Financier, Florian Homm, arrested after five years' flight

One of Europe's highest-profile fund managers caught in Italy

One of the world's most wanted fugitive financiers, whose activities allegedly contributed to investors losing hundreds of millions of dollars, is behind bars this weekend. Florian Homm, once voted hedge fund manager of the year and described by a friend as a cross between Albert Einstein and Mike Tyson, was arrested in, of all places, the Uffizi Gallery in Florence.

US officials have filed documents in Los Angeles that accuse him of orchestrating a share manipulation scheme that led to at least $200m (£134m) in losses for investors across the world. He has been charged with conspiracy to commit both wire fraud and securities fraud. If convicted, he faces up to 75 years in prison. He has denied wrongdoing.

The 6ft 7in German had been on the run for five years since fleeing his Mallorca home on 18 September 2007 – the same week that Northern Rock suffered its crisis. He left in a private plane with $500,000 stashed in his Calvin Klein underwear, briefcase and cigar box, and accompanied by his "friend and mule" Giorgio, who had another $700,000 about his person. We owe these details to Rogue Financier: The Adventures of an Estranged Capitalist, a book of memoirs he wrote from his place of clandestine exile.

In it, he wrote: "As the jet climbed I was profoundly unsettled, my mind in a dense fog. I was breaking all connections to my former existence: colleagues, clients, acquaintances, friends, bimbos, dogs, family and children, and annihilating my fortune in the process." And not just his. A divorce settlement agreed just before his disappearance gave his wife and children £18m worth of shares in his firm. By the time he was in the air, the holding was worth very little.

Mr Homm says he went to Colombia, although he is also known to have visited Venezuela in the past, since it was here in 2006 that he and a companion were shot by an assailant on a motorbike. The only time he surfaced was last year in Paris when, to promote his book, he met selected journalists who had been texted secret meeting places before being led to others; they were also scanned before their audience with Mr Homm.

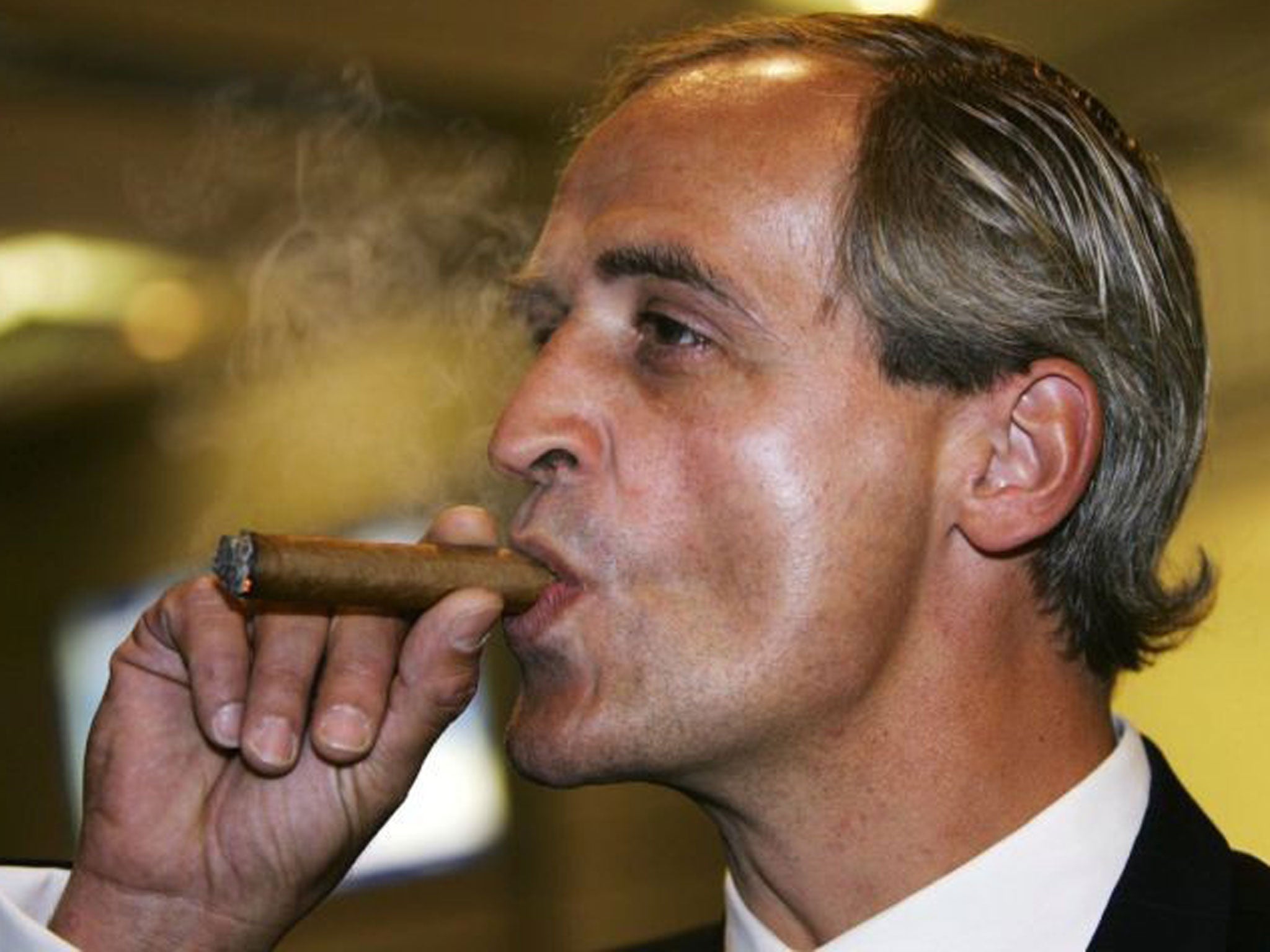

This was all a far cry from the years when he was one of Europe's highest-profile financiers, backing good causes, appearing on German chat shows brandishing a large Cuban cigar, and posing for photographs at his Mallorca home which he reportedly shared with a young woman described as a table dancer. He owed part of his fame to his rescue of the football club Borussia Dortmund from the brink of bankruptcy in 2004.

Mr Homm co-founded Absolute Capital Management Holdings Limited which managed nine hedge funds between 2004 and 2007. Using a Los Angeles brokerage company he co-owned, Mr Homm directed the hedge funds to buy billions of shares of US penny stocks, according to a criminal complaint. Authorities say that he controlled the trading among the hedge funds and manipulated the market.

After allegations were made by a whistleblower in 2006, prosecutors said Mr Homm dumped millions of dollars' worth of his own shares, which caused at least $200m in losses to investors. He and his co-schemers are believed to have made profits of more than $53m via trades.

The Securities and Exchange Commission filed a civil lawsuit two years ago in Los Angeles against Mr Homm and four other people, alleging a shares manipulation scheme to increase the value of Absolute Capital. This was done, it claims, by "portfolio pumping", which means that shares were bought and sold between connected parties to increase their apparent value.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks