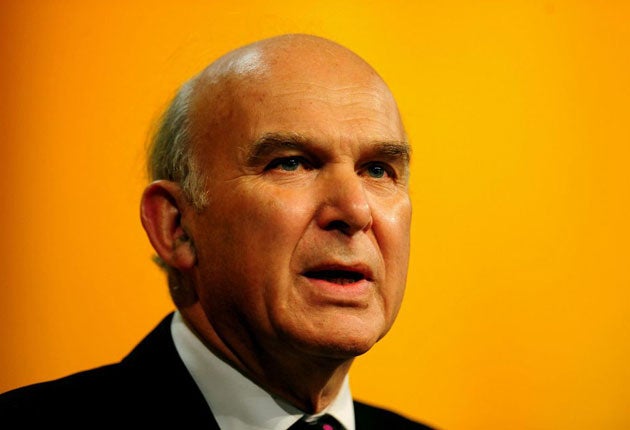

Vince Cable book boost 'led to tax error'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Business Secretary Vince Cable today blamed the surprise success of his best-selling book on the recession for his "embarrassing" failure to pay a tax bill on time.

Mr Cable was hit with a £500 penalty from HM Revenue and Customs (HMRC) after the blunder over a VAT bill of up to £15,000 on his media work.

The Business Secretary - who has criticised firms which seek to avoid tax - admitted it was a "bit embarrassing" that his VAT liability "wasn't spotted earlier".

But he insisted that he "made no attempt to avoid tax" and the "oversight" had happened in good faith.

Downing Street said it regarded the incident as "closed", adding that Mr Cable retained the Prime Minister's full confidence.

Mr Cable's tangle with the tax authorities occurred before he became a minister, when he earned an estimated £192,000 on top of his MP's annual salary of £65,738 in 2009/10.

HMRC rules state that if a person's turnover of VAT-liable goods and services over a 12-month period exceeds £73,000, they must register for the duty within 30 days.

Mr Cable said that his income was unexpectedly boosted above this threshold thanks to the popularity of his book The Storm: The World Economic Crisis and What it Means.

Speaking at an event hosted by thinktank Policy Exchange in Westminster after the fiasco was revealed, he admitted he "wouldn't offer any advice" to businesses on tax.

But he added: "All my income is fully declared, all taxes fully paid.

"There was an issue that arose on the back of my recent best-seller where I went through the tax threshold and didn't immediately notify it."

Mr Cable said that he approached HMRC unprompted, as soon as he realised he was liable for VAT on his earnings for 2009/10.

"The tax was paid in full and the matter closed within four weeks," he said.

"HMRC waived 50% of the fixed penalty for late notification in recognition of the fact that I did approach them unprompted and my oversight was in good faith.

"I made no attempt to avoid tax - in fact I made every effort to pay what was outstanding as soon as it became clear I was liable for VAT.

"It's a bit embarrassing that this wasn't spotted earlier. None of this will stop me talking out against tax avoidance."

The error was spotted by his personal accountants in January while his tax return for the previous financial year was being finalised.

The accountants notified HMRC officials and apologised, before offering to pay any due tax.

The former deputy leader of the Liberal Democrats was then billed for a figure of "less than £15,000" after a rebate on his charity donations was taken into account.

He is said to have sent a cheque to the Revenue by mid-February to make up for the shortfall, and was let off with half the usual penalty of £1,000.

Mr Cable's accountants, Myrus Smith, said: "There are no tax payments outstanding and none are being contested.

"When it became clear that Mr Cable's earnings had breached the level at which VAT was payable, an offer to settle immediately and in full was made to HMRC and this was duly accepted.

"The matter was dealt with within a month of the Revenue being informed in the first instance and is now closed."

A spokesman for HMRC declined to discuss Mr Cable's individual case, but said that penalties for late registration "depend on how much VAT is payable, how late the registration is and the level of co-operation".

Mr Cable has criticised tax avoidance in the past, writing in a 2009 article in the Guardian: "The evidence of systematic tax avoidance by rich individuals and UK-based companies strikes a particularly ugly note in these straitened times."

PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments