White House: GOP plans would drive deficits up $3 trillion

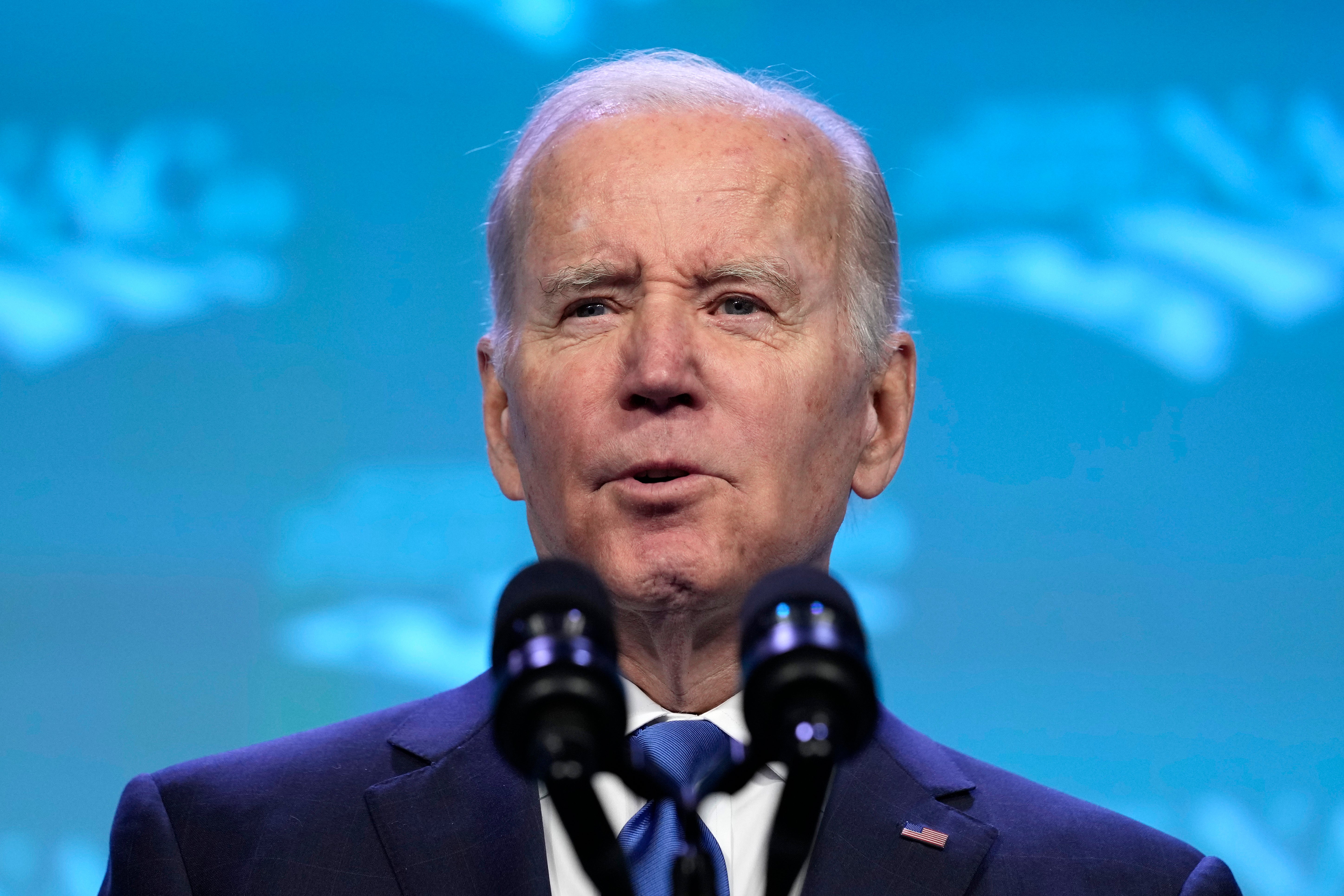

President Joe Biden plans to go on the offensive against Republicans by saying their policies would add $3 trillion to the national debt

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.President Joe Biden plans to go on the offensive against Republicans, saying in effect that their policies would add $3 trillion to the national debt.

Ahead of Biden's remarks to union workers Wednesday in Lanham, Maryland, the White House issued a fact sheet that questions the GOP's sincerity on deficit reduction.

The White House is charging the GOP with hypocrisy for favoring tax policies that could push the accumulated $31.4 trillion national debt higher. Yet Biden also wants to preserve some of the same tax cuts as Republicans so long as the approach is “fiscally responsible.”

The speech is the latest evolution in a political and economic debate that will play out over several months. Biden and House Speaker Kevin McCarthy need to reach a deal mid-summer on raising the government's legal borrowing authority or else the government could lack the funds to pay its bills and default.

McCarthy, R-Calif., says they should agree on a path toward balancing the budget, posting on Twitter last Friday: “No more blank checks for runaway government spending.”

The president detailed a recent exchange with the GOP speaker in a speech Tuesday in Washington to county government officials. He told them that McCarthy “made it real clear to me what he wants to do. He says he’s not going to raise any taxes at all on anybody. He just wants to cut programs."

The president said that Republican lawmakers should present their budget plan to the public, just as the White House intends to do on March 9.

“I believe we could be fiscally responsible without risking — threatening to send our country into chaos,” Biden said Tuesday of debt limit talks.

But the actual path of the national debt could hinge on the upcoming expiration of individual tax cuts that President Donald Trump signed into law in 2017. Extending those tax cuts would in theory raise the national debt, as the nonpartisan Congressional Budget Office based its projections on them lapsing after 2025. The CBO will release an updated budget outlook on Wednesday.

The White House fact sheet said Republicans would increase the debt by $2.7 trillion by prolonging those tax cuts, in addition to cutting a corporate minimum tax established by Biden and other policies that would add to the debt.

The White House noted that the extension of the Trump-era tax overhaul would give a $175,000 tax cut to families with incomes over $4 million. The size of that tax cut is roughly double the median U.S. household income.

But the same White House fact sheet adds that Biden would like to preserve some of the same tax cuts as Republicans, just not those that benefit the wealthy. Biden pledged during the 2020 campaign to not raise taxes on anyone making under $400,000, so letting the tax cuts expire could be viewed as a tax hike on the middle class.

The Tax Policy Center, a think tank, estimated when the law was passed that 53% of taxpayers would see their IRS bills increase in 2027 after the cuts expire. About 70% of those solidly in the middle class — the middle 40% to 60% of all taxpayers — would owe more.

The fact sheet previewing the speech said the president is committed to a “fiscally responsible approach to continuing current tax policies" for people earning less than $400,000. Until Biden issues his budget, it's not entirely clear what that could mean for the national debt, though he promised in last week's State of the Union address to cut deficits by $2 trillion.

That leaves Republicans and Democrats theoretically in agreement on keeping taxes low for most people, while leaders in both parties have pledged no cuts to Social Security or Medicare.

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said that lawmakers should consider everything if the goal is deficit reduction.

“If we truly want to address our fiscal situation — as we should — policymakers should put all their cards on the table, abandon their demagoguing, and come together for the good of the American people,” she said in a statement.