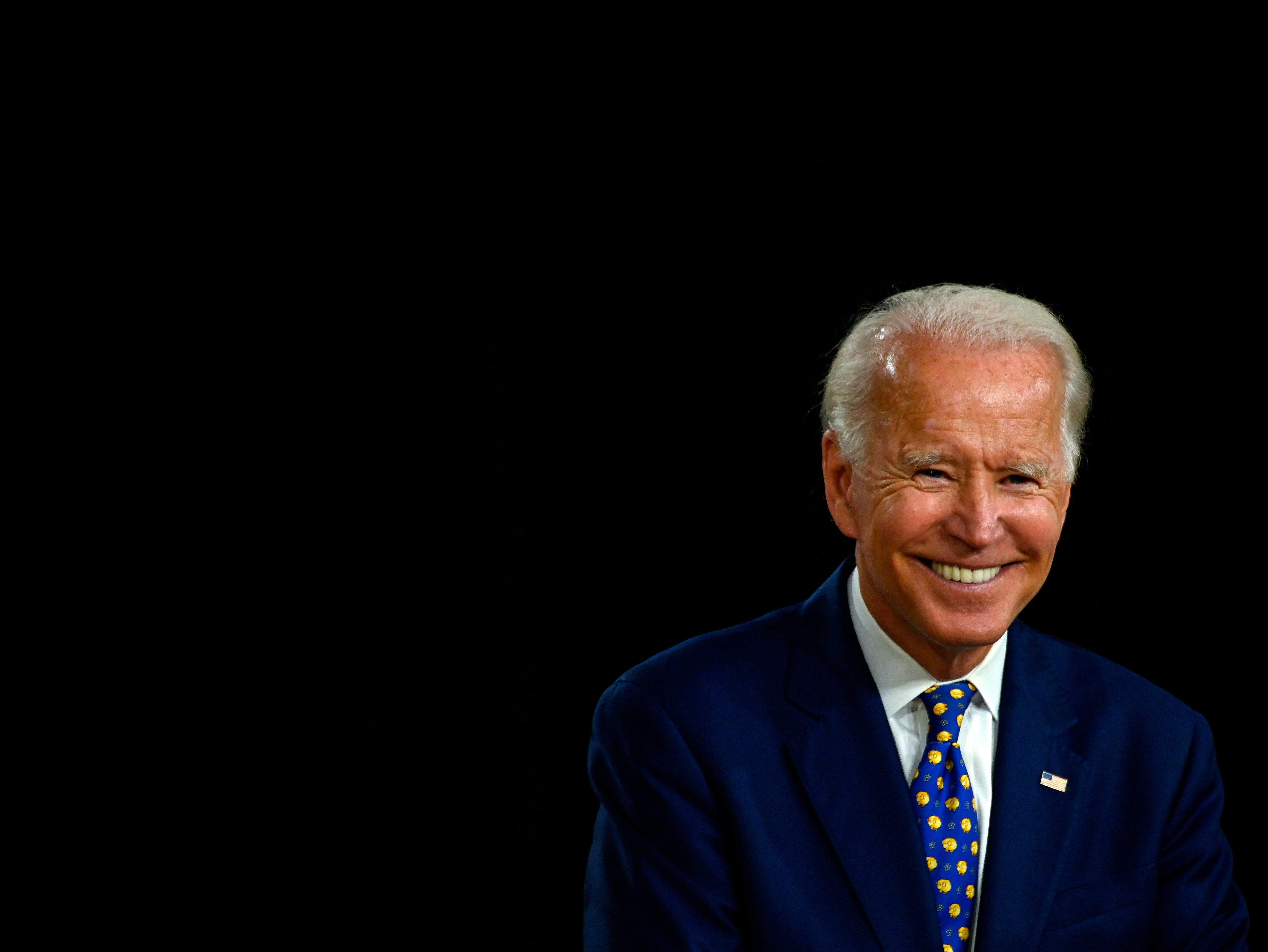

Biden’s sweeping tax plans are making some congressional Democrats nervous

Mr Biden’s plans are causing unease across Congress

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.President Joe Biden’s desire to offset more than $4 trillion (£2.8 trillion) in spending proposals with higher taxes is struggling to gain momentum in Congress.

Pockets of skepticism have emerged within Mr Biden’s party over White House plans to raise the corporate tax rate, revamp the international tax system and double tax rates on wealthy investors, among other measures critical to the administration’s plans. The party faces regional divides over taxes as well, with farm-state Democrats skittish about taxes on heirs and coastal Democrats demanding the repeal of limits on state and local tax deductions, which would amount to an expensive tax cut that would require higher taxes elsewhere.

The unease could have major implications for his domestic agenda, as Mr Biden has said he does not want new spending to be added to the deficit. He has insisted that changes to the tax code must be made to accommodate the new spending, but he has said he is flexible about how changes are designed. The White House is trying to whip up momentum for the plans, and Mr Biden plans to meet with numerous lawmakers this week in an effort to speed up talks.

The open-ended nature of the discussions has led to a bevy of ideas from Democrats and little clear progress toward a resolution. Democrats said some donors are anxious about the political ramifications of raising taxes before the midterms, especially given the party’s tough odds to hold onto the House. Representative Sean Maloney, chair of the Democratic Congressional Campaign Committee responsible for party fundraising, has privately warned the tax plans could hurt vulnerable House Democrats up for reelection in 2022, said two people familiar with the matter, who spoke on the condition of anonymity to discuss internal matters said.

The White House in April released a $2.3 trillion (£1.6 trillion) jobs and infrastructure package that would be funded by tax hikes on corporations. It then released a $1.8 trillion (£1.3) “families” plan funded by increasing enforcement at the Internal Revenue Service and higher taxes on high-income Americans and investors. Senate Minority Leader Mitch McConnell, has in private reassured allies of Democrats’ long odds in approving tax hikes, pointing in particular to the voting record of Senator Kyrsten Sinema, a centrist Democrat, two people familiar with his remarks, who spoke on the condition of anonymity to discuss them, said.

“Biden deserves some credit for trying to pay for permanent programs, but congressional Democrats do not want the politics of these tax hikes on their record in the midterms. There’s a major disagreement here,” said Doug Holtz-Eakin, a former economic adviser to President George W. Bush and the late Senator John McCain. “They are worlds apart.”

Congressional Republicans are unified in opposing virtually all of the more than $3 trillion (£2 trillion) in tax hikes Mr Biden has proposed. Republican lawmakers have proposed paying for an infrastructure package largely through fees imposed on the users of services created by new projects. The GOP provided scant details as part of a counterproposal they released last month, and Mr Biden has signaled his skepticism of that approach. But if Democrats try to pass the spending plans without GOP votes, they would need virtually every member of their caucus to support the measure, giving individual lawmakers power to demand changes or bring down the bill.

These congressional and political realities stand to pose a test of Mr Biden’s aspirations to fiscal responsibility. Last week, the president said that he was open to compromise on specific details but that he was “not willing to not pay for what we’re talking about. I’m not willing to deficit-spend.” A White House official said in a statement that the president was not articulating a new negotiating position and that the “only red line he continues to have is inaction,” suggesting that the administration would be open to a deal that added to the national debt.

The White House has emphasised it is flexible on negotiating the details of the package and is open to compromise with congressional Democrats. White House senior adviser Anita Dunn recently sent a memo to congressional Democrats emphasising the popularity of Mr Biden’s tax plans, which are aimed at a narrow slice of wealthy Americans and firms.

Congressional Democratic leaders firmly support the measure, although that could change if the approximately 30 “front-line” House Democrats vulnerable in 2022 believe they are being hurt by the proposals.

“The anxiety is anytime you raise taxes there is a belief among some Democrats and some in the consulting community that Democrats always get blamed,” said one Democratic official involved in the issue, who spoke on the condition of anonymity to candidly discuss internal dynamics.

Many, if not most, of the White House’s tax plans have faced pushback from congressional Democrats.

Senator Joe Manchin, and a handful of other centrist Democrats have rejected Mr Biden’s plan to increase the corporate tax rate from 21 per cent to 28 per cent, suggesting it should only go up to 25 per cent. That would shave as much as $300 billion (£212 billion) off the amount of new revenue from Mr Biden’s tax plans. Mr Biden appeared to nod to that reality on Thursday, for the first time saying the new corporate tax rate should be between 25 per cent and 28 per cent.

The White House’s single largest tax proposal - an overhaul of taxing multinational corporations aimed at raising more than $1 trillion (£0.7 trillion) in revenue - also appears vulnerable. Representative Richard Neal, the powerful chairman of the House committee in charge of writing the nation’s tax code, has been largely silent on whether he supports the sweeping changes. Senate Finance Committee Chairman Ron Wyden, Senate Banking Committee Chairman Sherrod Brown and Senator Mark Warner, have released an international tax “framework” that was similar in aspirations to Mr Biden’s plan but diverged from it in other key ways, suggesting an overhaul to the global tax system set up by the 2017 GOP tax law rather than outright repeal. Business lobbyists say they have just begun explaining the complicated changes to congressional Democrats and express confidence they can sharply limit the changes sought by the administration.

“We believe the international provisions that have been proposed by the White House won’t make it into law. When you peel back the onion, you realise this would significantly disadvantage American companies,” Neil Bradley, executive vice president of the US Chamber of Commerce, said in an interview. “We’ve had success educating members, and that’s what we’re hearing.”

Other complications have emerged. Democrats primarily from high-cost cities on the coasts have taken aim at a limit on how much in state and local taxes Americans can deduct on their annual federal returns. That limit was created by the 2017 GOP tax law. Democratic lawmakers including Representative Josh Gottheimer of New Jersey and Tom Suozzi of New York have pledged there would be “no deal” unless the White House and Congress repealed the cap. White House press secretary Jen Psaki said at a news conference in April that the administration is open to discussing the matter. If the White House bends to Mr Gottheimer and Mr Suozzi to secure a deal, its would have to find as much as $300 billion (around £200 million) in tax hikes on the rich or businesses elsewhere, jettison key parts of the spending package or add the cost to the national debt.

Also on rocky ground is Mr Biden’s proposal to approximately double the amount of capital gains paid by investors who earn more than $1 million (£700,000) annually. That measure reflects a Biden campaign promise aimed at bringing capital gains taxes in line with ordinary income taxes. But Senator Robert Menendez, a member of the Senate Finance Committee, told the Wall Street Journal that “it seems like a rather high rate to me.” Mr Warner, who is also on the Finance Committee, has also said he is not convinced by the White House’s capital gains proposal, a spokeswoman said. The administration has emphasised that about 0.3 per cemt of taxpayers would be affected by that change.

On Thursday, another source of tax trouble emerged. Representative Cindy Axne, led a group of about a dozen other farm-state and centrist House Democrats in warning against the impact of a plan to substantially increase taxes on assets passed down to heirs. If that provision is stripped, the tax increase on capital gains could result in a decrease in government revenue, according to estimates by the University of Pennsylvania’s Penn Wharton Budget Model, as investors would avoid selling their assets. The White House has expressed support for exemptions to the tax hikes on family farms but details remain murky.

Supporters of the White House’s tax hikes say they understand the challenges they face.

“This is a puzzle, and it’s a very personal puzzle to a lot of people who have parochial investment agendas trying to get their own things stuffed into these plans,” said Frank Clemente, executive director of Americans for Tax Fairness, which is pushing for higher taxes on the rich. “Biden is full-throated with his endorsement of making the rich and corporations pay their fair share. Democrats need to come in behind him.”

Congressional aides point out that Democrats are unified in general on increasing taxes on businesses and the wealthiest Americans, with broad support for increasing the top marginal tax rate and on corporations. There is also widespread support among Democrats for beefing up Internal Revenue Service enforcement and reversing other parts of the GOP 2017 tax law.

An increase in income inequality has changed the thinking of Democratic lawmakers, who were far more averse to tax increases under President Barack Obama than they are today. That is fueling hopes that despite the complications, a deal is possible.

And other Democrats say the party should not be overly concerned with ensuring their plans are fully offset. Despite the mounting debt burden, interest rates remain low. Democratic lawmakers believe their plans are necessary to confront major crises facing the country, such as climate change and repairing the nation’s crumbling roads and bridges.

“The whole point is that we are making generational investments that will provide value for 30 or 50 or 100 years. With interest rates at a historic low, it makes sense to pay for these initiatives over a longer period of time,” Senator Brian Schatz, D-Hawaii, said in an interview.

Still, not paying for most of the legislation would be at odds with the goals set out by the president. The Biden administration has already faced mounting skepticism over some of its calculations. Mr Biden has said his plan to beef up IRS enforcement would raise $700 billion (£500 billion) in new revenue, but some tax experts think that number is likely substantially lower. Democrats could also face a political backlash if they try to too dramatically step up reporting requirements on businesses and banks to crack down on tax avoidance.

“In practice, the IRS’ task would be daunting and, in fact, bury the agency in a sea of unproductive information,” wrote Steve Rosenthal, a policy expert at the nonpartisan Tax Policy Centre, of Mr Biden’s plan. “Indeed, some taxpayers may be confused by the new information requirements, while others may find ways to circumvent the rules.”

Meanwhile, some independent forecasters have cast doubt on other rosy projections from the White House. The Penn Wharton model found that Biden’s American Families Plan would cost $700 billion (£500 billion) more than the White House estimated while bringing in about $500 billion (£350 billion) less in new revenue, adding more than $1 trillion (£0.7 trillion) to the deficit even if passed in its current form. Ms Psaki dismissed that analysis on Thursday, citing other independent forecasts more in line with the administration’s.

“The administration knows these taxes are very popular,” said Celinda Lake, a Democratic pollster who advised Mr Biden’s campaign. “But Democrats in Congress are nervous from decades about being attacked as tax and spenders.”

The Washington Post

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments