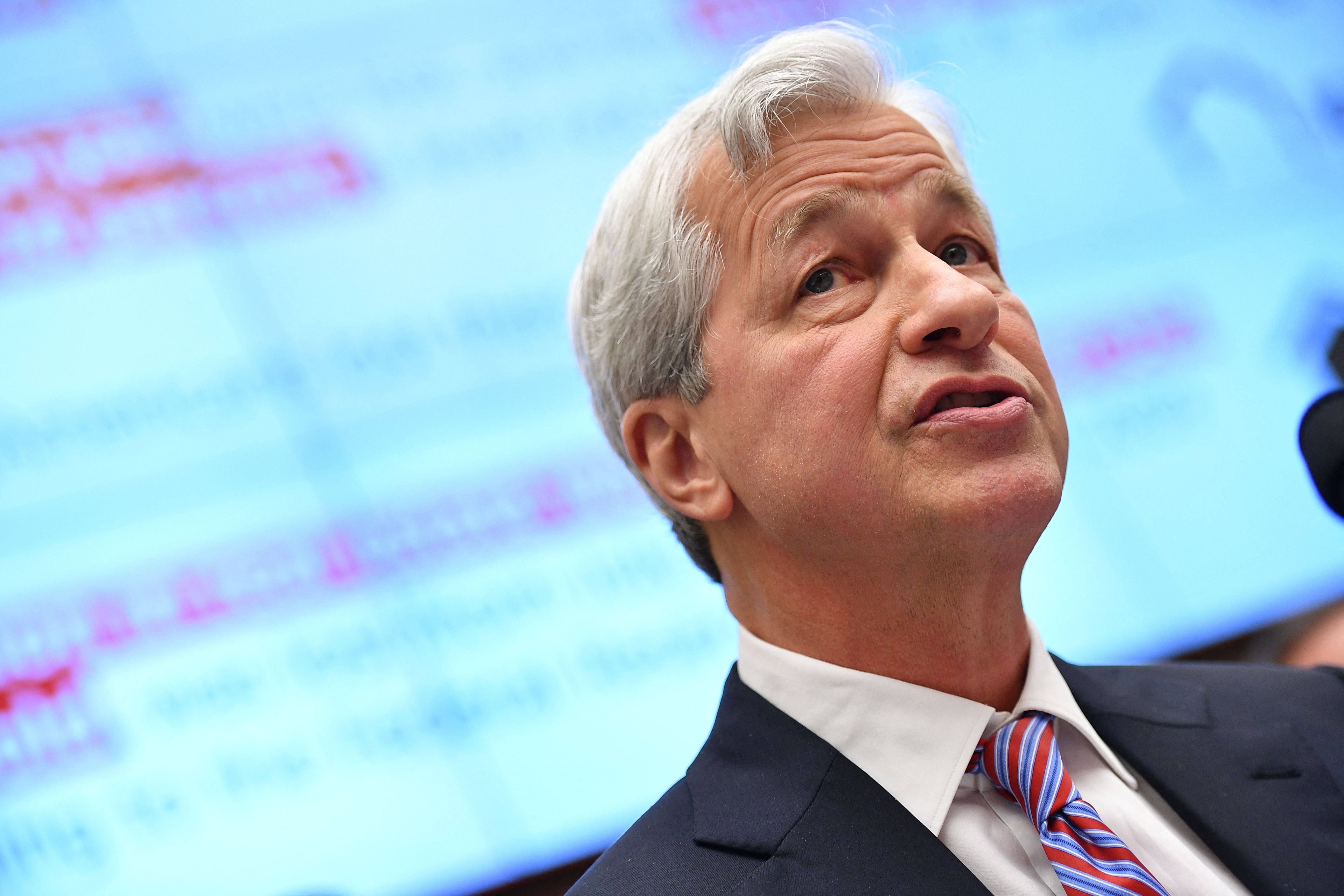

JPMorgan Chase CEO Jamie Dimon says the ‘American dream is fraying’

The business leader said the government and corporations would have to work together to solve issues of racial and income inequality

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The CEO of one of the nation's largest investment banking companies said he was concerned that the American Dream is quickly dying.

Jamie Dimon, the CEO of JPMorgan Chase, said rising wealth inequality, particularly among Black Americans, is killing the notion that people in the US can carve out lives of prosperity for themselves.

"The American dream is fraying and income inequality is like the fault line," Mr Dimon said during an interview on The Axe Files podcast.

He said the rebounding economy - thanks in large part due to federal stimulus spending to help Americans - is a bright spot in an otherwise difficult time for many Americans.

"The consumer today has a tremendous amount of money, mostly from stimulus and unemployment checks, et cetera. Their balance sheets are in very good shape. Their confidence levels are going up," he said.

"Tremendous amount" is a relative term, and even with stimulus and unemployment checks, many Americans - including the tens of thousands who still are unemployed or underemployed due to the pandemic - are struggling to pay rent and provide for their basic needs.

Despite this, Mr Dimon said that the post-pandemic economy will be strong, and will be a fruitful time for many consumers as people rush back to their "normal" lives once they are able to do so.

"There's going to be a little bit of a euphoria coming out of the pandemic," he said. "That will definitely, in my view, fuel a very strong economy for years."

He said he was optimistic the US would enter a "Goldilocks scenario" for several years following the pandemic.

Mr Dimon also addressed racial inequality issues during the podcast and discussed how his bank was working to try to address some of the issues.

He said the bank was working to lend more to Black-owned businesses and provide affordable home loans to Black borrowers, as well as financially supporting initiatives to help Black job-searchers find work. One of the ways he hopes to help Black job-seekers is by training and hiring more Black wealth managers to work at the bank.

He acknowledged that these efforts alone could not fix racial inequality in the US, and said the country needed to do more to address those issues.

"America is exceptional. America has an unbelievable hand. But we need to do something to fix these problems," he said.

He said it would take both the government and the business community to work together to fix issues of systemic racism in our country.

"The only way you're going to fix it is to attack it at a very detailed level. Business can do its share. Government obviously is critical to doing this right, because businesses can't do it by itself," Mr Dimon said. "But I think it's time to attack it."

He also supported raising the minimum wage to a "much higher number," but said he was opposed to increased taxes of businesses.

Instead, he suggested that if a tax hike was necessary, they should be raised on the incomes of the mega-wealthy.

"If you've got to raise taxes, do it on the income of the wealthy, like a Buffett type of tax. That will be far more effective in growing the economy than taxing primary capital formation," he said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments