Stanford 'was informant for US anti-drug agents'

Authorities accused of turning a blind eye to financier's banking business

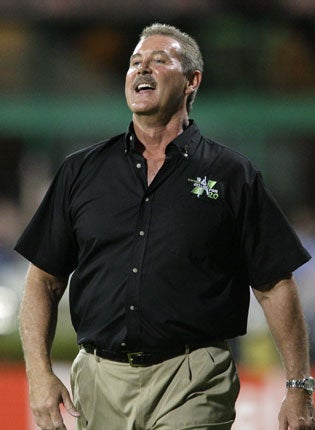

Sir Allen Stanford, the Texan billionaire who ploughed millions of pounds into English cricket, may have been working as an informant for American anti-drug agents in return for official protection which gave him free rein to run his banking empire, it emerged yesterday.

An investigation into the financier has found that just $500m (£331m) of the claimed $7.2bn of deposits held by his Stanford International Bank, based in Antigua, has been traced by a UK-based receiver who was called in by authorities when fraud allegations were laid against Stanford in February.

The resulting $6.7bn hole in the bank's balance sheet, which leaves 28,000 depositors – including 200 Britons – with near-worthless investment certificates, raises serious concerns about the extent to which officials in America and Britain were aware of Stanford's personal finance issues and the activities of his banks long before the current economic crisis. A BBC Panorama programme, to be screened tonight, alleges that the 6ft 4in-tall businessman may have been allowed to run his banking business unfettered for up to a decade because he was passing information on to America's Drug Enforcement Administration (DEA) about the money-laundering activities of drug baron clients from Colombia, Mexico and Venezuela.

His status as a confidential informant could have secured Stanford a degree of protection from financial regulators such as the US Securities and Exchange Commission (SEC) and may explain why a SEC investigation into his dealings in 2006 was quietly dropped following a request by another American government agency.

A source close to the DEA told Panorama: "We were convinced that Stanford's bank attracted millions of narco-dollars but it was very difficult to get the evidence to nail him. The word is that Stanford has been a confidential informer for the DEA since at least 1999."

Confidential documents show the British Foreign Office and the American authorities also knew as early as 1990 that Stanford, who was once listed as the 205th most wealthy man in the United States with a personal fortune of $2.2bn, had been made personally bankrupt in 1984 after his first business, a chain of health clubs, went bust.

British authorities ceased their investigation into Stanford after he moved his operations from the volcanic island of Montserrat, a British overseas territory, to Antigua, which has been independent from the UK since 1981.

Stanford, 59, shot to prominence last year when he signed a multimillion-dollar deal to sponsor a Twenty/20 cricket tournament, culminating in a $20m match between England and an all-stars West Indian team. The billionaire was famously allowed to land his helicopter on the hallowed turf of Lords.

He vigorously denied all allegations of wrongdoing when the SEC froze his assets and accused him of orchestrating a "fraudulent, multibillion-dollar investment scheme" which effectively used the money of new investors to pay large dividends to existing depositors. The Texan has vowed to return money to all depositors and ruled out running a pyramid scheme.

The Foreign Office said it was not responsible for the investment decisions of individuals. But a spokesperson said: "The UK Government does take financial malpractice very seriously."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks