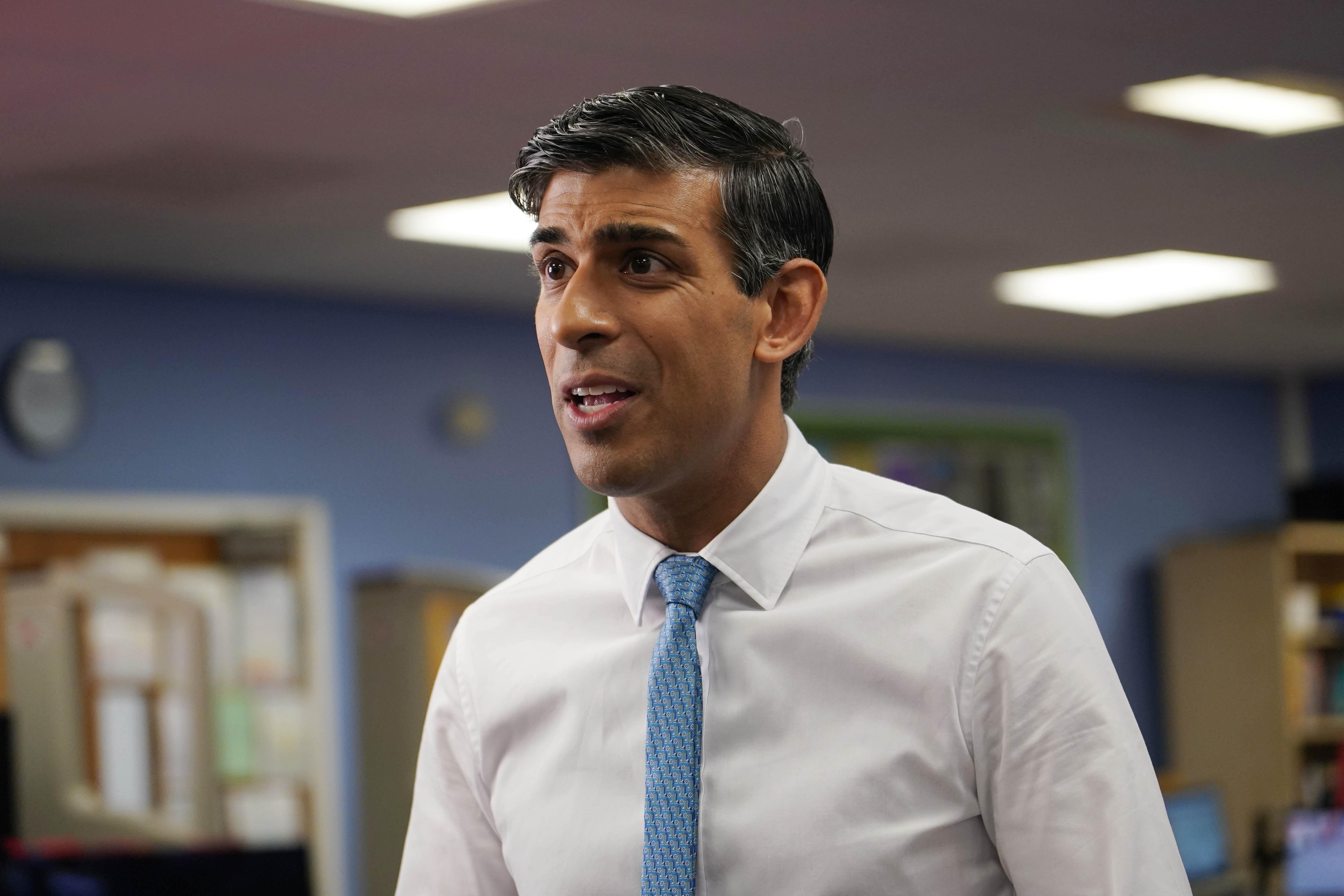

Sunak silent on inheritance tax cut speculation

Rishi Sunak said that there was always ‘plenty’ of speculation about tax.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Rishi Sunak has said there is always “plenty” of speculation about tax, amid suggestions that the Prime Minister is drawing up plans to slash death duties.

The Prime Minister insisted that he would not be commenting, after speculation that he is considering cutting inheritance tax.

Downing Street had sought to play down reports in The Sunday Times about potential reforms, with Mr Sunak on Monday instead choosing to stress Government efforts to halve inflation.

According to the newspaper, one proposal being considered is for Mr Sunak to announce his intention to phase out the levy by reducing the 40% inheritance tax rate in the budget in March, while setting out a pathway to abolish it completely in future years.

“I never would comment on tax speculation, of which there is always plenty,” the Prime Minister told broadcasters at a community centre in Broxbourne, Hertfordshire.

“What I would say is that the most important tax cut I can deliver for the British people is to halve inflation.

“It is inflation that is putting up prices of things, inflation that is eating into people’s savings and making them feel poorer. And the quicker we get inflation down, the better for everybody.

“We are making progress, we saw that in the most recent numbers. The plan is working, but we have got to stick to the plan to bring inflation down and that is the best way to help people with the cost of living.”

Cabinet minister Grant Shapps over the weekend called inheritance tax “punitive” and “deeply unfair”, but said that Chancellor Jeremy Hunt was in a “fiscal straitjacket”.

Inheritance tax is levied at 40%, but the vast majority of estates fall below the threshold – which can be up to £1 million for a couple – to incur the charge.

The latest figures, for the tax year 2020 to 2021, showed just 3.73% of UK deaths resulted in an inheritance tax (IHT) charge.

There has been pressure within the Tory Party to change or scrap IHT, with former prime minister Liz Truss among those calling for it to be axed.

The move would not be universally popular within the Tory ranks, with some backbenchers already warning against any such move.