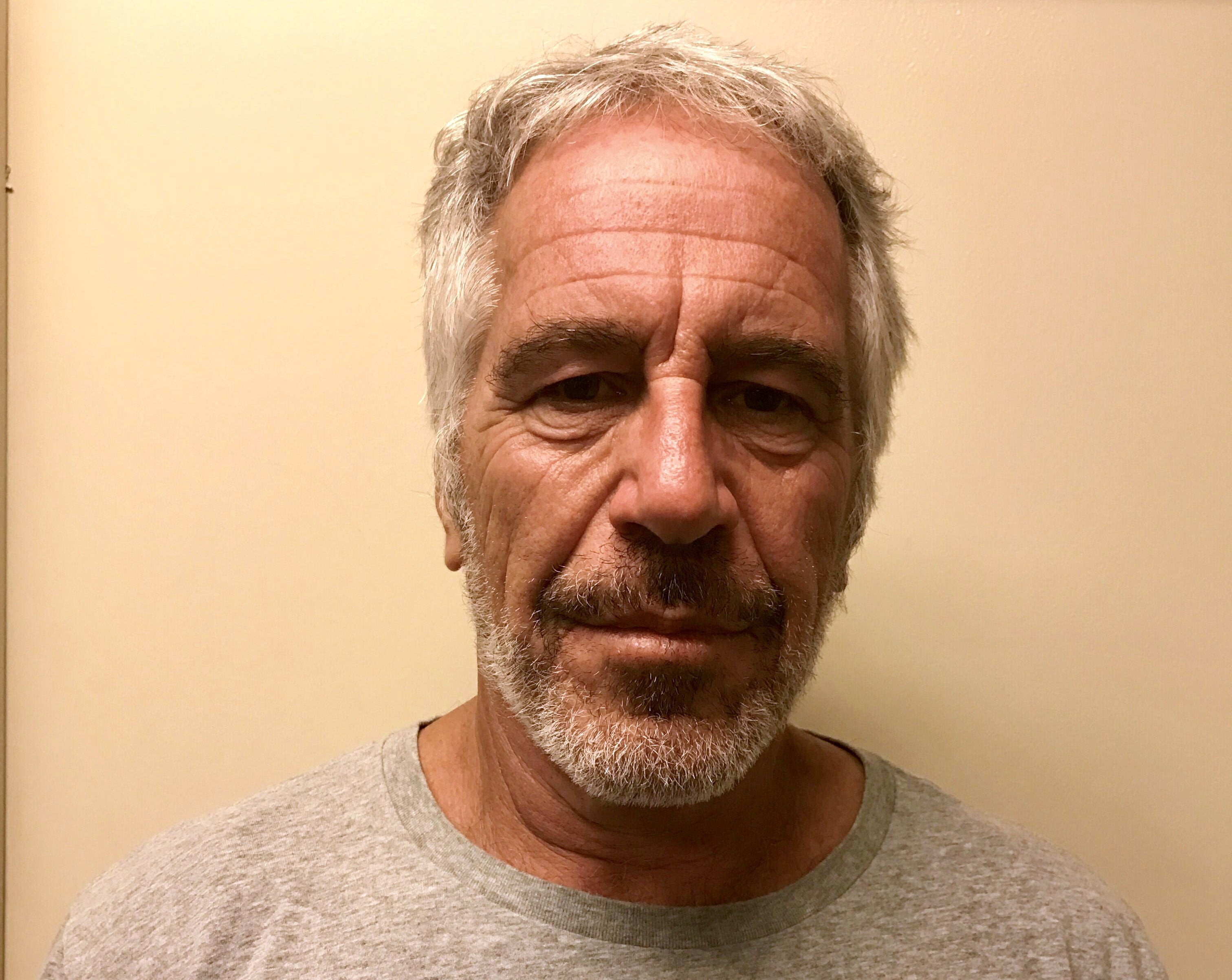

The long shadow of Jeffrey Epstein forces a reckoning between JPMorgan and the US Virgin Islands

A sprawling lawsuit that pits the US Virgin Islands against JPMorgan Chase has entangled some of the world’s wealthiest and most powerful individuals, Bevan Hurley writes

In 1998, Jeffrey Epstein purchased Little Saint James in the US Virgin Islands and began trafficking girls as young as 14 into “sexual servitude” at the secluded island.

The same year, he opened his first account with JPMorgan Chase, the start of a lucrative partnership for the Wall Street giant that would continue for years after the late financier had been “red flagged” by the bank as a child sex offender.

To keep his illicit sex-trafficking scheme running, Epstein needed access to large amounts of cash to pay off recruiters and attempt to silence victims.

JPMorgan is alleged to have “pulled the levers” through which Epstein paid his network of enablers, according to a lawsuit filed by the US Virgin Islands (USVI) Attorney General in a US court in December.

The lawsuit claims that JPMorgan concealed wire and cash transactions that were part of a “criminal enterprise” whose currency was vulnerable and desperate women and girls, groomed and recruited over decades by Epstein and his chief lieutenant Ghislaine Maxwell.

In separate lawsuits, several survivors of Epstein’s abuse sued JPMorgan and Deutsche Bank accusing them of actively enabling his abuse.

On 12 June, a JPMorgan spokesperson said the bank had agreed in principle to reach a settlement with the survivors. Lawyers for the accusers said the settlement is worth $290m.

The sprawling US Virgin Islands legal action is still pending, and a jury trial has been scheduled for October.

It has already drawn in some of the world’s wealthiest individuals including billionaire JPMorgan CEO Jamie Dimon, Tesla CEO and Twitter owner Elon Musk, Google’s co-founders Larry Page and Sergey Brin, and Microsoft co-founder Bill Gates.

All have denied any involvement in Epstein’s offending.

JPMorgan has rejected allegations of complicity and tried to shift blame for Epstein’s crimes onto high ranking USVI officials. Their lawyers have claimed in court that the USVI shielded him from accountability while “reaping the benefits of his wealth”.

JPMorgan has also sued former top executive Jes Staley, alleging he hid Epstein’s abuse and trafficking to keep the financier as a client. Mr Staley has previously denied wrongdoing, and said he is being scapegoated by the bank.

Here’s what to know about the lawsuit and the powerful figures it has entangled.

‘The time has come’

The legal action began in November, when two women who said they had been preyed on by Epstein filed lawsuits against JPMorgan Chase and Deutsche Bank for allegedly ignoring warning signs.

According to the lawsuit taken against JPMorgan, one woman, a former ballet dancer, was sexually abused by Epstein and his friends from 2006 to 2013.

She alleged large sums of money were withdrawn from JPMorgan to pay her and other victims in cash for sex acts.

A separate suit taken against Deutsche Bank alleged that it was complicit in aiding an Epstein victim to be trafficked for sex between 2003 and 2018.

“The time has come for the real enablers to be held responsible, especially his wealthy friends and the financial institutions that played an integral role,” their attorney Brad Edwards told the Wall Street Journal.

In May, Deutsche Bank agreed to pay the victims $75m to settle the lawsuit.

Mr Edwards said in a statement at the time it was believed to be the largest sex trafficking settlement with a bank in US history.

“The settlement will allow dozens of survivors of Jeffrey Epstein to finally attempt to restore their faith in our system knowing that all individuals and entities who facilitated Epstein’s sex-trafficking operation will finally be held accountable,” Mr Edwards’ firm said.

The settlement agreed to by JPMorgan this week is even larger at $290m, according to Mr Edwards.

“A settlement of this size finally acknowledges the magnitude of the suffering of Epstein’s victims, the degree to which our system is broken, and the extent of Epstein’s influence to corrupt our system,” he said, per the Wall Street Journal.

Under the Bank Secrecy Act, financial institutions are required to monitor and report suspicious activity related to illegal activities such as human-trafficking.

‘More than close-up view’

In late November, Epstein’s estate agreed to pay $105m to the US Virgin Islands to settle a three-year lawsuit that claimed the late paedophile had used his private island in the archipelago for sex-trafficking.

The then-attorney general Denise George had accused Epstein of deceiving authorities into granting tax breaks to his financial advisory company Southern Trust Company.

Then in late December, Ms George filed a suit against JPMorgan in New York alleging the bank and senior executives “had a more than close-up view of Epstein’s sex-trafficking”.

Within days, Ms George was removed from her post by USVI governor Albert Bryan, a spokesperson told The Independent at the time.

Officials refused to provide an explanation, but did nothing to quell reports that the governor had been blindsided by the JPMorgan lawsuit.

Any concerns that Ms George’s removal as AG might see the lawsuit withdrawn were soon extinguished.

The USVI quietly began issuing subpoenas for the bank’s top executives and other powerful, peripheral figures.

In February, newly unsealed passages of the lawsuit alleged that former JPMorgan executive Jes Staley had exchanged more than 1,000 emails from his work account with Epstein between 2008 and 2012.

They included an exchange which the USVI claimed referred to Epstein procuring young women to Mr Staley while he was visiting London.

Epstein asked the bank exec if he “needed anything” while in England, to which Mr Staley allegedly answered yes. Mr Staley later responded “that was fun,” and, “Say hi to Snow White,” according to the documents.

Mr Staley also allegedly wrote to Epstein while he was incarcerated in Florida for underage sex offences from the financier’s private island Little Saint James in 2009.

“So when all hell breaks (loose), and the world is crumbling, I will come here, and be at peace,” Mr Staley allegedly wrote.

“Presently, I’m in the hot tub with a glass of white wine. This is an amazing place. Truly amazing. Next time, we’re here together. I owe you much. And I deeply appreciate our friendship. I have few so profound.”

A month later in the fall of 2009, Mr Staley is alleged to have sent Epstein another email saying: “I realise the danger in sending this email. But it was great to be able, today, to give you, in New York City, a long heartfelt, hug.”

According to the lawsuit, Epstein responded with a photo of a young woman, which was redacted from the filing.

Mr Staley left JPMorgan in 2013 and later became CEO of Barclays Bank before resigning in November 2021 amid investigations into the bank’s dealings with Epstein. He has expressed regret for befriending Epstein.

In March, JPMorgan sued Mr Staley for allegedly concealing Epstein’s sex trafficking to keep him as a client. The bank said he should bear the cost of any financial penalty.

In response, Mr Staley accused the bank of “slanderous” attacks and said he was being made the fall guy for its own oversight failures.

He asked the court to severe the lawsuit from the JPMorgan lawsuits in a letter to the court in April.

“The allegations against him are slanderous, and the potential damages are astronomical,” his attorney Brendan Sullivan wrote.

Last month, US District Judge Jed Rakoff ruled that JPMorgan’s lawsuit against Mr Staley could move ahead.

The Independent has sought comment from Mr Staley’s legal team.

Red flags raised

In March, the scope of the USVI lawsuit broadened significantly as subpoenas were issued to Google co-founders Sergey Brin and Larry Page, Hyatt Hotels executive chairman Thomas Pritzker and real estate mogul Mortimer Zuckerman.

JPMorgan’s head of asset and wealth management, Mary Erdoes, sat for a deposition that month with the USVI’s attorneys.

According to a court filing, Ms Erdoes admitted under oath that she knew in 2006 that Epstein had been “accused of paying cash to have underage girls and young women brought to his home”, seven years before the bank cut ties with him.

A source familiar with the matter told The Independent at the time that Ms Erdoes had read about the accusations in news reports.

Epstein had been convicted of procuring underage prostitutes in 2008 and sentenced to 18 months in prison.

But it took another two years for the bank to flag Epstein’s status as a sex offender, and he remained as a JPMorgan client until 2013, where his accounts were worth hundreds of million of dollars.

The filing claimed that JPMorgan executives had wrestled internally with whether to continue to work with Epstein after accusations of abuse and trafficking young girls first emerged.

JPMorgan’s Rapid Response Team raised red flags as early as 2006 that Epstein was making cash withdrawals of between $40,000 and $80,000 several times each month, totalling over $750,000 per year.

According to a transcript of her deposition, Ms Erdoes said JPMorgan dropped Epstein as a client when it realised that the large withdrawals were for “actual cash”.

“Had the firm believed he was engaged in an ongoing sex trafficking operation, Epstein would not have been retained as a client,” a JPMorgan spokesperson has said previously.

The civil complaint further alleged that JPMorgan had obstructed federal law enforcement agencies from pursuing Epstein.

The suit also stated that Epstein’s former confidante Ghislaine Maxwell was flagged by the bank in 2011 after trying to open an account for a “personal recruitment consulting business.”

A JPMorgan executive testified at Maxwell’s sex-trafficking trial in 2021 that Epstein had wired tens of millions of dollars to her since the 1990s.

‘Never met Jeff Epstein’

When JPMorgan CEO Jamie Dimon was quizzed under oath by USVI attorneys in late May, he said he did not recall ever hearing about Epstein or his sexual misconduct until after his arrest in 2019.

Mr Dimon, a Wall Street power player who has expressed an interest in running for president, said he first heard about Epstein “when the story blew wide open”.

According to a transcript of the video deposition, Mr Dimon was confronted with an email from Epstein’s former assistant suggesting the pair were scheduled to meet as far back as 2010.

He replied emphatically that he had never had an appointment, never met, or never known “Jeff Epstein”.

“I have no idea what they’re referring to here,” he said.

Mr Dimon conceded that the bank’s relationship with Epstein had been a “disaster”.

In June, it emerged that survivors of Jeffrey Epstein’s sex-trafficking ring had written to Mr Dimon and Ms Erdoes begging them to admit what they knew about the paedophile’s offending.

Haley Robson, who was a high school student when she was recruited by Epstein, wrote to the JPMorgan CEO saying: “Dear Jamie Dimon. I cannot begin to explain how Epstein has consumed my life.

“I cannot make you see, force you to feel or even request that you show compassion to all the survivors.

“I don’t understand how so many people, colleagues, knew what was going on, or had evidence and information that could have helped us, and chose not to speak up,” she wrote, in a letter obtained by the Daily Beast.

She went on to reference a smear campaign by Epstein’s attorneys against the victims after his conviction for soliciting prostitution from young girls in 2008.

“Why did we all get picked apart publicly when the reality is you and many more knew something and didn’t speak up?” she asked.

“If you are a good human you will just admit to making a mistake and be the first to try to do what is right to end this chapter on a positive note for all of us.”

Another survivor, Courtney Wild, wrote to JPMorgan executive Mary Erdoes last month asking her to support the victims’ quest for justice, the Daily Beast reported.

Ms Wild wrote that she believed JPMorgan was “Epstein’s right hand man in allowing him to become the most abusive sex offender in history.”

“Yet, rather than acknowledging a wrong doing, accepting responsibility, making an apology to all of us, and doing what is right, I understand that JPMorgan has unleashed an army of lawyers to torture the victims who brought the cases and put them through even more pain and suffering,” she wrote.

“Does nobody at JPMorgan have a conscience?”

A settlement deal was reached in principle with the victims, JPMorgan confirmed in a statement to The Independent on Monday.

“We all now understand that Epstein’s behavior was monstrous, and we believe this settlement is in the best interest of all parties, especially the survivors, who suffered unimaginable abuse at the hands of this man,” a spokesperson said.

“Any association with him was a mistake and we regret it. We would never have continued to do business with him if we believed he was using our bank in any way to help commit heinous crimes.”

Billionaire’s row

In a court filing in May, the USVI’s attorneys revealed they had tried to issue a subpoena to the Twitter owner and Tesla CEO Elon Musk for documents related to the case.

The Virgin Islands claimed that Epstein may have referred “or tried to refer” Mr Musk to JPMorgan as a client.

It sought records of communications with Epstein and JPMorgan and “all documents reflecting or regarding Epstein’s involvement in human trafficking and/or his procurement of girls or women for commercial sex.”

Responding on Twitter, Mr Musk called the subpoena “idiotic on so many levels”, adding: “That cretin never advised me on anything whatsoever.”

Mr Musk said he had severed Tesla’s relationship with JPMorgan more than a decade ago.

USVI attorneys have also issued similar subpoenas for Sergey Brin and Larry Page, the billionaire co-founders of Google, seeking records containing any communications between them and Epstein related to sex trafficking.

The Independent has attempted to contact Mr Brin and Mr Page for comment.

The bank’s attorneys claim that Epstein touted his connections to high net-worth individuals to maintain in good standing with JPMorgan.

The Independent has attempted to contact Mr Pritzker, the Hyatt Hotels executive chairman, and real estate mogul Mr Zuckerman.

Bill Gates

Microsoft co-founder Bill Gates was linked to Epstein through various philanthropic causes, and visited his Manhattan townhouse three times, the New York Times revealed in 2019.

Mr Gates has repeatedly expressed regret over the connection.

In May, the Wall Street Journal revealed that Epstein had tried to blackmail the billionaire in 2017 after learning about an affair he was having with Russian bridge player Mila Antonova.

Court filings alleged that Epstein blackmailed Mr Gates after he failed to convince the world’s fourth richest man to join a multibillion-dollar charity fund that he attempted to set up with JPMorgan.

The latest fallout from the USVI lawsuit added weight to longstanding speculation that Epstein may have been extorting his powerful network of friends.

He was married to Melinda French Gates at the time of the affair. They divorced after 21 years of marriage in 2021.

In an interview with CBS Mornings the next year, Ms French Gates described Epstein as “evil personified”.

Epstein ‘backed’ USVI political campaigns

In court filings in May, JPMorgan accused the islands and senior officials of enabling Epstein to commit his crimes.

Lawyers for the bank claimed high ranking USVI officials had been bought off by Epstein and actively worked with him while “reaping the benefits of his wealth.”

“He gave them money, advice, influence, and favors. In exchange, they shielded and even rewarded him,” they wrote.

JPMorgan also claimed that Epstein had bankrolled a USVI official’s political campaign who later awarded him tax breaks.

They claimed that the “primary conduit for spreading money and influence” throughout the USVI government was former First Lady Cecile de Jongh, the wife of Governor John de Jongh, who ruled from 2007 to 2015.

The lawyers said officials were lenient with requirements that he register as a sex offender, doing inspections of his residence that were “cursory at best.”

The Independent has contacted a spokesperson for the USVI governor.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks