Treasury says tax cap on giving won't hurt charities

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

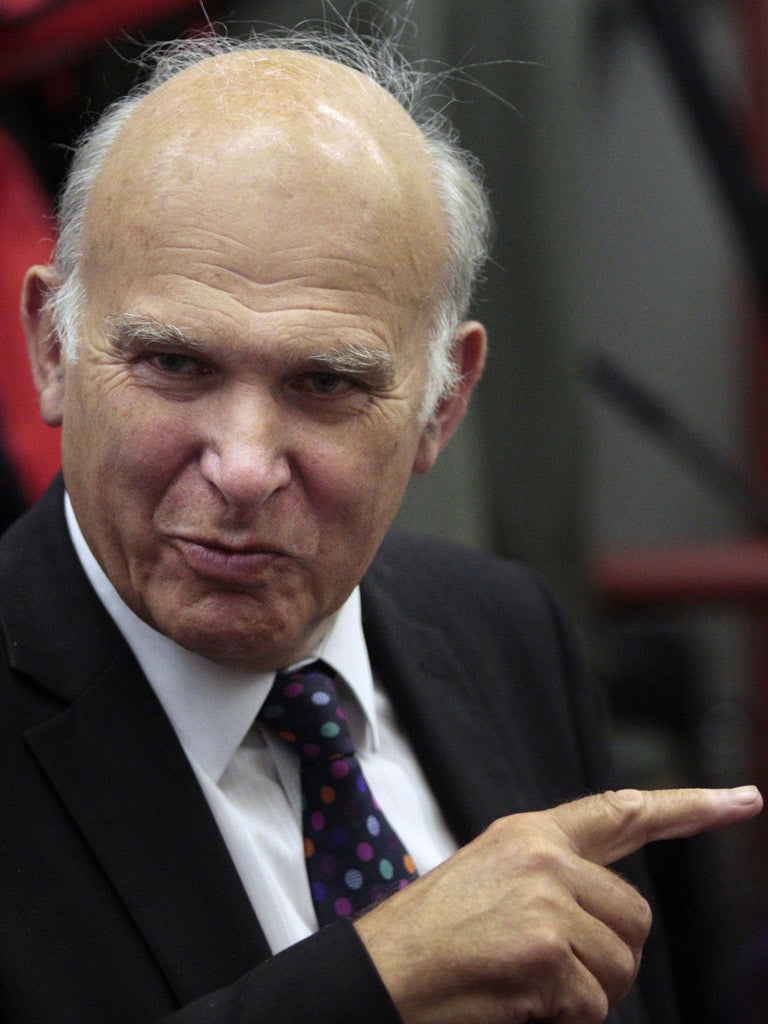

Your support makes all the difference.Vince Cable yesterday became the most senior minister to openly question the Government’s plans to restrict tax relief on charitable donations after intensive lobbying from universities.

The Business Secretary said while he was not opposed to cracking down on tax avoidance he was concerned that the measure could adversely effect genuine charitable donations.

Universities UK has warned the Government that the cap could undo much of the progress universities had made in raising funding from private donors – almost £560 million last year.

Mr Cable’s spokesman said the minister “fully supports the need to clamp down on abusive tax avoidance but this should be separated from genuine charitable giving”.

She added “Concerns have been raised with ministers, including Vince, by universities, and he is sympathetic to those concerns. We will make sure that what we are hearing from universities is fed back to the Treasury."

Mr Cable’s concerns came as the Treasury promised its proposed tax-relief cap on charity donations will be implemented flexibly as it tried to calm the storm of protest over the move.

David Gauke, a Treasury Minister, denied there would be a U-turn but pledged that the change would be introduced “without having a significant impact on those charities that depend on those donations”.

Adopting a more conciliatory tone than has previously been heard from the Government on the issue, he said: “We’re not saying that every charitable donation is somehow an abuse and that all charities are somehow a tax dodge, that’s not the case. But we are ending up with a situation where a small number of very wealthy individuals end up paying essentially very little – if any – income tax and we don’t think that is fair.”

Mr Gauke, who has begun talks with charities on the issue of donations, said: “There will be a proper consultation over the summer and then draft legislation produced in the autumn so we are going about this in a methodical way.”

Ministers at the Department for Culture are also urging the Treasury to change their plans and Ed Miliband said the plan marked a “new level of incompetence” by the Government.

John Low, the chief executive of the Charities Aid Foundation, said: “The time has come for George Osborne to listen to the many voices inside Government, and among charities and donors, who are saying clearly that he should now think again.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments