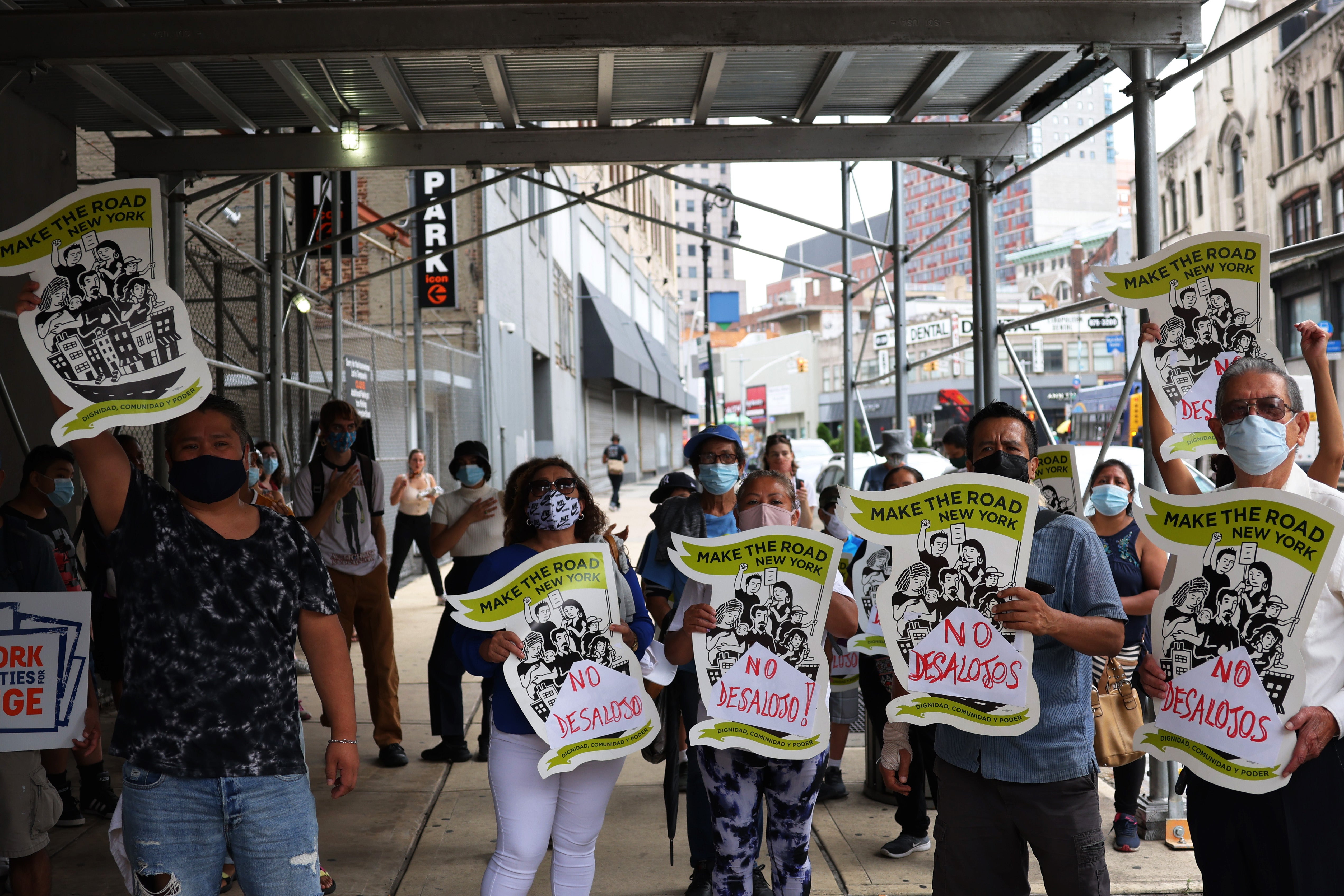

Millions fear losing their homes as pandemic moratorium on evictions set to run out

A large share of at-risk households are those with low incomes and people of colour

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The US economy is recovering from the effect of Covid-19, but millions who lost income are behind on housing payments and on the brink of eviction or foreclosure, a latest report has said.

“The State of the Nation’s Housing 2021” report released by the Harvard Joint Centre for Housing Studies on Wednesday said that due to widespread income losses during the pandemic, 14 per cent of all renter households were behind on their housing payments in early 2021, and in ten US states, more than one-fifth of renters were in arrears.

“With so many renters in financial distress, there are concerns about an impending wave of evictions. So far, substantial federal relief, along with federal and state eviction moratoriums, have prevented large-scale displacement,” said the report.

However, “if the federal moratorium ends in July, staving off a substantial increase in evictions and homelessness will depend on whether the latest round of assistance reaches at-risk households in time,” the report stated.

It said that households that weathered the pandemic without financial distress are snapping up the limited supply of homes for sale, pushing up prices and further excluding less affluent buyers from homeownership.

A disproportionately large share of at-risk households are those with low incomes and people of colour, the report said.

Chris Herbert, managing director of the centre, said in a statement: “For those households with secure employment and good-quality housing, their homes provided a safe haven from the pandemic.”

“But for millions struggling to cover the rent or mortgage, their housing situations have become increasingly insecure and these disparities are likely to persist even as the economy recovers, with many lower-income households slow to regain their financial footing,” he said.

While policymakers have taken bold steps to prop up consumers and the economy, additional government support “will be necessary to ensure that all households benefit from the expanding economy,” the report said.

“Unprecedented events of 2020 both exposed and amplified the impacts of unequal access to decent, affordable housing,” it added.

It expressed concern about an emerging bubble due to the “combination of robust demand and limited supply” which has lifted home prices to their fastest pace in over a decade.

“These outsized increases have raised concerns that a home price bubble is emerging. But conditions today are quite different from the early 2000s, particularly in terms of credit availability. The current climb in prices instead reflects strong demand amid tight supply, aided by record-low interest rates,” Daniel McCue, a senior research associate at the Harvard Joint Centre for Housing Studies, said in a statement.

The report further highlighted the disparities in homeownership. It said in the first quarter of 2021, the “Black-white homeownership gap stood at 28.1 percentage points, an improvement from the record high of 30.8 percentage points in 2019 but still large by historical standards.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments