Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Conservatives want to make £12bn worth of welfare cuts, but where will they come from?

Reports emerged last night that £5bn could come from tax credits. Let's look at why they might consider doing that.

A large part of the welfare budget is off-limits

The Chancellor has ruled out any cuts to pensioners or universal pensioner benefits like bus passes or TV licences.

These make up £95bn a year, or 40 per cent of the total welfare budget.

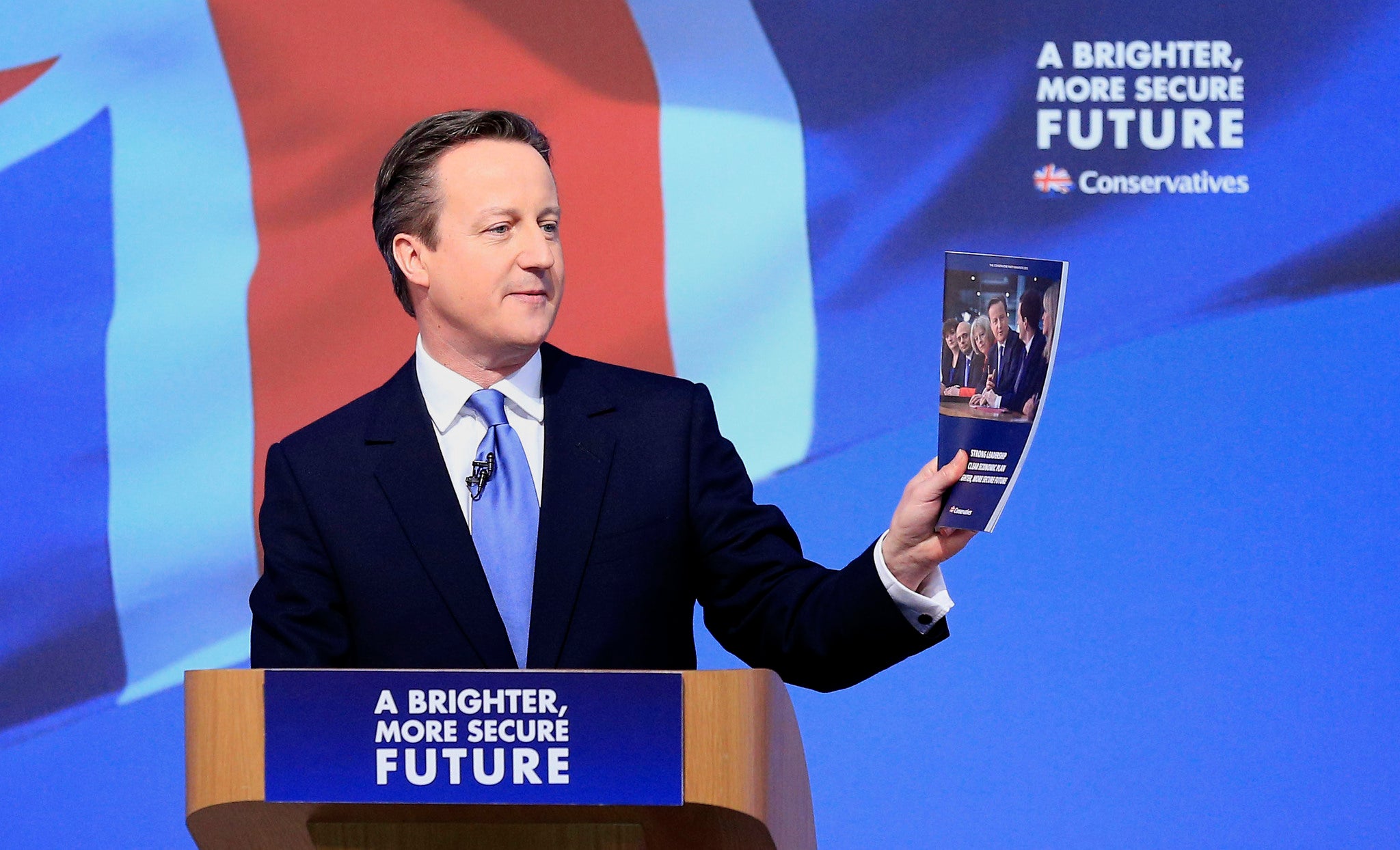

The cuts explicitly outlined in the Conservative manifesto save very little

The Institute for Fiscal Studies says about £1.5bn in cuts have been outlined in the manifesto.

These include freezing working age benefits for two years, which save £1bn.

Other measures including reducing the benefit cap to £23,000 a year, which saves only £0.1bn, and removing housing benefit from young people, which saves the same small sum.

The options left are quite limited

This means that £10.5bn have to come from what's left. Below is what's left for George Osborne to cut:

.png)

From this chart it should be clear the scale of the cuts being made.

Totally abolishing all of Jobseekers' Allowance and Income Support wouldn't even cover half the cuts George Osborne wants to make to benefits.

Totally scrapping child benefit would do it, just about.

Housing benefit and child benefit have already been subject to restrictions in the previous parliament and further restrictions on housing benefit are already included in the roughly £1.5bn cuts in the Conservative manifesto.

Disability benefits are in the middle of a transition to a new system which the Government will be keen to make sure goes as smoothly as possible.

Tax credits are the biggest single lump. A government that made £13bn welfare cuts without touching tax credits would end up making even sharper cuts elsewhere.

This isn't to say that such cuts are necessary: there are good arguments against George Osborne's overall spending plans. Even if you agreed with those, the same savings could be accomplished with tax rises of departmental cuts.

But with what the Conservatives have set out to do in mind, it's no surprise that ministers are considering tax credits for the axe.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments