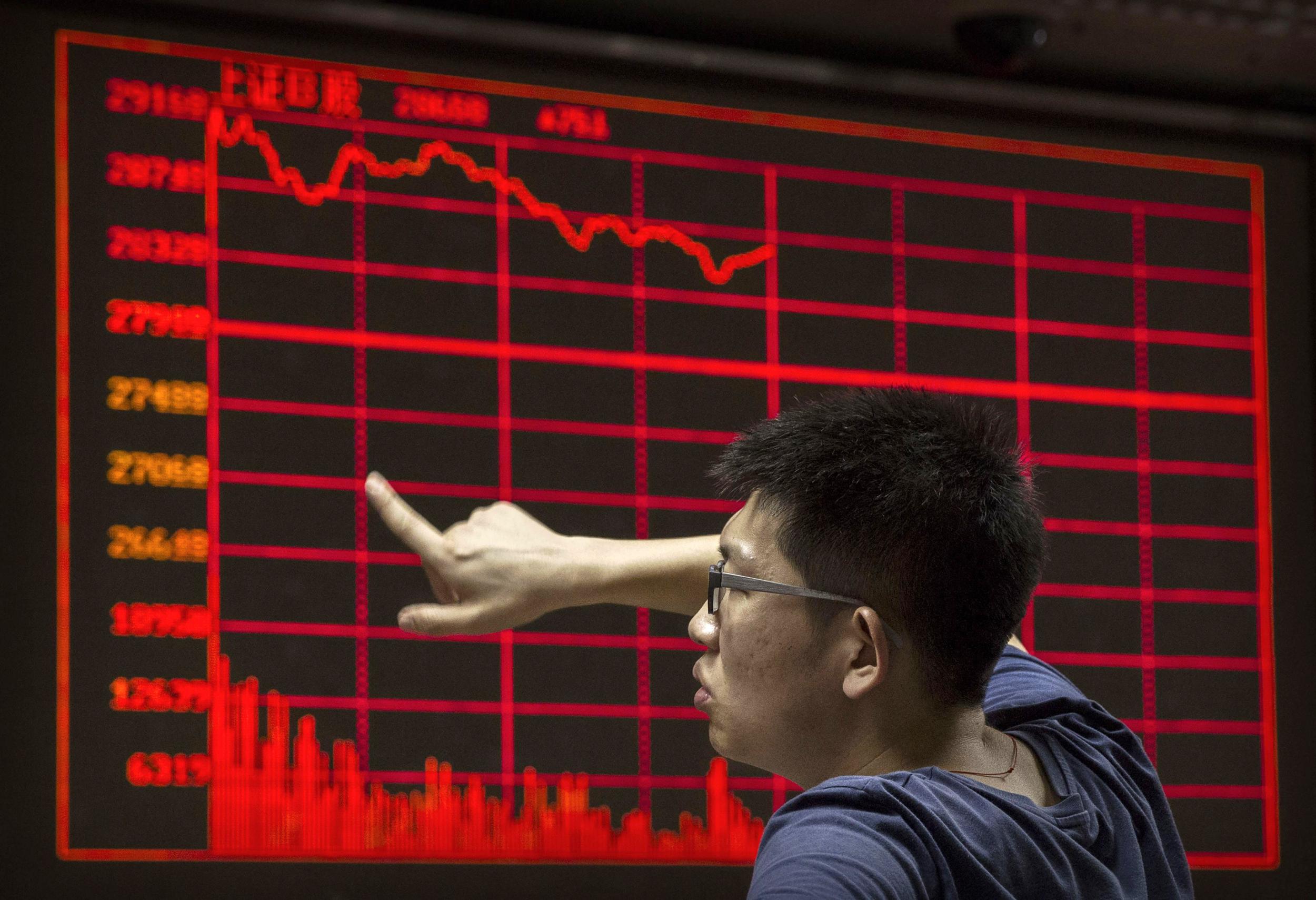

China heading for 'financial crisis' that could have 'very serious repercussions' for global economy, IMF warns

Markus Rodlauer, deputy director of the IMF’s Asia-Pacific department, said the level of debt in the Chinese economy was on an “unsustainable path”

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.China could be heading for a financial crisis due to the level of financial and corporate debt, the International Monetary Fund (IMF) has warned.

Markus Rodlauer, deputy director of the IMF’s Asia-Pacific department, said the level of debt in the Chinese economy was on an “unsustainable path”, adding that a financial problem in China would have “very serious repercussions” for the global economy.

Mr Rodlauer told The Telegraph: “The level of financial and corporate debt and the complexity of the financial system and rapid growth in shadow banking is on an unsustainable path.

“While still manageable in its size given the size of the public assets under public control, the trend is dangerous.

“The longer it lasts ... the more serious the disturbance and the disruption might be. [The reaction could range] from a mild growth slowdown, to a sharp slowdown in growth to potentially a financial crisis.”

Mr Rodlauer, who has served as the IMF’s China's mission chief for five years, added that an economic crisis in China would have serious implications for the rest of the world.

He said: “There is no doubt that a calamity or a problem in China would have very serious repercussions for the global economy, both real and financial.”

The IMF’s latest World Economic Outlook revealed debt in China was rising at a “dangerous pace”, while its Financial Stability Report showed small Chinese banks were heavily exposed to shadow credit as a share of capital buffers, with exposure reaching nearly 600pc at some banks.

Growth investment by private firms in China fell to a new record low in the first half of this year and fixed asset investment growth in the first half slowed to 9 per cent, the weakest since March 2000.

Last month a Harvard professor said China was the biggest threat to the global economy, and several international bodies have expressed concern about the slowdown in the Chinese economy in recent months.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments