France's rogue trader: 'I was only a prostitute in great banking orgy'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

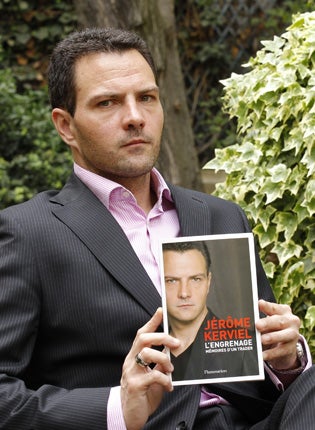

Your support makes all the difference.The five-billion-euro rogue trader Jérôme Kerviel will claim in a book this week that he was merely a "prostitute" in the "great banking orgy" and should be treated leniently in his trial next month.

Mr Kerviel, 33, has broken a long silence with an autobiography and two newspaper interviews in which he says that his €4.9bn losses in rogue trades in 2006-07 should be blamed on a world banking industry "disconnected from reality".

At his trial, which is due to begin in Paris on 8 June, Mr Kerviel and his lawyers evidently intend to cite the sub-prime crisis and the global financial meltdown of the past two years as the case for the defence. Mr Kerviel also appealed yesterday for other bank employees to break their omertà and testify on the "irresponsible" culture which prevailed at his own bank, Société Générale – and the whole industry.

On 24 January 2007, Société Générale stunned the world when it announced that it had lost around €4.9bn because of what it insisted were unauthorised deals by Mr Kerviel on the futures market for European share prices. The young trader immediately admitted to investigators that he had made enormous bets on the downward movement of shares but insisted that his superiors knew and had turned a blind eye – so long as he was winning.

He will go on trial for breach of trust, falsifying documents and hacking into the bank's computers to cover his tracks by posting fake trades. Possible fraud charges were abandoned when investigating magistrates accepted that Mr Kerviel had never attempted to embezzle a cent of the billions of euros that flickered across his computer screens.

If found guilty, the young man, now earning £24,000 a year as a computer programmer, faces up to five years in prison and could be ordered to pay up to €5bn in damages.

In his book to be published next week, L'engrenage ("The Vicious Spiral"), Mr Kerviel accepts that he enthusiastically plunged into the culture of the trading floor and that he ignored the official limits placed on his speculative trades. But he says that he rapidly became just "a number" and "a creature without any real identity". He says that he was "broken by the machine" and treated as a "prostitute" in the "great banking orgy".

In an interview yesterday with Le Journal du Dimanche, Mr Kerviel said that the bank accepted – and even tacitly encouraged – massive risk-taking, so long as a trader was making profits.

"I lived in a world completely disconnected from reality and in many ways irresponsible. The only concern was to make the most possible money in the shortest possible time," he said.

The ex-trader laughed off suggestions that he was driven by a desire to earn big bonuses. "Some [of my colleagues] got bonuses of €1m to €2m. I got one of the smallest bonuses, even though I was making 60 per cent of the profits of the whole team. That shows you just how screwed up the system was."

Mr Kerviel's "sub-prime crisis" defence may well be effective. The morality of the allegedly Anglo-Saxon banking practices which generated the crisis have been much discussed in France. The trial, which is expected to last two to three weeks, will be a reminder that large French banks were almost as involved as American and British ones. Another French banker, Fabrice Tourre, was at the centre of the property derivative deals which have brought legal action against Goldman Sachs in New York. There is no suggestion that Mr Tourre acted without the bank's authority.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments