Tax credit cuts: George Osborne U-turn 'only delays squeeze on working poor'

Two of the country's most respected think-tanks warn working families will still be much worse of by end of the decade

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Chancellor’s U-turn on tax credit cuts has only delayed, rather than avoided, a severe squeeze on the incomes of poor working families, according to two of the country’s most respected think-tanks.

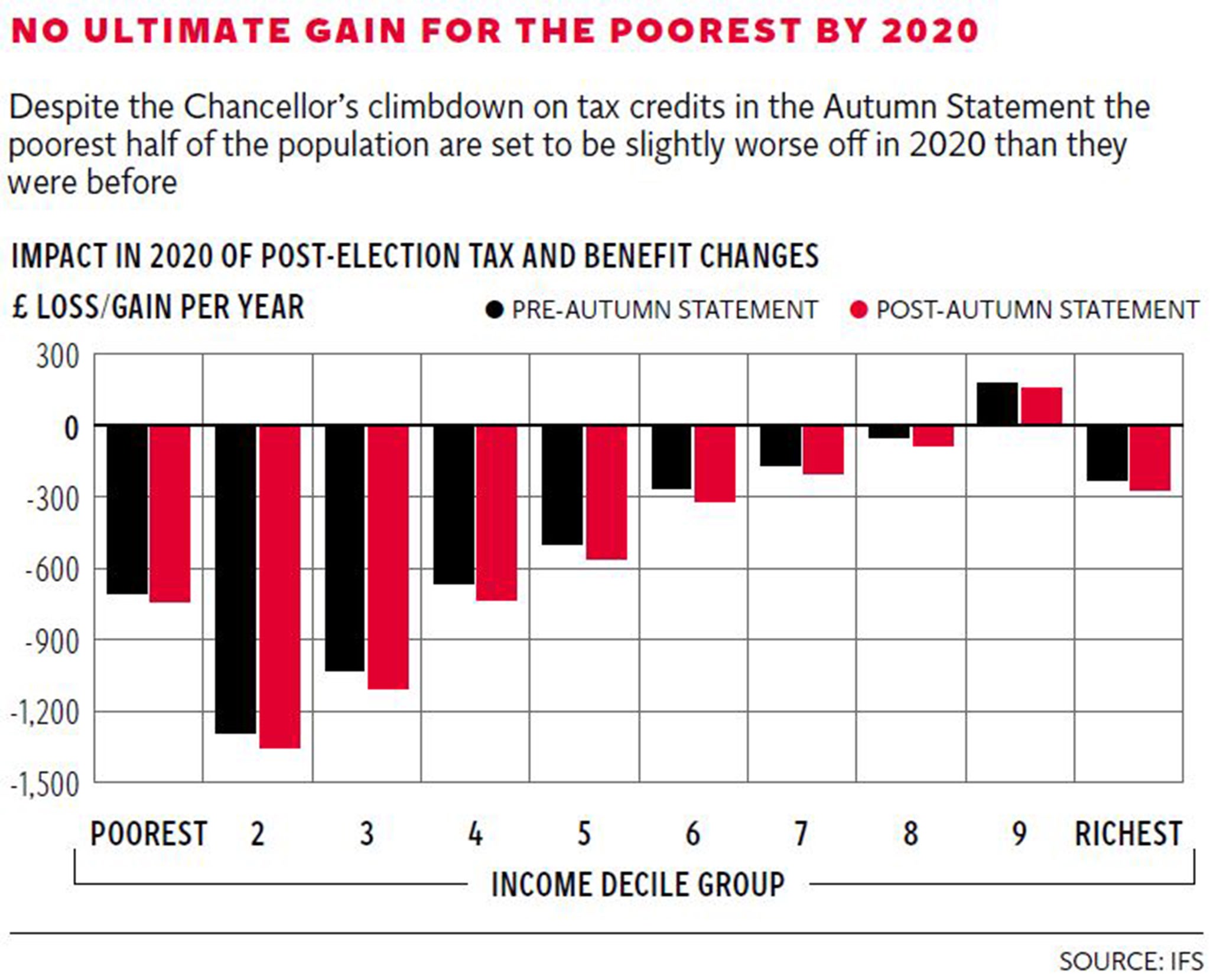

Despite George Osborne’s headline-grabbing retreat on his controversial plans to slash cash payments to more than three million low-income working families from next year, he will still make millions of such families considerably worse off by the end of the decade through his post-election welfare cuts, both the Resolution Foundation and the Institute for Fiscal Studies has stressed.

Some 3.3 million working households had been on course to lose an average of £1,300 from next April thanks to George Osborne’s July Budget welfare cuts, prompting a historic revolt from the House of Lords. Mr Osborne was accused of hurting the very “strivers” he claimed to be trying to help and even many Conservative MPs were alarmed by the plan.

The Chancellor had sought to make a virtue of his complete climbdown on tax credits in his Autumn Statement speech on Wednesday saying: “The simplest thing to do is not to phase these changes in, but to avoid them altogether”. That prompted many opponents of the cuts to proclaim victory.

But Matthew Whittaker, the chief economist of the Resolution Foundation, said that because tax credits are being phased out and replaced by a wholly new benefits system known as universal credit, poor working families will be just as hard hit by 2020 as they were before this week’s policy reversal.

“Working households on universal credit face a lower average entitlement of £1,000 a year in 2020” he said. “That rises to £1,300 for working families with children and higher still if we include the cuts applying to new claims.”

Paul Johnson, the director of the Institute for Fiscal Studies (IFS), echoed the point.

“The long-term generosity of the welfare system will be cut just as much as was ever intended as new claimants will receive significantly lower benefits than they would have done before the July [Budget] changes,” he said.

Research presented by the IFS researcher Andrew Hood showed that 2.6 million working families would be an average of £1,600 a year worse off than under the current system.

Mr Hood also presented a chart showing that the impact of the post-election tax and benefit changes by Mr Osborne on families in the lower half of the income distribution in 2020 was virtually identical both before and after the Autumn Statement volte-face on tax credits – confirming that the scrapping of these credit cuts merely postpones the negative impact on the less well off of government welfare cuts.

“We said this was a smoke and mirrors spending review and we were right. IFS research shows that George Osborne has not reversed his welfare cuts; he has just delayed them,” said Labour’s shadow Chancellor John McDonnell.

Tax credit recipients will not now receive a cash cut to their benefits – something that many Conservative politicians had feared would lead to a popular backlash against their party.

But poor working families will be gradually moved on to a universal credit system that will be considerably less generous than planned before the July Budget, meaning that by the end of the decade the final overall annual loss to the working poor will be almost as great.

A Treasury spokesperson said it was “not legitimate” to compare the two benefits systems. “Universal credit is designed to ensure that work always pays.

“It is an entirely different system to the current one, taking in six different tax credits and benefits – with none of the cliff edges of tax credits,” they said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments