The Trumps want to make crypto ‘user-friendly’. Here’s what you need to know about the venture that has Barron as its ‘visionary’

Donald Trump’s sons say they want World Liberty Financial to make ordinary people feel welcome in crypto. But will it protect them from the sharks? asks Io Dodds

"You can literally sell s*** in a can, wrapped in piss, covered in human skin, for a billion dollars if the story’s right, because people will buy it.”

So said internet marketer and self-professed "dirtbag" Chase Herro from the driver’s seat of his Rolls-Royce in a 2018 YouTube video, according to Bloomberg News.

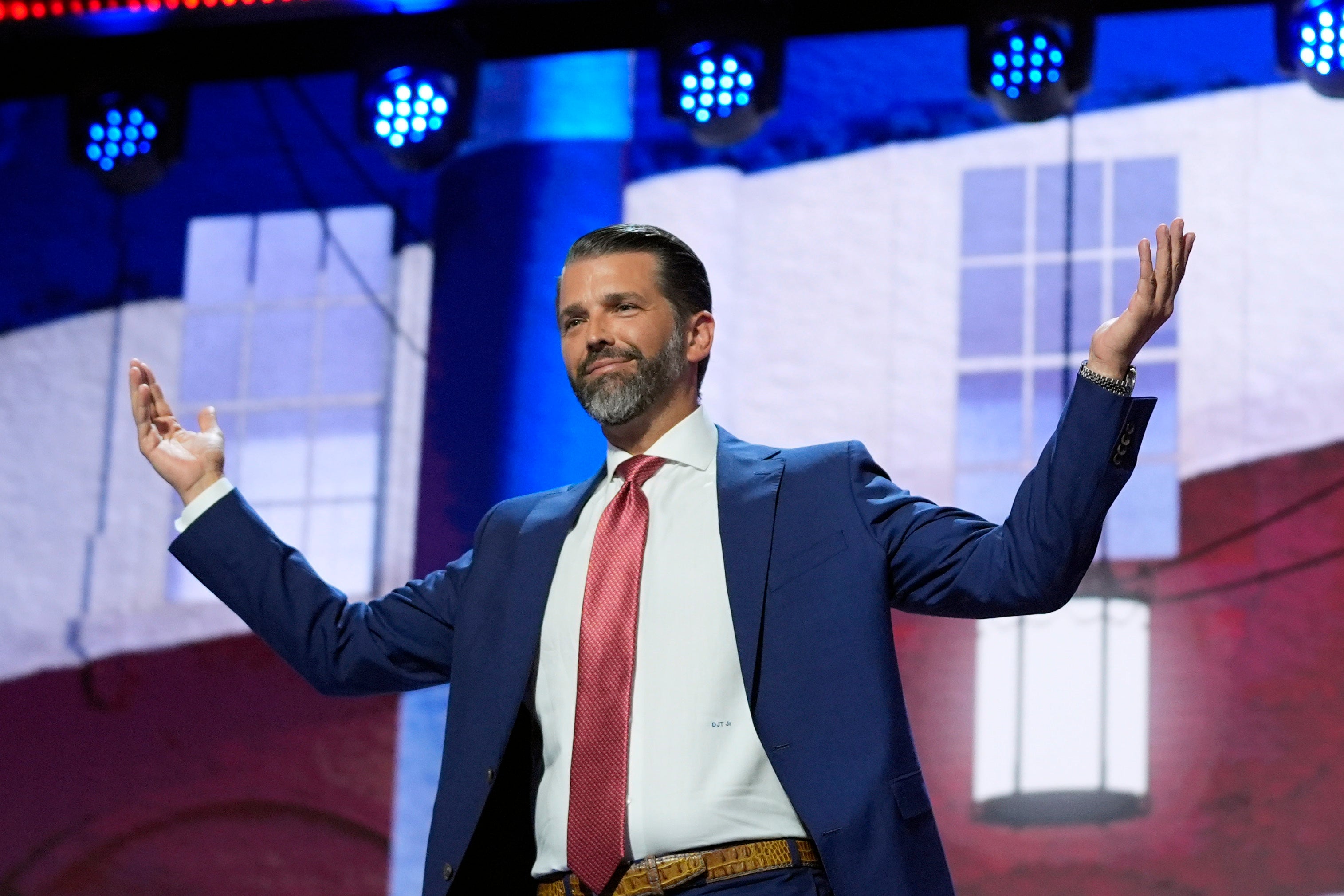

Six years later, Herro is one of the brains behind a new cryptocurrency venture backed by none other by Donald Trump and his three sons. The elder sons Don Jr and Eric are leading the promotion, although supposedly it is 18-year-old Barron who will serve as the project’s "visionary"."

In a live broadcast on the social network X on Monday night, Don Jr billed the project – known as World Liberty Financial (WLF) – as "the start of a financial revolution", while Eric said it would challenge the power of big traditional banks by making crypto as smoothly hospitable to ordinary Americans as one of the Trumps’ famous hotels.

"If there’s one contribution I want to make to the world of crypto, it’s actually making it user-friendly," said Eric.

"We better damn well embrace [crypto] as a country, because it’s coming,” Eric continued. “And the people who are ignoring it – the people who don’t want to figure it out, who don’t want to make the effort – they’re going to be left behind.

"But at the same time, it’s truly our job to make it understandable... we have to make it intuitive. We have to make it user-friendly. And we will."

How WLF actually plans to do that, and indeed what exactly WLF is, remained mysterious even at the end of the two-hour livestream.

But based on what little we know so far, crypto experts interviewed by The Independent were skeptical that the Trumps would protect its users from the scammers and criminals who swarm through the cryptocurrency ecosystem (related: Donald Trump, his older sons and the Trump Organization have been ordered to pay $454m for a civil suit in New York related to financial fraud).

But can the Trumps and their business partners achieve what many in the industry have struggled for years to do and achieve Eric’s goal of making crypto understandable and accessible?

"You’ve got tens of thousands of people that have raised billions and billions of dollars, that are all trying to solve that problem: how do I make my crypto transactions as easy as my transactions on my credit card?" says Zach Hamilton, a longtime crypto venture capitalist and founder of the crypto-powered document storage firm Cache Legal.

"It’s an incredibly hard problem to solve… I don’t really want to speculate on if it could be successful or not, because it doesn’t exist yet. Maybe they’ve got some secret sauce; I doubt it."

‘We went from elite to just totally cancelled’

As Don Jr told it, his eyes were opened to the world of cryptocurrency and "decentralized finance" – or DeFi for short – when conventional banks withdrew services from the Trump family due to their political activities.

"We went from being the elite in that world to just being totally canceled, and it changed our perspective so much," he said on Monday. "When you really look at the way our founding fathers set everything up, I think DeFi is what they would envision – not a broken, bureaucratized system where a bunch of middlemen are getting pieces for doing nothing."

These and other statements from people involved with WLF, and leaked draft documents obtained by the crypto news site CoinDesk, suggest that WLF wants to build a decentralized crypto borrowing and lending system.

In traditional finance, transactions are executed and verified by a small number of powerful institutions such as banks or credit card companies. When you send ordinary money (called fiat money) across national borders, no currency actually moves; rather, the sending and receiving institutions simply agree to adjust their records of what you own and where.

Cryptocurrencies, like bitcoin and ethereum, are different. They are essentially software networks running simultaneously on many computers around the world, which execute transactions collectively by working together to verify each other’s identity and check each other’s math.

In principle, that means no government agent or bank employee can ever block or reverse a crypto transaction. The big exception is cryptocurrency exchanges (such as Coinbase and Binance) that let you convert fiat money into crypto or vice versa, which are consequently required to follow banking law in most major economies.

But WLF probably isn’t building an exchange, according to Zach Hamilton. Those are too expensive and too difficult to set up. Instead he suspects they will modify (or "fork") an existing crypto lending protocol such as Aave, which uses self-enforcing "smart contracts" to execute and collect loans without any human oversight.

This is not a new idea. "There are a number of prominent DeFi borrowing and lending platforms that have operated for years in crypto, that were built by very well respected teams, where the resilience of the smart contracts and technology has been proven by their durability and popularity," says Gareth Rhodes, a lawyer and former New York market regulator who now advises finance tech start-ups. "It’s an open question [what] WLF will add in terms of user experience or technology capabilities."

In that regard, the WLF team’s track record is hardly promising. Although all four Trumps were given job titles in the draft white paper obtained by CoinDesk, it stressed that they will not own or manage WLF but may receive financial benefit from it.

The real managers appear to be Herro and another businessman named Zachary Folkman, who are both listed, are best known for a previous DeFi lending system called Dough Finance. After attracting a few million dollars in transactions, it was hacked and had $2m stolen in July and is now reportedly inactive.

According to a profile by Bloomberg News, Herro made his money through a string of internet marketing and coaching schemes, some of which appeared to flout Facebook’s advertising rules, while Folkman is a former pick-up artist who ran a seminar series called Date Hotter Girls.

Neither Rhodes nor Hamilton said they had heard of Herro or Folkman. And none of the dozen-plus digital asset investors asked by Bloomberg had heard of them either. WLF and the Trump Organization did not respond to requests for comment.

Still, Hamilton says WLF does have one good asset. Forking a lending protocol like Aave is the easy part; that can be done "in an afternoon", from anywhere around the world The harder thing is to bring enough people into the service, and enough money, to provide the level of liquidity that will actually allow it to function as a market.

"The one thing the Trump Organization has is the biggest megaphone in the world. Anything those people do will be covered ad nauseam by the media," says Hamilton. "You have to get people’s eyes on what you’re doing, and you have to convince them to move money."

Even this, however, is only one half of the challenge facing WLF.

‘This is for votes, nothing else’

Less than 24 hours after Monday’s livestream, the crypto lawyer and security expert Alexander Urbelis posted a list of no less than 41 fake web domains aping WLF’s address, likely from scammers looking to cash in on the hype.

Indeed, earlier this month the X accounts of Donald Trump’s daughter Tiffany Trump,30, and his daughter-in-law, Eric’s wife Lara Trump, were hijacked by apparent cybercriminals promoting a hoax WLF Telegram group, offering up to $15,000 worth of (doubtless illusory) cryptocurrency to anyone who connected a crypto wallet to their service.

These shenanigans underline how rife the crypto ecosystem still is with scams, fraud, and theft. Losses reported to the FBI swelled from just under $4bn to nearly $6bn between 2022 and 2023.

"My industry is not being honest, with the government or the general public, about the scale of cybercrime," says Rich Sanders, an independent crypto crime investigator who says he has spent the past two years busting Russian-affiliated crypto networks in Ukraine.

Criminals love crypto precisely because it skips traditional middlemen. Transactions are irrevocable, usually unblockable, and safe trading often requires significant technical savvy. Outside of "custodial" services such as Coinbase, which hold crypto on your behalf much like a traditional bank, nobody is going to save you if you make a mistake or fall for a scam. And while nearly all crypto transactions are publicly traceable, it’s sometimes tough to find out the real identity of a given recipient.

So if WLF wants to bring new, non-techie users into this risky world, how does it plan to protect them? "[With] security, you can never be perfect. You know, I think of security as more of a journey," said WLF adviser Corey Caplan on Monday. "So it’s really important for not just myself but this whole team to remain nimble, adapt, continue to soak up new information like a sponge,"

Both Rich Sanders and Zach Hamilton said that there is a zero-sum trade-off between making crypto newbie-safe and idiot-proof while simultaneously refusing to serve as a middleman or keep custody of users’ currency.

"There’s nothing that WLF is doing that negates the reality that the consumer is going to be the one that holds the private keys. Because they can’t have consumer protection while being a non custodial service; both cannot be true," said Sanders.

Yet both Sanders and Hamilton also said the impact would be limited because WLF is unlikely to actually attract many (or any) novices. Anyone choosing to use a decentralized lending protocol that cannot swap fiat money for crypto is already diving in at the deep end.

Instead, Sanders claims that the whole project is really just a ploy for Donald Trump to curry favor from the crypto community. "WLF itself is barely worth discussing; it is inevitable vaporware," he says. "It doesn’t have a vision, doesn’t have a plan, doesn’t fulfil a need, doesn’t need to exist... this is for votes, nothing else."

Indeed, when Trump visited a bitcoin bar in New York City and spoke to crypto enthusiasts about US monetary policy, crammed together with reporters under a low yet ornately tiled ceiling, it had the vibe of any other campaign stop.

That’s not to say it couldn’t backfire. Nic Carter, a well-known pro-Trump crypto entrepreneur, has appealed to the community to find some way of stopping WLF’s launch, arguing that any successful hack or government investigation could damage the former president’s election campaign.

Hamilton is more sanguine. He hopes that someone as controversial as Trump will at least draw the attention of regulators and force them to set clarifying precedents, illuminating what he describes as a still-murky legal landscape for crypto entrepreneurs.

Still, he adds that a WLF hack, while probably not very damaging economically, would be a big reputational hit to the crypto industry. "I hope they’re doing their security right. I hope they’ve got all their audits done correctly," he says. If not, "it would make all of us look a little stupid."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks