Beijing backs railway rival to Panama Canal

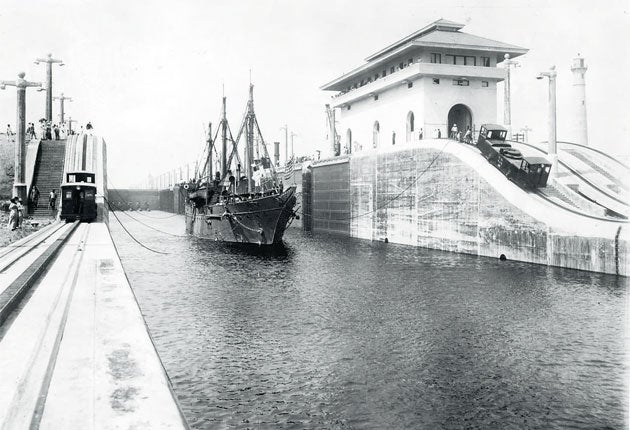

It could one day become the most dramatic symbol of China's new economic incursion into South America: a 220km railway line bisecting the neck of Colombia just south of Panama, creating a whole new means of moving goods at low cost between the Pacific and the Atlantic.

Talks between Colombia and China on building a rival route to the venerable and over-subscribed Panama Canal are already "quite advanced", according to Colombia's President Juan Manuel Santos, who disclosed details of the project in an interview with the Financial Times.

Creating a competing route joining the oceans has tickled the imaginations of other governments in the region for decades. Nicaragua once thought it could do the same, as at one point did Mexico. But attempting it now, just as Panama is embarking on a $5.25bn expansion to double the canal's capacity, might seem like bravado.

Yet the Chinese are rarely in the business of merely dreaming, and in recent years the country has become a prolific exporter of railway construction expertise. It recently signed a $13bn deal to built track for Iran, while in South America it is involved in major rail expansion projects in both Venezuela and Argentina. Last year China said it was planning to develop its own high-speed train network, linking the country with 17 others in central and south-east Asia using bullet trains.

The attention that China is paying Colombia may jolt the US into finally moving to ratify a long-delayed trade pact between the countries. Concern has long been growing in Washington that the US is gradually being displaced by China as the main partner in many South American countries.

Ties between China and Colombia have been burgeoning as bilateral trade has exploded from just $10m a year in 1980 to more than $5bn last year.

Colombia is the world's fifth-largest producer of coal, a commodity China can barely get enough of. China is already investing in a $7.6bn project to join coal producing areas in the interior of Colombia with the Pacific port of Buenaventura. Among others projects with Chinese involvement is a new plant by the truck builder Foton Motor, which should start building 5,000 light trucks a year by 2012.

"I don't want to create exaggerated expectations, but it makes a lot of sense," Mr Santos said of the putative trans-continental railway. "Asia is the new motor of the world economy."

China is keen to make friends in Latin America – and to extend its growing "soft power" in the region, just as it has in Africa, to give it access to the raw materials. It is thought that the China Development Bank would step in with the £4.7bn in cash needed to fund the project, while it would be built and operated by the China Railway group.

The new so-called "dry canal" would involve the construction of a new port city close to Cartagena on the Atlantic side, where Chinese goods would be assembled before being shipped onwards to North American markets.

That China is even pondering the rail line in Colombia is only the latest example of the country finding new ways to spend its prodigious cash reserves, switching the focus from buying debt to investing in and building infrastructure, particularly where it serves its own trade interests.

Other countries in Latin America benefiting from China's new wealth include Ecuador, where Beijing is a partner in new power generation plants and, most importantly, Brazil, which is in the midst of an economic boom driven in part by China's demand for raw materials.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks