Asian shares mostly higher after Trump stops stimulus talks

Stocks are mostly higher in Asia despite an overnight decline on Wall Street after President Donald Trump ordered a stop to talks on another round of aid for the economy

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Stocks were mostly higher in Asia on Wednesday despite an overnight decline on Wall Street after President Donald Trump ordered a stop to talks on another round of aid for the economy

Markets rose in Hong Kong and Sydney but fell in Tokyo.

Trump’s announcement via Twitter came after Federal Reserve Chair Jerome Powell urged Congress to come through with more aid, saying that too little support “would lead to a weak recovery, creating unnecessary hardship.”

Hours after his tweets about ending the stimulus talks, though, Trump appeared to edge back a bit from his call to end negotiations, calling on Congress to send him a “Stand Alone Bill for Stimulus Checks ($1,200)”

Some analysts characterized Trump's move as likely a negotiating ploy.

“I do not believe hopes of a stimulus deal are now gone forever," Jeffrey Halley of Oanda said in a commentary. “One of Mr. Trump’s favorite negotiating tactics, judging by past actions, is to walk away from the negotiating table abruptly. The intention being to frighten the other side into concessions."

With Chinese markets closed for a weeklong holiday, trading in Asia has been subdued.

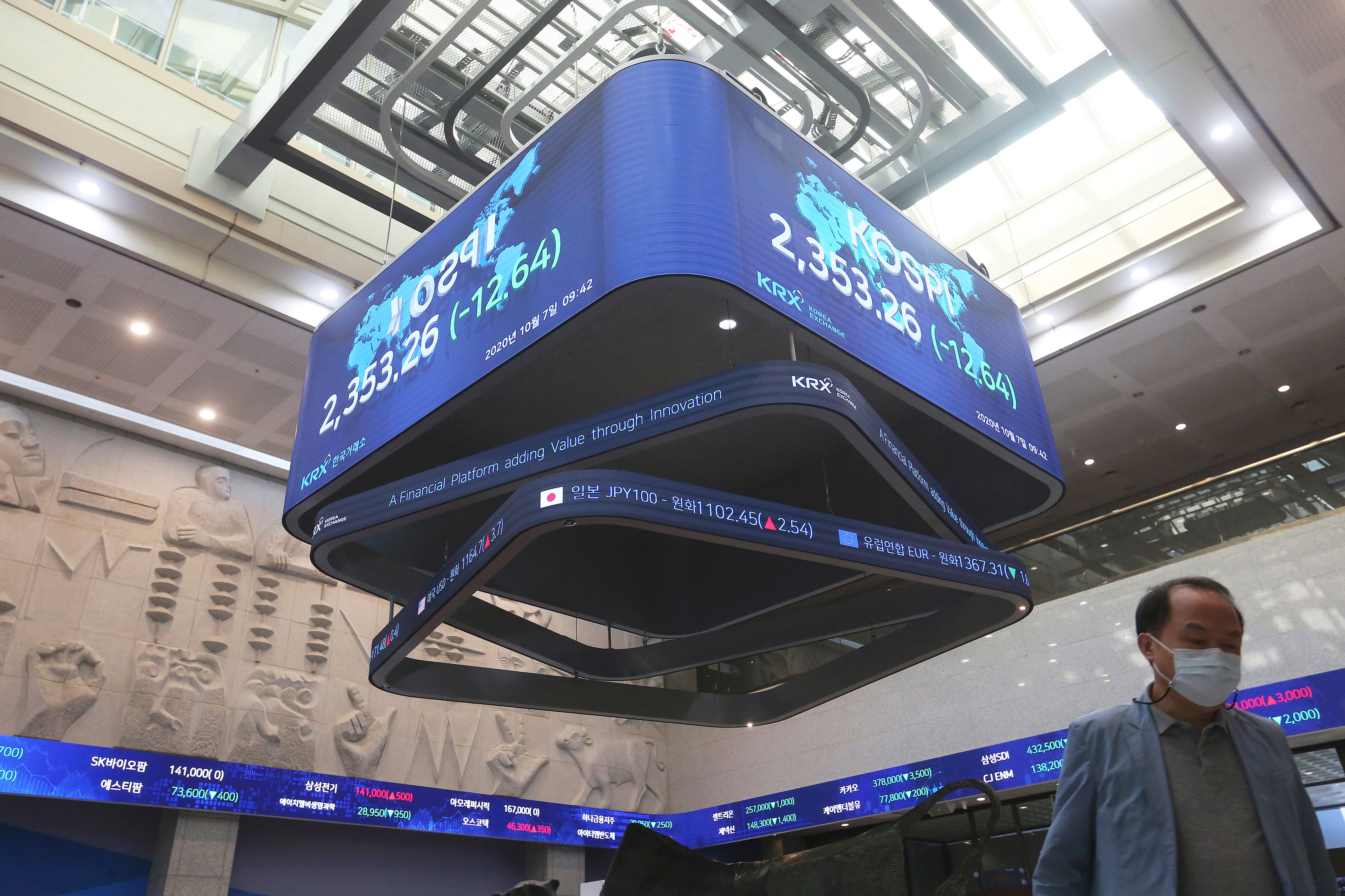

Hong Kong's Hang Seng rose 0.8% to 24,179.86 and the Kospi in South Korea surged 0.9% to 2,386,42. Japan's Nikkei 225 slipped 0.1% to 23,422.82.

Australia's S&P/ASX 200 jumped 1.3% to 6,036.40, as investors were cheered by the government's budget plan, which included tax cuts, subsidies and other stimulus to counter the impact of the pandemic.

Shares fell in Singapore but rose in Indonesia.

The S&P 500 index slid 1.4% to 3,360.97 after gaining 0.7% before the president’s announcement, which he made on Twitter about an hour before the close of trading. The late-afternoon pullback erased most of the benchmark index's gains from a market rally a day earlier.

In a series of tweets, Trump said: “I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major stimulus bill that focuses on hardworking Americans and small business.” He also accused Speaker Nancy Pelosi of not negotiating in good faith.

Optimism that Democrats and Republicans would reach a deal on more stimulus ahead of the Nov. 3 elections had helped lift the stock market recently. Now, investors face the prospect that more aid may not come until next year, after the new Congress is seated, said Willie Delwiche, investment strategist at Baird.

“This isn’t just pushing it off until after the election, this realistically is pushing it off until spring,” Delwiche said. "I don't think this is just a one-day financial markets reaction. This really goes to the health of the recovery.”

The Dow Jones Industrial Average dropped 1.3%, to 27,772.76. The Nasdaq composite lost 1.6% to 11,154.60. The Russell 2000 index of small-cap stocks gave up 0.3%, to 1,577.29.

Powell, the Fed chair, has repeatedly urged Congress to provide additional aid, saying the Fed can’t prop up the economy by itself, even with interest rates at record lows. “The expansion is still far from complete,” Powell said in a speech to the National Association for Business Economics, group of corporate and academic economists.

Trump's mention of $1,200 stimulus checks is a reference to a batch of direct payments to most Americans that has been a central piece of negotiations between Pelosi and the White House. Pelosi has generally rejected taking a piecemeal approach to COVID relief.

Without more stimulus, analysts expect that growth will slow significantly in the final three months of the year. Last month, Goldman Sachs slashed its forecast for growth in the fourth quarter to just 3% at an annual rate, down from a previous forecast of 6%, because they no longer expected an aid package to be approved. That would leave the U.S. economy 2.5% smaller at the end of 2020 than a year earlier, even after a large rebound in the July-September quarter.

The stimulus cutoff coincides with a slowdown in hiring, as employers added 661,000 jobs in September, the government said Friday. That was down from 1.5 million in August and 1.8 million in July.

A report on Tuesday showed that U.S. employers advertised slightly fewer job openings in August than the prior month. But the number was nevertheless better than economists expected.

Several big challenges lie ahead of markets. Chief among them is the still-raging pandemic, as so clearly illustrated by Trump’s COVID-19 diagnosis and brief stay in the hospital. The worry is that a ramp-up in infections could cause governments to bring back some of the restrictions they put on businesses early this year, which sent the economy hurtling into a recession.

The upcoming election adds to uncertainty about tax rates and regulations on businesses, while tensions between the United States and China continue to simmer.

The yield on the 10-year Treasury note was steady at 0.75% late Tuesday. While that’s still very low, the yield has been generally climbing since dropping close to 0.50% in early August.

In other trading, U.S. benchmark crude oil shed 58 cents to $40.09 per barrel in electronic trading on the New York Mercantile Exchange. It jumped $1.45 to $40.67 on Tuesday. Brent crude, the international standard, gave up 47 cents to $42.18 per barrel.

The U.S. dollar bought 105.75 Japanese yen, up from 105.62 late Tuesday. The euro strengthened to $1.1742 from $1.1734.