Masterworks: The $1bn company selling paintings as stocks and changing art forever

The company, formed just five years ago, is valued at over $1 billion, and may soon become the biggest art buyer in the world, writes Josh Marcus

The most impactful, thoroughly modern art collection in the world does not sit in some industrialist’s private collection, nor in the great museums of New York. Instead, the masterpieces – encompassing art from Basquiat to Banksy – reside in quiet anonymity in crates in a massive warehouse in Delaware, out of sight.

The Delaware Freeport, a climate-controlled, high-security art storage facility, is a fiscal and physical black box, a low-key but bustling node in the increasingly intertwined global networks of art and capital.

Recognised as a Foreign-Trade Zone by US Customs, the Freeport can store art shipped from abroad duty free. Delaware is also a favourite US tax haven, and the multi-millionaires who stash their work in the facility can avoid paying hundreds of thousands in taxes so long as the art remains inside.

It is here, in the humming silence of a 36,000-foot warehouse, where a company called Masterworks is pioneering an unprecedented new way of interacting with art: as a pure financial commodity.

These works are not to be fully possessed, or even physically witnessed, by their owners or the public, but rather bought and sold as a full-blown financial asset, a line on the balance sheet, code in someone’s trading portfolio.

It’s an idea that’s quickly taken hold. The company, formed just five years ago, is valued at over $1 billion, and may soon become the biggest art buyer in the world.

Here’s how it works: Masterworks has spent years buying up a portfolio of more than 80 works of blue-chip art worth more than $450 million in total, from renowned (and bankable) artists including Andy Warhol and Claude Monet.

It then sells its ownership of these pieces in slices, offering investors the chance to buy a share of the work, the same way an investor would buy a share in a company, for prices as low as $20 per share, as part of a higher minimum investment price. Customers then can either hold onto their stake until Masterworks sells the piece at auction, hopefully for a profit, or trade their shares on a secondary market.

The company was founded by CEO Scott Lynn, a venture capitalist and early internet businessman who made his first fortune as a teenager, before becoming a serious art collector.

“One day, [Mr Lynn] just sort of realised a lot of the artworks that he owned were going up in value. Then he started thinking to himself, ‘Is it just my artworks, is it all artworks?’” Masterworks chief investment officer Allen Sukholitsky told The Independent.

My Lynn, who by then had spent decades trying to seek out hidden value in the business and art worlds, decided to hire dozens of analysts to answer his big question. They poured over thousands of data points, scrutinising public auction records going back to the mid-1900s, and came to the conclusion that artworks were delivering massive, and barely noticed, returns as financial commodities.

“It’s almost like financial services have kind of passed over art as an asset class. It has centuries of data. It could have been investable long ago, but it never was,” Mr Sukholistky adds.

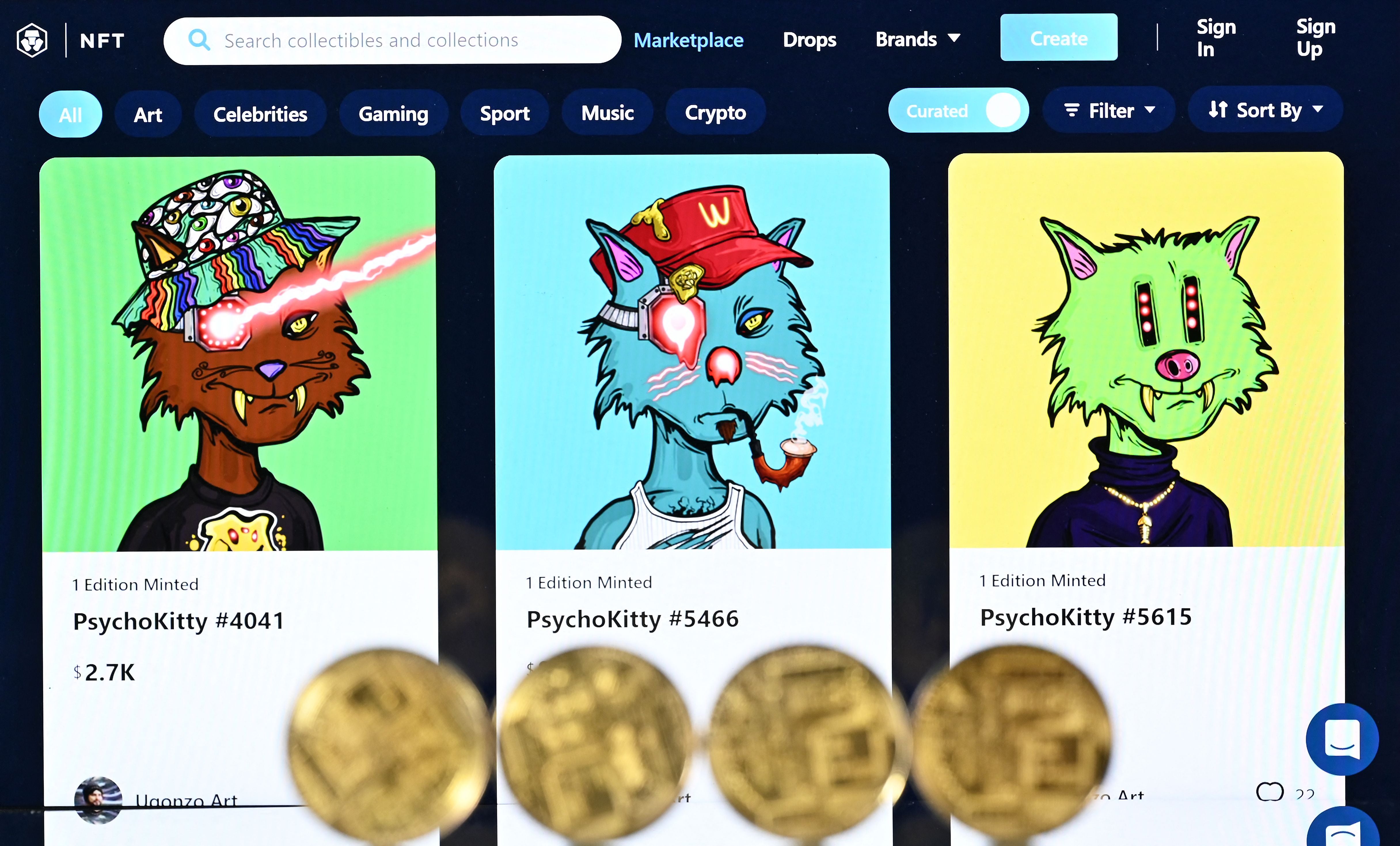

That is, until Masterworks came along. The company, likely the first of its kind, says it quickly became profitable on its own, well before it got $110 million in outside funding last fall. Now it has more than 300,000 customers, from all 50 US states and more than 100 different countries. Clearly then, in an age of NFTs, cryptocurrencies, globalisation, and whip-quick dissemination of arts and culture online, there seemed to be hunger for its securitised take on the art market.

This momentum could propel Masterworks to become a major institutional art buyer, with spending power that may soon outstrip any sheikh, Silicon Valley billionaire, or well-known museum. It expects to buy nearly $1 billion of art in 2022, a level of spending that could help it achieve something like monopsony power over the sales of great works of art.

Whether all that hype is built on sound economics is another story. Masterworks, and its hundreds of thousands of investors, certainly think so.

The art market, estimated to be worth around $1.7 trillion dollars, has appreciated in value by 14 per cent between 1995 and 2020, outperforming the S&P 500 by nearly 50 per cent, according to an analysis by Citi Bank. Not only that, according to CIO Sukholitsky, the value of art doesn’t often correlate with other traditional financial indicators like stocks and bonds. Rather, in business as in philosophy, art exists in a realm apart.

“What was incredible to me when I came across art as an asset class, and I started doing the research on art, it has special characteristics,” the Masterworks executive said. “Art has a very low correlation to all of them … That’s quite special.”

The company is quick to caution investors they shouldn’t expect immediate returns, but rather expect profitability after three to 10 years of ownership. Others, however, don’t believe art is quite the investment it’s touted to be, no matter how many years one holds onto it.

The economist William Baumol once suggested investing in art could be equivalent to a “floating crap game”, and found that inflation-adjusted returns for art over a 300-year period amounted to less than one per cent, below what even many traditional and conservative financial products can offer. Methods vary widely, but others have estimated art returns to be 2 per cent over 250 years, or 5 per cent over the last 125.

“I would not buy art purely for investment purposes. You can look at the returns that have been estimated. On balance, they are lower than stock returns, and there’s more volatility. That’s not to be unexpected,” said Kathyrn Graddy, dean of the international business school at Brandeis University, who researches the economics of art.

“People say, ‘Oh look, look at how it’s appreciated.’ I think you have to really look at the numbers, you have to look at the samples they’re using. You have to look at when they started.”

Surveys from Deloitte’s annual art and finance report also suggest that professional wealth managers, art collectors, and arts professionals alike are all more interested in direct, full ownership of art than in art securities as a prefered investment, at least for now.

That hasn’t stopped Masterworks customers from quickly buying out each new bundle of shares in a matter of days, almost like a hyped fashion drop from Supreme or Nike – if a hyped fashion drop was also registered with the Securities and Exchange Commission. And the company is now looking to work with institutional investors. A future where your pension fund or university endowment owns some art could be soon-ish at hand.

The company’s first sale captured this sea change well, representing the moment an audacious new player entered the buttoned-up worlds of art auctions and high finance. In 2020, Masterworks sold street art prankster Banksy’s take on the Mona Lisa – which features the famed dame holding an AK-47 with a bullseye target on her forehead – for $1.5 million. The sale delivered returns of more than 30 per cent to investors, double the growth of the S&P 500 during the time the company owned the piece.

It’s a full-circle moment for Masterworks CEO Scott Lynn. A keen understanding of cutting-edge business turned him into an art collector, and a keen understanding of art collecting turned back into a serious business.

He made his first millions as a teenager in Kansas City in the late ‘90s, inventing the popular “Punch the Monkey” web banner ad in the early days of the commercial internet. He later transformed the cheeky pop-up into a booming online sweepstakes/data collection business. He bought his first works by Picasso and Matisse before he was 21.

As he continued to build his profile in business, his art collection rose to serious heights, coming to include works by Marc Chagall and Willem de Kooning. In 2012, he acquired a work by the latter which he then sold two years later for nearly double the price, for $13,500,000 in gross proceeds.

“I do this partly because I love it, but I also view each acquisition as an investment and do rigorous analysis around that,” Mr Lynn once wrote on his Medium page.

Masterwork may be offering a new way to invest in art, but neither the company nor its founder are the first to mingle creativity with capitalism. Far from it.

The elites of the world have essentially always poured their money into art, seeking, in varying degrees, social standing, intellectual prestige, joy, and, eventually, profit, while acting as patrons and collectors.

Henry Clay Frick, for example, is known as both a famed 19th century strike-breaker and American industrialist for his work with the Carnegie steel empire, as well as a fanatical art collector.

“Once he was so over the top wealthy, he resigned, that’s what he lived for,” says Nancy Scott, a Brandeis art historian who teaches a class on the economics of art alongside Dean Graddy. “One of his highest goals, The Polish Rider by Rembrandt, he lured away from a castle in Poland.”

He eventually left his Fifth Avenue mansion, his horde of art, and $15,000,000 to New York City to establish the Frick Collection museum. Once, a story goes, someone offered the collection another Rembrandt, and his daughter remarked, “Why would we do that? We already have three”.

In more recent times, equally complicated characters like the Sackler family, blamed for fuelling the opioid crisis via their family company’s drug OxyContin, have thrown themselves into patronage, putting their name on galleries and a whole wing inside New York’s famed Metropolitan Museum of Art, before activists demanded it be taken down.

Art funds, too, have been tried before. In the early 1900s, a famed French art fund known as the Skin of the Bear (Peau de l’Ours) patronised cutting-edge artists like Picasso, Matisse, and Gauguin, and sold their works for a fine profit just before the outbreak of World War I, splitting the earnings between investors and the artists themselves. In the late 20th century, various banks and pension funds experimented with art funds, to mixed success.

There is, more or less, a mirror art economy that mimics the wider world (and pitfalls) of traditional financial markets. The art economy has its own institutional heavyweights, its own art finance and lending corporations backed by private equity, its own snake-oil art dealers and “specullectors” looking to make a quick buck, its own byzantine arrangements between sellers and billion-dollar auction houses to sell works for guaranteed minimums, and its own shell game of dummy corporations and elaborate mechanisms for moving goods and cash around the globe. In other words, as the writer James Rushing Daniel has said, art was already a “financial instrument with a pretty face” before Masterwork came along.

What is new about this moment, however, is the particular blending of art, business, and luxury as both mass-market commodities and signs of exclusivity. Celebrities and athletes have thrown their names (and their millions) into NFTs – often via ownership of a digital artwork, with proof of their stake held in the blockchain – riding a wave of cool powered by a combination of crypto bros and digital artists. Luxury goods houses like Tiffany have tapped music stars Beyoncé and Jay-Z to promote their diamonds, standing in front of a little-seen Basquiat, together forming a picture of unreachable, yet familiar, prestige. The street art of Keith Haring, meanwhile, has been mass-marketed into oblivion, slapped on a seemingly endless procession of clothing, sneakers, and design collaborations.

As everyone gets into appreciating, and buying, art, global taste in art itself has shifted overwhelmingly towards contemporary art, and local preferences are dying out in favour of a homogenised worldwide set of modern aesthetics, according to art market data, which suggests regional tastes at big-name auction houses are waning.

Each day that goes by, art becomes further unglued from its origins as something to experience in a direct, personal way, and is instead melting into the ether of the global economy. But it would be a shame to regard art as just a commodity, according to Professor Scott, the art historian.

“If you want to spend money on art, travel, go to great museums, buy art you could live with and love,” she says.

Masterworks says they don’t see a contradiction between what they are doing and an appreciation of art for art’s sake. Their hundreds of thousands of customers now spend hours thinking about works and their relative merits, albeit financial, leading some who have never cared to take an interest in art. The company had a gallery space before the pandemic, and hopes to return to public exhibitions once coronavirus dies down, channeling this wellspring of virtual interest in art back into the physical world.

“Art museums, they really only showcase a very small segment of their work. What we’re doing its, yes, we’re approaching art from a totally different perspective than it’s ever been before. We would argue those 300,00-plus investors who have come to our platform, there’s a reasonable chance they maybe would’ve had far less interest in art or maybe would’ve been less knowledgeable before they came to our platform,” Mr Sukholitsky said.

Even if all Masterworks achieves is making some people rich while art sits in a box in Delaware, they will have ended up proving something about art itself in the process.

Art is one of the few things that outlives us all, retaining its strong psychic pull and diverse meanings across the ages, as Donna Tartt writes at the conclusion of her Pulitzer Prize-winning 2013 novel The Goldfinch, a story of how a Dutch Golden Age painting travels across the world, driving people to obsession, violence, and underworld crime.

“Between reality on the one hand, and the point where the mind strikes reality, there’s a middle zone, a rainbow edge where beauty comes into being, where two very different surfaces mingle and blur to provide what life does not: and this is the space where all art exists, and all magic,” her narrator writes, adding, “And in the midst of our dying, as we rise from the organic and sink back ignominiously into the organic, it is a glory and a privilege to love what Death doesn’t touch.”

Art, money, and power may change hands, but the force of beauty will remain long after we’re gone and all our debts are settled.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks