Republicans include Obamacare repeal in their tax overhaul

They failed multiple times to dismantle Obamacare earlier this year

By injecting a healthcare proposal into their sweeping tax legislation, Republicans appear like they want to have it all.

After having failed to dismantle Obamacare multiple times, Senate Republicans now intend to include a repeal of the law’s requirement that most people have health insurance in their tax rewrite.

“Ultimately, I’m more than willing to defend the decision to end the individual mandate taxes,” Senate Finance Committee Chairman Orrin Hatch, who drafted revisions to the bill, said at the start of a hearing on the new measure. “It’s the right thing to do. Far more people will be better off as a result.”

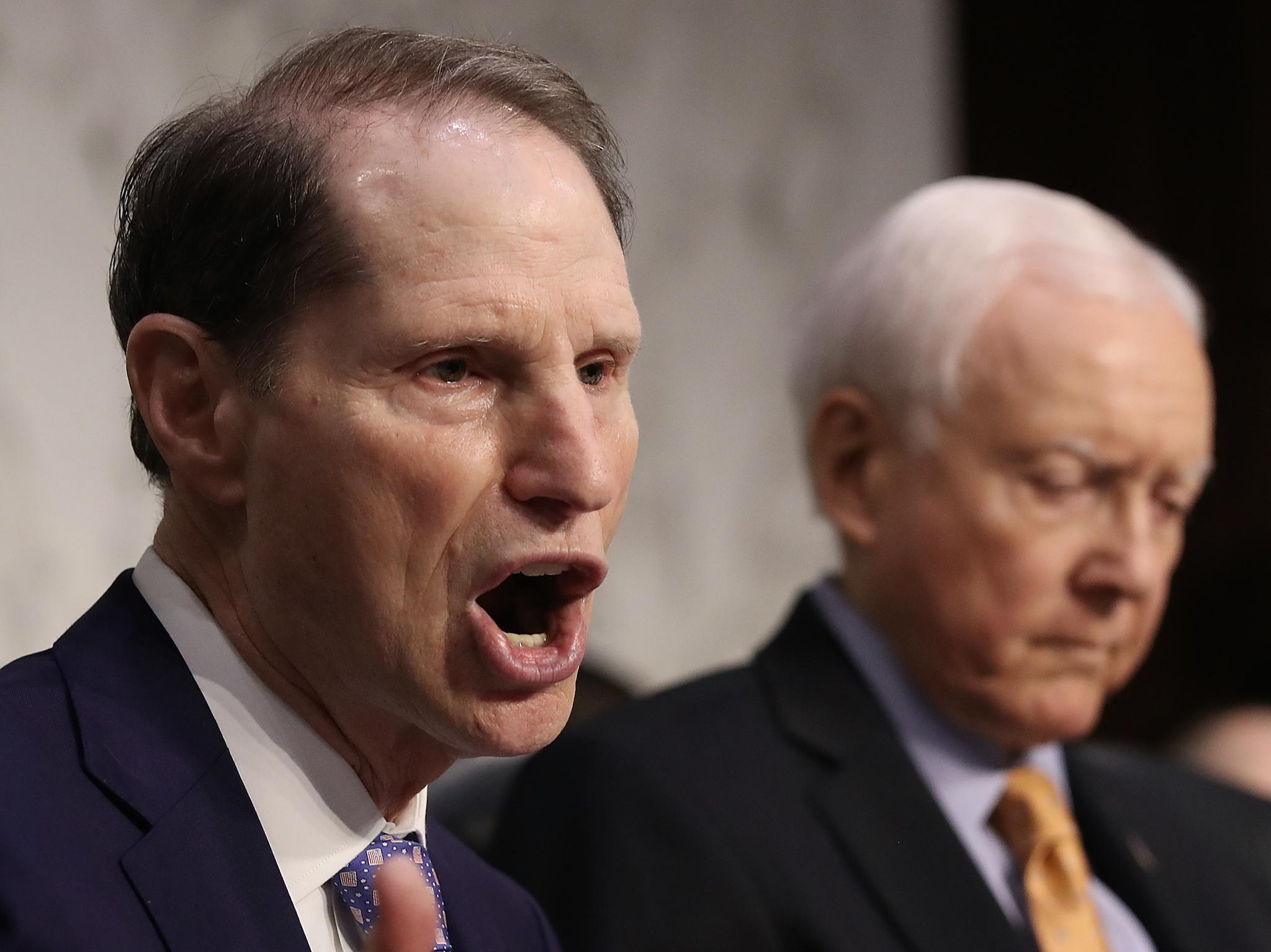

Democrats have attacked the proposal, which Senator Ron Wyden – the ranking Democrat on the Senate Finance Committee – said seems to be getting “worse by the hour”.

“This is not just another garden variety attack on the Affordable Care Act, this is a repeal of that law,” Mr Wyden said.

Republicans have been desperate to find a way to fund their tax proposal so as not increase the budget deficit by $1.5 trillion over 10 years.

Since party members are using a legislative process known as reconciliation – meaning they can push a bill through Congress without any support from Democrats – they must keep the cost of the bill to to this amount.

Repealing the health law’s so-called individual mandate would allow Republicans to save more than $300bn over 10 years. But according to the nonpartisan Congressional Budget Office, it would lead to 13m people losing their health insurance over the next decade and health insurance premiums would rise by about 10 percent.

Senator John Thune of South Dakota, the chamber’s third-ranking GOP leader, said the benefit of the savings would go to middle-income taxpayers.

“It’ll be distributed in the form of middle-income tax relief,” he said, according to a statement distributed by Senate Majority Leader Mitch McConnell’s office.

However, the latest changes to the Senate Republicans’ proposal have also imposed a 2025 expiration date for individual tax cuts, while making the corporate tax cuts permanent. A new proposal to double the child tax credit to $2,000 would also expire by then.

Critics of the effort for a tax rewrite say the overhaul will significantly benefit the wealthiest Americans while only providing modest gains for some middle-class families.

“For multinational corporations, their handouts are set in stone, written in ink, locked in place with the key thrown away. But not for the middle class,” Mr Wyden said. “For middle-class families, premium increases are the same thing as tax increases.”

President Donald Trump has promised Americans a “tremendous” tax cut for Christmas as his administration seeks to secure a major legislative victory before the first year of his presidency comes to an end.

There is still question over how the latest changes to the Senate bill will affect votes. In July, three Republicans killed a measure that would have overhauled Obamacare, partially out of concern that too many people would lose their health insurance.

Like in his Obamacare repeal efforts, Senate Majority Leader Mitch McConnell can only afford two defections from Republicans on the tax bill. All 48 Democrats in the 100-member Senate are expected to oppose it.

Republican Senator Ron Johnson had already said he won't vote for the proposal, saying it unfairly benefits corporations more than other types of businesses.

The House of Representatives is expected to vote on its own tax legislation on Thursday.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks