Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.MPs have voted to make £1 billion of cuts to tax credits, without holding a parliamentary debate on the subject.

George Osborne said in his autumn statement that he had cancelled cuts to the in-work benefits – but a little-noticed cut to the so-called “income disregard” was quietly left in place.

The change reduces the amount a claimant’s income can increase in a year before their claim is reassessed – from £5,000 to £2,500.

Any low-income worker who earns more than they had expected in a year over the threshold is forced to pay back some or all of their tax credits.

Labour says the £1 billion cuts will make 800,000 more people on low incomes poorer.

MPs voted by 272 to 228 to pass the cuts, with most Labour MPs against and most Conservatives in favour.

The cut was brought through Parliament as a statutory instrument meaning it does not have to go through all the stages of debate – a favourite tactic of the current Government.

The Treasury will gain £935million from the cut by 2020, according to an impact assessment.

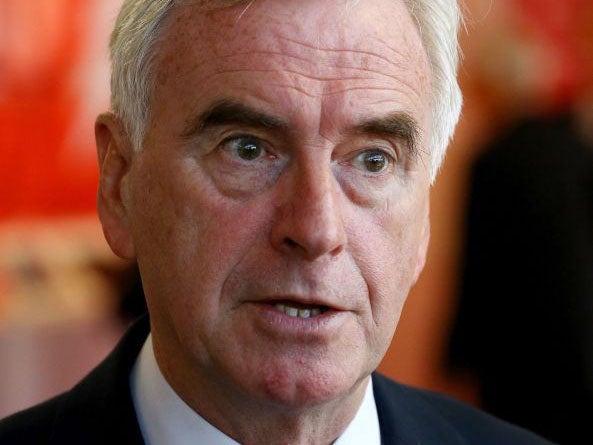

While MPs were not allowed to debate the subject this evening, Labour’s shadow chancellor John McDonnell said last month that the Tories did one thing in public and another in private.

“It's completely shameful when you consider that 800,000 working people, almost the equivalent of a city the size of Leeds, face losing £300 a week when the Tories are cutting taxes for a wealthy few,” he said.

“This is something George Osborne needs to urgently reverse in full in the budget next month, and it's something he could easily do if he wants to.

“There will be many Tory MPs who told their constituents that their Chancellor was not cutting their tax credits who'll now be left looking silly.”

As well as the income disregard cuts to the tax credit system, all the originally planned the tax credit cuts will also be applied to the Government's new Universal Credit system - meaning they have effectively only been delayed until 2020.

A Treasury spokesperson said the cuts were fair and that there would be “no losers” from them.

“It is a simple matter of fairness and common sense that tax credit awards are reviewed as people’s incomes change,” he said.

“It isn’t right that someone earning significantly more should do just as well in terms of tax credits than someone earning less.

“Lowering the maximum annual pay rise that is disregarded to £2,500 will simply return the system to the same level as when tax credits were first introduced.

“By definition there will be no losers because people’s increase in income will outstrip any reduction to their tax credit award.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments