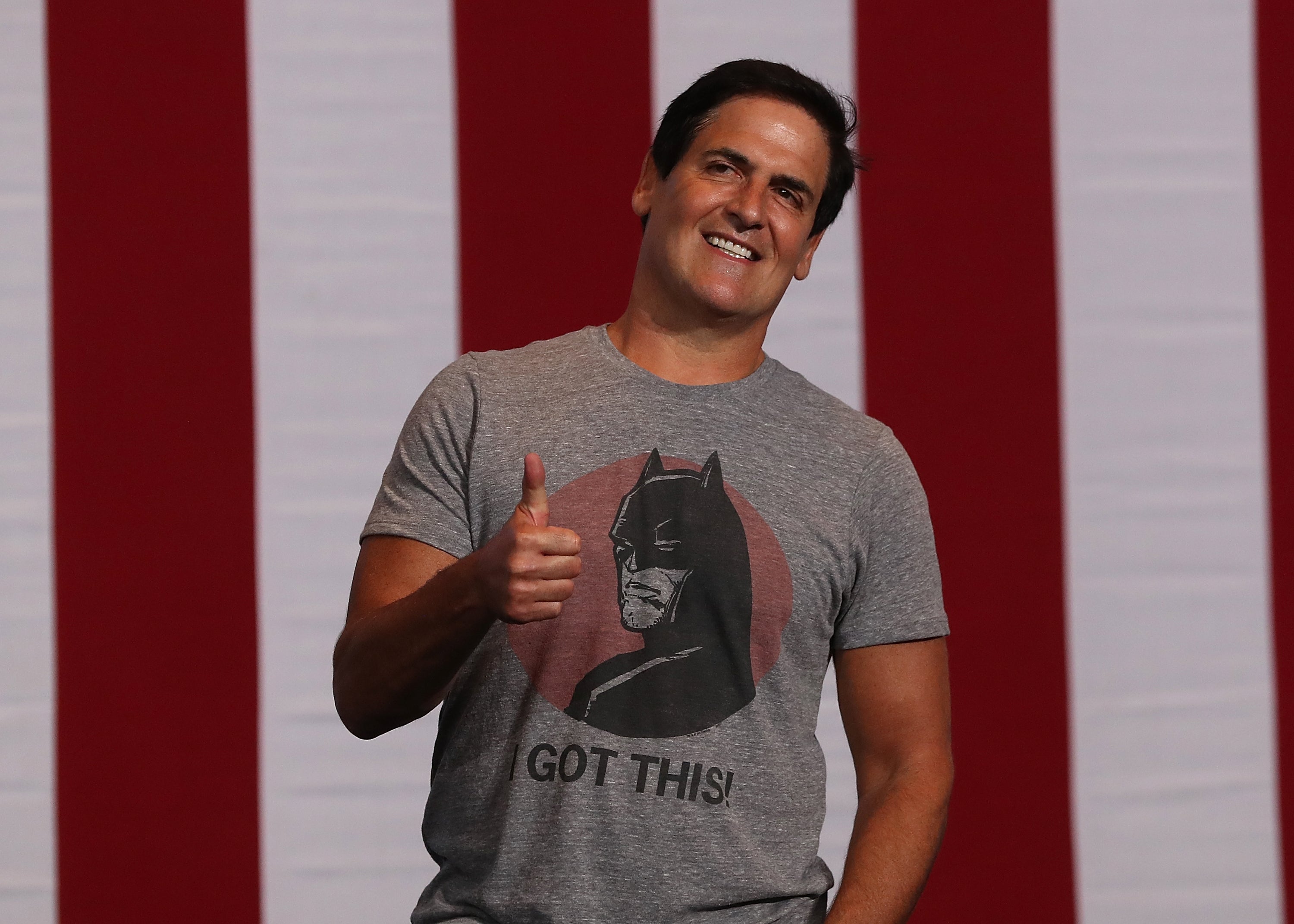

Billionaire Mark Cuban says he has ‘hedged the heck’ out of his portfolio amid worries over GameStop market war

Shark Tank star admires WallStreetBets’ use of hedge fund tactic for success

Billionaire entrepreneur Mark Cuban says he is a fan of the Reddit-inspired short squeeze of GameStop but admits he has “hedged the heck” out of his own portfolio.

The Shark Tank star told CNBC that the WallStreetBets group had simply used a tactic often deployed by investment professionals.

“It’s not the first time low float or heavily shorted stocks have been targeted,” said Mr Cuban on the Squawk Box programme.

“There are many hedge funds that have made a lot of money over the years targeting heavily shorted stocks. I don’t think this is anything different.

“It’s just the people who are making the push aren’t who we expect them to be and so that’s why I like it.”

“When you bring people out of nowhere to really show the inefficiencies of the market, it’s a good thing,”

GameStock surged almost 2,000 per cent following the group’s investment in the heavily-shorted stock, a move that has punished some hedge fund managers and Wall Street professionals.

“As long as we’re allowing companies to trade stocks in milliseconds, how can we expect this to be an investors’ market?” added Mr Cuban.

“Until you change that, you can’t change what’s happening with WallStreetBets.”

Mr Cuban said that he had concerns about valuations across a string of asset classes and has adjusted his own investments to reflect that.

“I hedged the heck out of my portfolio,” he said.

“There will be a deflation of some sort in those appreciable assets and it’s going to be scary when that happens.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks