Fears over Bangladesh's 'bank of the poor' Grameen Bank as commission says it should be split up

A Bangladeshi commission has recommended splitting-up the Nobel Peace Prize-winning Grameen Bank into 19 segments, sparking fears that the government is attempting to strengthen control over an institution which prides itself on having helped more than eight million impoverished people in the country from the grass roots up.

The Grameen Bank Commission was formed in May last year to scrutinise the legal status, financial transactions and succession rules of the micro-finance lender which has been dubbed the “bank of the poor”, as well as 48 other organisations that bear the Grameen tag.

One of the recommendations for restructuring the bank, made in the eight-page working paper titled “The future of Grameen Bank: Some Options”, involves awarding 51 per cent or more shares in the bank to the government, along with majority seats on the board of directors. The government currently owns three per cent of the bank based on equity, while the rest of the shares are held by the bank’s members, who are mostly women.

“The Grameen Bank Commission did not inform us about these plans,” Tahsina Khatun, a member of the board and also a micro-lender of the bank, told The Independent.

“We found out from local media reports last week that final decisions on these plans will be made on [2 July],” she added Khatun.

In August last year, the government of Bangladesh amended the 29-year-old law governing Grameen Bank, giving more power to the government-appointed chairman to choose the bank’s chief executive.

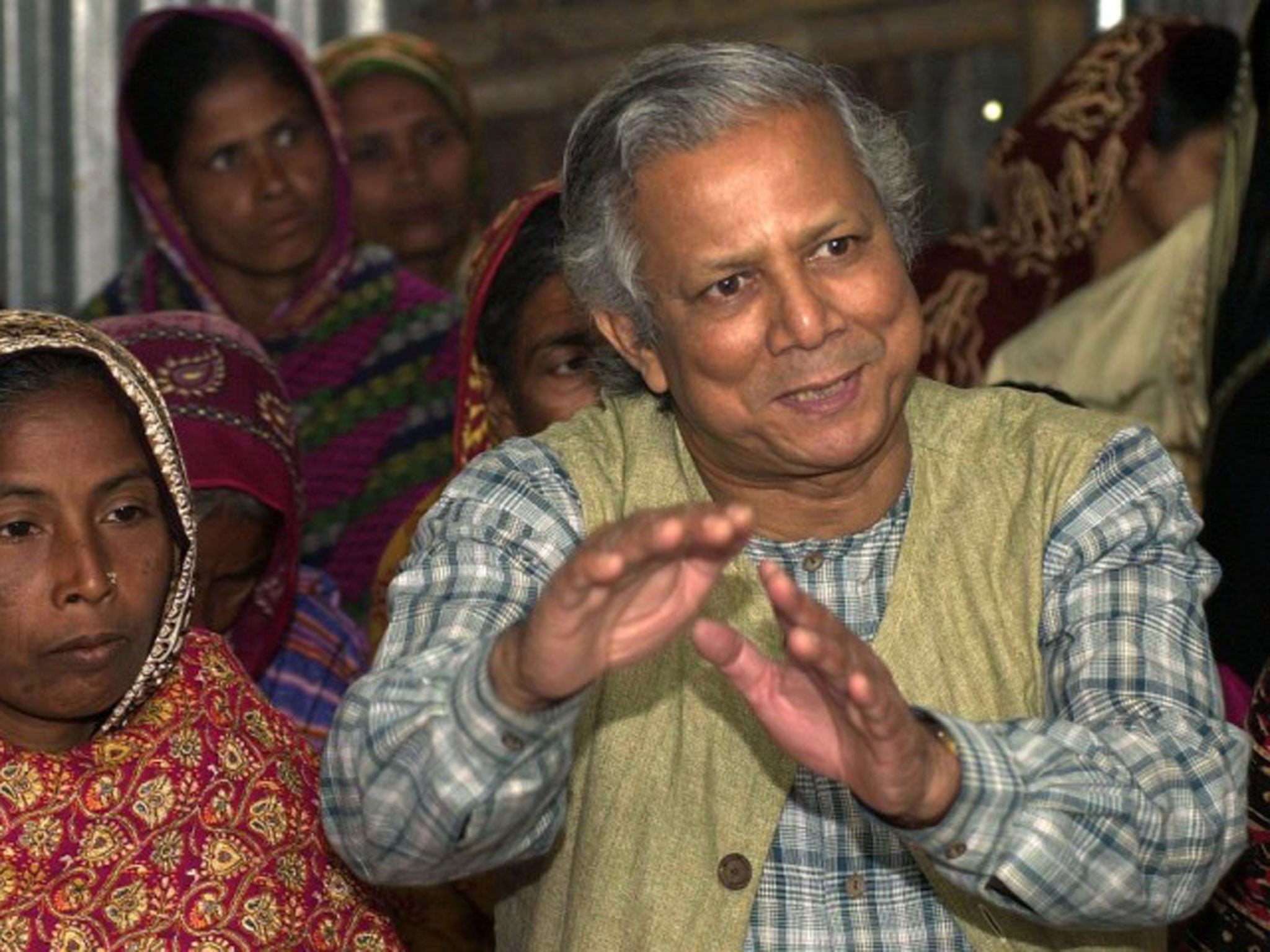

This followed the government’s removal of the bank’s founder, Muhammad Yunus, in 2011, as managing director of the bank in 2011. The government said he had passed retirement age.

“The government takeover of a sound financial institution owned by 8.4 million poor women would be a case of an extreme abuse of government power,” said Mr Yunus said.

“The Government has taken the step to destroy the [Grameen] bank,” Akbar Ali Khan, former finance secretary and adviser to Bangladesh’s former caretaker government, told local media. “It is totally a political decision.”

Final decisions on the restructuring of the bank based on the commission’s recommendations are due on 2 July.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks