follow two-days of discussions by ministers in the 19-member eurogroup.

The heads of state picked up the baton at an emergency summit on Sunday, after the eurogroup discussions came to a close.

Jeroen Dijsselbloem, the head of the eurogroup, said: "We've come a long way but a couple of big issues are still open so we're going to put it to the government leaders and it's up to them."

A split appears to have developed between France and Germany, with Germany, backed by the more fiscally conservative eurozone members, taking a firmer line.

A German proposal for Greece to take a temporary "time-out" from the euro appeared to be dismissed by Francois Hollande, the French president, who said Greece was either in or out of the euro.

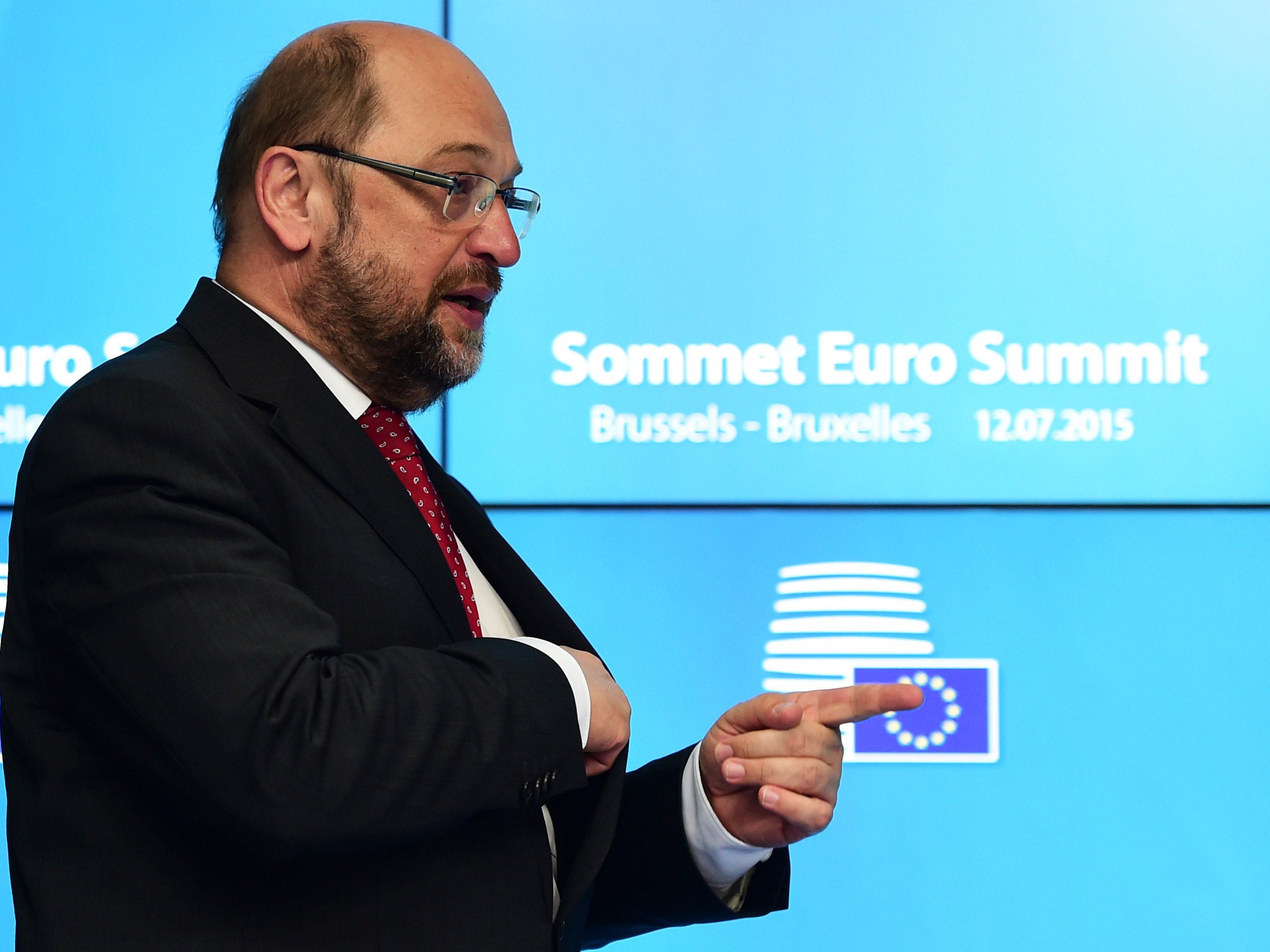

Martin Schulz, the president of the European parliament, also told a media conference that the "broad majority" of his colleagues in the parliament "subscribe to the view that Grexit is not an option".

Germany has also proposed the transfer of €50bn of Greek state assets into a fund to be managed by an external agency.

As the talks continue Greece is struggling to avoid financial chaos.

A €60 per day limit on cash machine withdrawals has been in place since June 28 and Greek banks have been closed for two weeks.

Greeks rejected an earlier bailout and its attached austerity conditions in a referendum this month, but a new proposal by Prime Minister Alexis Tsipras appeared largely in line with the creditors' initial proposals.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments