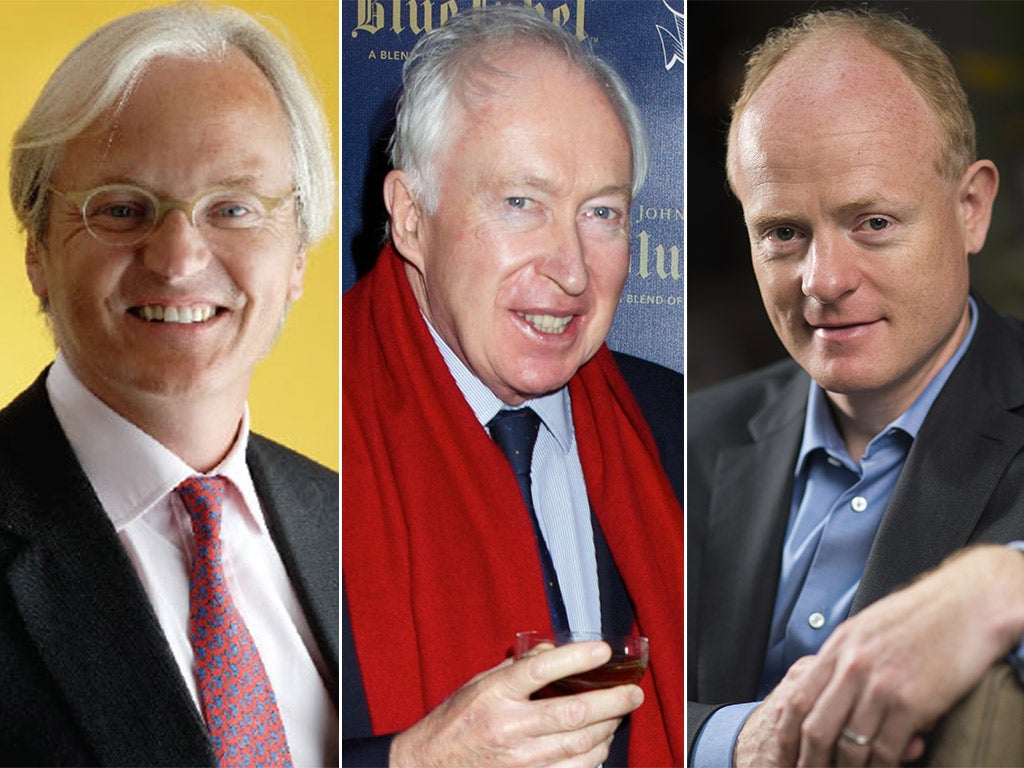

These are the hedge fund managers bank-rolling the Tory party

They include billionaires and lords

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.David Cameron’s links to bankers and the hedge fund industry have come under renewed attention after it emerged that almost half of the wealthiest fund managers in the country have donated to the Tories.

On Monday, the Prime Minister will host the Conservatives’ annual Black and White Ball, the party’s last big fundraiser before the general election.

According to Labour, 27 of the 59 wealthiest asset managers in the most recent Sunday Times rich list have voted blue with their cash in the past, amounting to £10 million since the 2010 election alone.

The Tories counter that since Ed Miliband became leader, the unions have given Labour £35 million – including £12.8 million from Unite alone.

But who’s bank-rolling Mr Cameron? Here’s a breakdown of the 10 biggest Tory hedge fund donors – along with their overall wealth.

Michael Farmer, £150m

A Tory peer, “Lord Copper” is a veteran metals trader and senior treasurer of the party. An evangelical Christian who built his fortune with the Red Kite commodities trading group. Donation: £6.5m

Sir Michael Hintze, $1.05bn

Founder of the CQS hedge fund, served in Australian army for three years before moving to London to work in finance. Appointed by Pope Francis to serve on board of Vatican Bank. Donation: £3.2m

Lord Fink, £130m

Veteran hedge fund figure who served as party treasurer until 2013. Donation: £3.1m

Chris Rokos, £230m

Old Etonian who earned $900m in 10 years at Brevan Howard hedge fund before resigning in 2012. To launch new fund this year, according to the FT. Donation: £1.3m

Andrew Law, £350m

A Manchester state schoolboy who worked his way up through two banks to a director role at Goldman Sachs. Joined hedge fund Caxton Associates in 2003 and was made CEO in 2012. Donation: £1.2m

Sir Paul Ruddock, £300m

Formerly the chairman of Lansdowne Partners, he resigned in 2013 – presumably giving him more time to focus on his other role as chair of the Victoria and Albert Museum. Donation: £820,000

David Harding, £750m

Cambridge-educated executive chairman and CEO of Winton Capital Management. Donation: £600,000

Hugh Sloane, £185m

Co-founder of Sloane Robinson in 1993. Donation: £533,000

Sir John and Peter Beckwith, £350m

Brothers who established a real estate company together in 1971. Now trading as RiverCrest Capital. Donation: £520,000

Alexander Knaster, £1.26bn

A US billionaire who founded Pamplona Capital Management in 2004 – and yes, that’s named after the bull-running festival. Donation: £400,000

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments