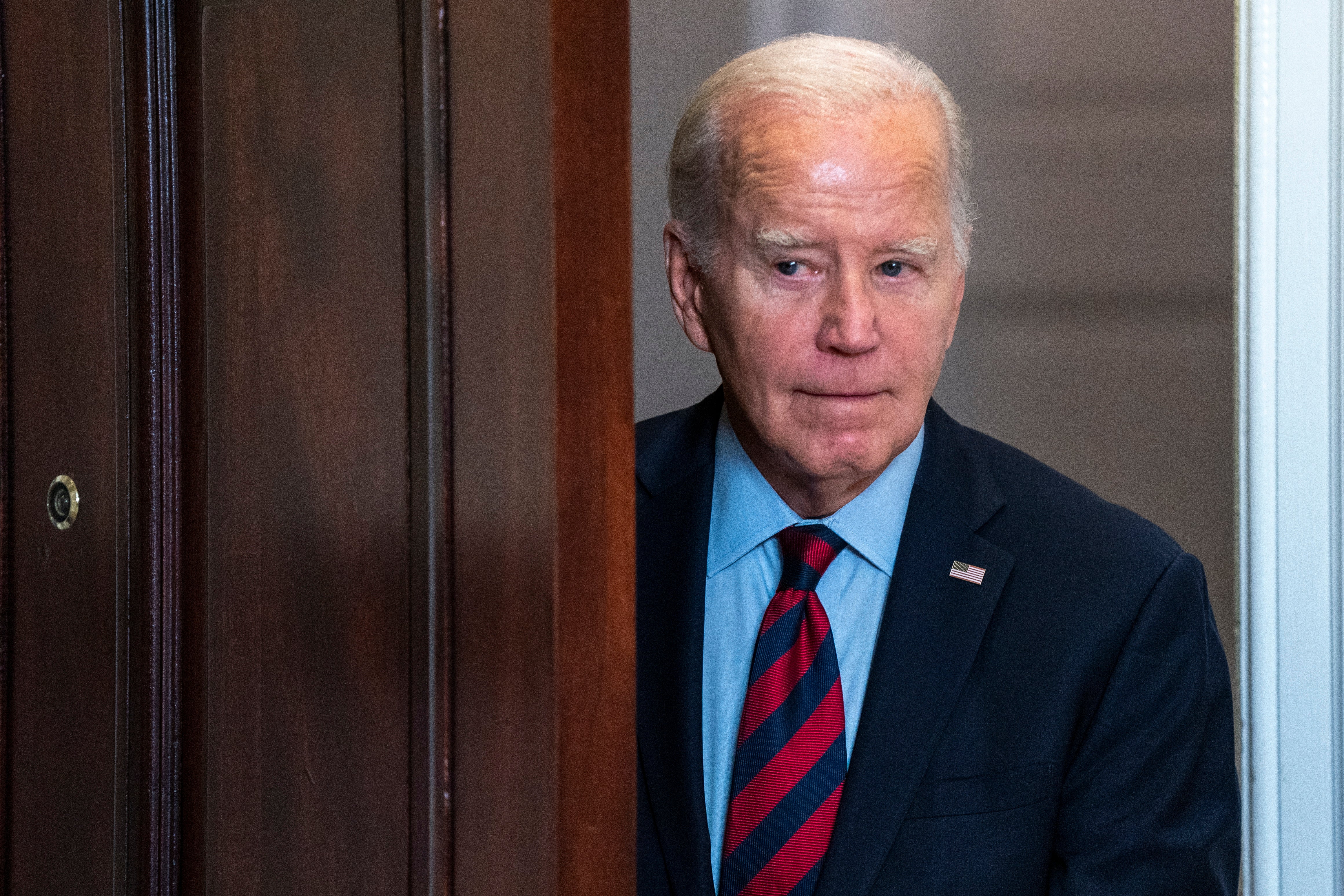

Student loan repayments are back, but Joe Biden has a new plan for debt relief

The White House charts progress cancelling debts. Advocates say the president can do more, and fast

This summer, the US Supreme Court struck down President Joe Biden’s ambitious plan to broadly cancel up to $20,000 in student loan debts for millions of borrowers.

In the wake of that decision, the president promised his administration would forge a “new path” for relief within the court’s legal bounds while leveraging existing programmes to ease debt burdens for tens of thousands of eligible Americans.

On 4 October, the White House announced another batch of 125,000 borrowers are eligible for $9bn in debt relief through three existing programmes, just as millions of borrowers are resuming payments into student loan balances after the expiration of a three-year pandemic-era pause on repayments.

With his campaign-trail promise for wider relief blocked in the courts, the Biden administration has instead pursued a series of targeted relief measures, cancelling roughly $127bn for nearly 3.6 million borrowers as part of an effort to fix what the White House has called a “broken” system for loan forgiveness frustrating millions of people long after they graduated or dropped out.

That figure represents only a fraction of the millions of borrowers eligible for relief under the previous plan, and an even smaller fraction of the tens of billions of dollars in the nation’s student loan debt balance.

Meanwhile, more than 4 million people have already signed up for the administration’s new repayment plan that promises to lower monthly bills, and the president has promised to “use every tool at our disposal to help ease the burden of student debt so more Americans can be free to achieve their dreams,” he said in remarks from the White House on 4 October.

That repayment plan programme, Saving on a Valuable Education, or SAVE, will also automatically enrol certain eligible borrowers who have fallen behind on repayments, acting as a safety net to prevent borrowers from defaulting.

And separately, the Education Department is still reviewing a course of action for mass relief through a rule-making process under the Higher Education Act, which will go through several rounds of hearings and public comments, months of negotiations with stakeholders and potential lawsuits and court challenges that will tie up future plans for debt cancellation in another round of months-long litigation.

“We’re committed to standing up for borrowers and making sure that student debt does not stop anyone from climbing the economic ladder and pursuing the American dream,” Education Secretary Miguel Cardona said on 4 October.

The latest move cancels $5.2bn in debts for 53,000 borrowers through an existing programme for borrowers with public service jobs. The administration has repeatedly criticised the application of the Public Service Loan Forgiveness programme for poorly administering relief for eligible borrowers working in public service, including teaching, public health, law enforcement and other jobs.

Enforcement of the programme has delivered nearly $51bn in debt cancellation for roughly 715,000 eligible borrowers, according to the White House.

The administration also announced $2.8bn in new debt relief for 51,000 borrowers enrolled in income-driven repayment plans, impacting people who have made their loan payments for at least 20 years or more but were never granted the relief they were entitled to.

Another relief measure automatically discharged $1.2bn in federal student loan balances for nearly 22,000 borrowers with a total or permanent disability through a data match with the Social Security Administration. In all, nearly 513,000 eligible borrowers have had $11.7bn in debts automatically wiped out through the Social Security match, according to the White House.

The Biden administration has continued to hammer GOP officials and the Supreme Court for upending debt relief plans, when the money “was literally about to go out the door,” Mr Biden said on 4 October.

The decision from the nation’s high court ended up “snatching from the hands of millions of Americans thousands of dollars in student debt relief that was about to change their lives,” he said.

Mr Biden’s initial plan would have wiped out balances for roughly 20 million federal student loan borrowers.

Borrowers who earned up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans cancelled. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants, under the plan.

Roughly 16 million people had already submitted their applications and received approval for debt cancellation last year before the Supreme Court shot down the plan and sided with legal challenges from Republican officials in several states.

Debt relief advocates have welcomed the latest efforts from the White House and the US Department of Education to find solutions to cancelling debt balances amid a ballooning crisis, but they have argued there is still more work to be done, and fast.

“What’s good about this: he is cancelling debt automatically without waiting for [negotiated rulemaking], no application, no way for SCOTUS to change the law,” according to debt cancellation advocacy group and debtors union Debt Collective.

“What’s bad about this: this is a tiny amount. He can cancel as much as he wants and he’s choosing nickels [and] dimes,” the group said.

Unlike the administration’s wider plan to broadly cancel debts for millions of borrowers, a new repayment plan option that debuted this summer will become a permanent piece of the government’s student loan framework.

The amount of debt taken out to support higher education costs has surged within the last decade, alongside growing tuition costs, increased private university enrollment, and dramatic cuts to higher education under Republican governments, putting the burden for such costs largely on students and their families.

Loan balances have skyrocketed to nearly $2 trillion, most of which is wrapped up in federal loans. Millions of Americans also continue to tackle accrued interest without being able to chip away at their principal balances.

The Supreme Court’s decision required a “swift” response from the White House, Natalia Abrams, president of the Student Debt Crisis Center, said in a statement at the time. “The president possesses the power, and must summon the will, to secure the essential relief that families across the nation desperately need,” she said.

“History has shown us that bold decisions and transformative policies are often met with initial resistance,” the organisation’s executive director Cody Hounanian added. “We now look to President Biden to deliver on his promise by cancelling student debt using other powers available to him.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks