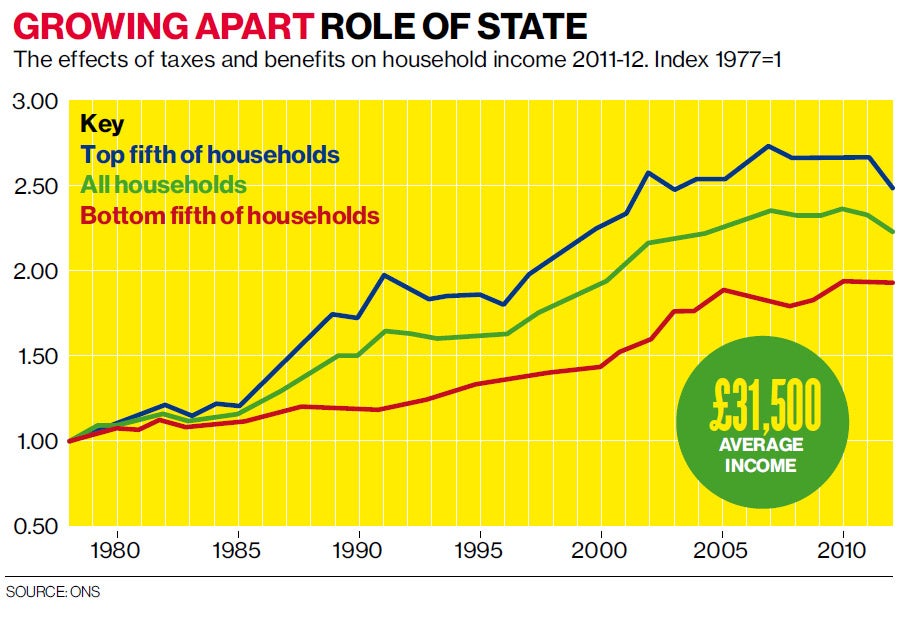

That's a surprise: gap between Britain's richest and poorest now smallest for a generation

But there's still one of the biggest divides in western Europe between the two

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.It might not feel like it to millions of families struggling to make ends meet, but the gap between rich and poor has narrowed and is now at its smallest for a generation.

The average household income in Britain has fallen by four per cent - equivalent to £1,200 in real terms - since the economic crisis began in 2007-08.

But the overall figure masks huge variations between different groups. The average income of the wealthiest fifth of households has dropped by 6.8 per cent - equivalent to £4,200 - as middle-class earnings fell.

Over the same period the income of the worst-off fifth increased by 6.9 per cent - equivalent to £700 - because of rises in the income tax threshold and changes to benefit levels, the Office for National Statistics (ONS) reported today.

Critics will point out that Britain still remains one of the most unequal societies in western Europe and the good news could be short-lived once the impact is felt of new Coalition welfare cuts which came into force three months ago.

The ONS reported that in 2011-12 the average annual incomes of the best-off and worst-off households, once taxes and benefit payments are taken into account, were £57,300 and £15,800 respectively. The ratio between them is less than four to one, which is the smallest gap since 1986.

The statistics authority partly attributed the change to the steady increase at the rate at which workers are liable for income tax, which has been a key Liberal Democrat policy.

It also pointed to increases under the last Labour Government to National Insurance rates, by which higher-paid employees were more affected, and to child tax credits, which boosted the incomes of the worst-off.

The average pre-tax income for the best-off was £78,300, compared with £5,400 for the bottom fifth, a disparity of 14 to one before taxes and benefits narrow the gap. The gap was 16 to one the year before.

All income groups paid more in indirect taxes - such as VAT and duties on fuel, alcohol and tobacco - than in the previous two years because of the rise in VAT to 17.5 per cent in 2010 and 20 per cent in 2011.

The inequality gap may begin to widen again in the near future because of a new squeeze on welfare. In April the "bedroom tax", under which benefit claimants deemed to have a spare room will lose up to 25 per cent of their housing benefit, came into force. In the same month benefit and tax credit rates rose by a below-inflation one per cent.

Meanwhile, the top rate of income tax for people with salaries of more than £150,000 was reduced from 50p to 45p.

Stephen Williams, a Liberal Democrat treasury spokesman, welcomed the impact of taking low-earners out of tax on the income figures.

He said: "In Government, Liberal Democrats have been working hard to build a stronger economy in a fairer society even while we have had to make difficult decisions to bring the deficit down.

"These figures show our manifesto pledge to take the poorest out of tax and give millions of low-earners a £700 tax cut is making Britain a fairer place."

He said: "The tax and benefits system we have created leads to income being shared more equally between households than ever since 1986."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments