Robert Smith: Billionaire who promised to pay off students' debt admits to tax fraud

Case is connected to Robert Brockman, the CEO of a private equity firm, who is also facing tax fraud charges

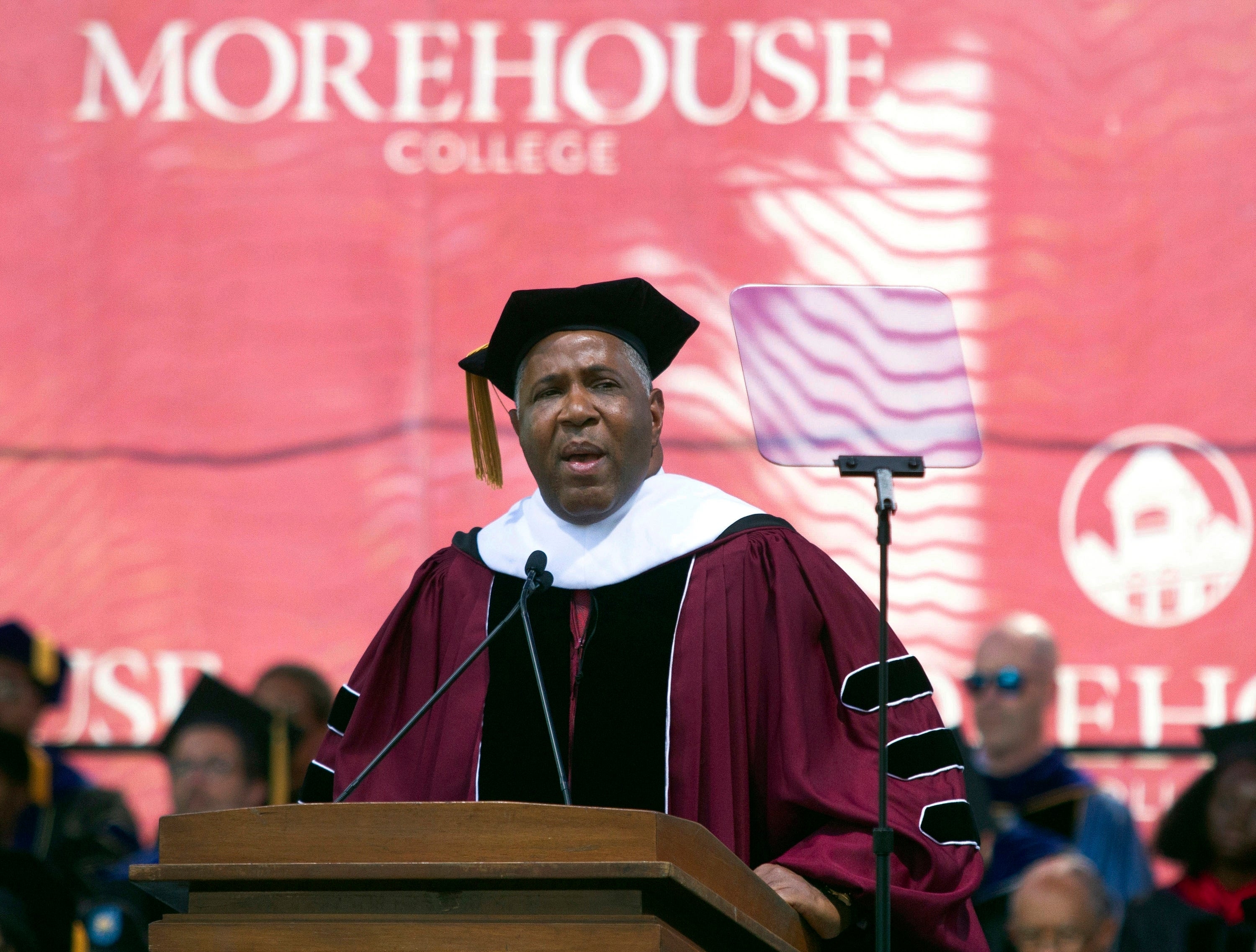

Robert Smith, the Texas billionaire who last year promised to pay off the debt of the graduating class of Morehouse College, has admitted to tax evasion through an illegal scheme that used offshore banks for 15 years, prosecutors said on Thursday.

The US Justice Department said Mr Smith, 57, entered into a Non-Prosecution Agreement for his involvement in the illicit tax evasion scheme and agreed to cooperate with the ongoing investigation. Mr Smith has also agreed to pay back taxes and penalties in full.

“It is never too late to do the right thing", US Attorney David Anderson said in a statement. “It is never too late to tell the truth. Smith committed serious crimes, but he also agreed to cooperate. Smith’s agreement to cooperate has put him on a path away from indictment.”

According to the agreement, Mr Smith formed the Excelsior Trust in Belize and Flash Holdings in Nevis in 2000. He used third-parties to hide his ownership in these entities that he created to avoid paying US taxes.

Mr Smith admitted that he “knowingly and intentionally” used these entities and their corresponding bank accounts in the British Virgin Islands and Switzerland to hide from the IRS and US Treasury Department income he earned private equity funds.

In total, he did not report more than $200 million of income as a result of the illegal tax scheme. Prosecutors said Mr Smith used about $2.5 million in untaxed funds to buy and upgrade a vacation home in Sonoma, California, purchase two ski properties in France, and spend $13 million to buy a property and charitable activities in Colorado.

He made headlines late last year when he promised the entire graduating class of Morehouse, a historically Black all-male college, that he would wipe out their student loan debt.

His case is connected to Robert Brockman, the 79-year-old CEO of a private equity firm, who was charged on Thursday with a $2 billion tax fraud scheme. Prosecutors said at a news conference that Mr Brockman hid capital gains income for more than 20 years through a web of offshore entities.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks