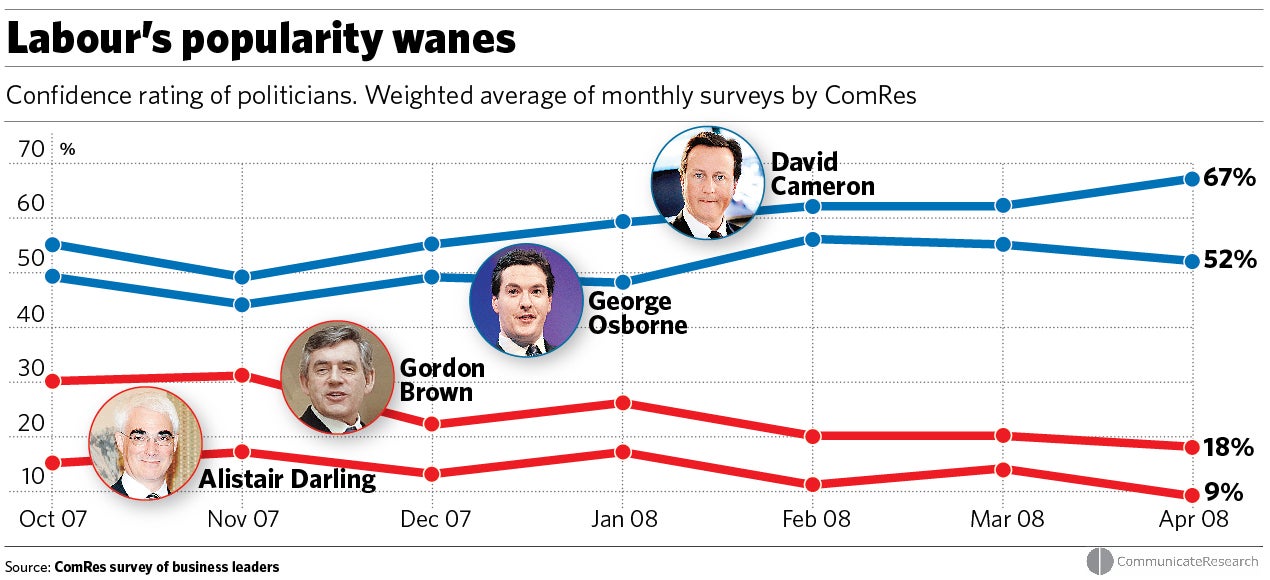

Survey of businessmen shows only 18 per cent have confidence in PM

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Business leaders' confidence in Gordon Brown and Alistair Darling has slum-ped to a new low, according to the latest monthly survey by ComRes.

Only 9 per cent of the 220 businessmen polled said they have confidence in the ability of the Chancellor, while 90 per cent are "not confident". The Prime Minister's confidence rating is higher at 18 per cent, but has slipped from 30 per cent since last October as economic prospects have darkened. Today, 82 per cent are "not confident" in Mr Brown's ability.

In contrast, the ratings of David Cameron and shadow Chancellor George Osborne have improved steadily. Some 67 per cent of business leaders say they have confidence in the Tory leader, while 31 per cent describe themselves as "not confident." More than half (52 per cent) have confidence in Mr Osborne; 42 per cent do not.

Ministers insist Mr Brown can regain his previously strong reputation on the economy if Britain emerges from the slowdown in better shape than its rivals. But the poll figures will alarm Labour MPs, some of whom fear that it will be difficult to recover from a prolonged downturn.

ComRes found that 76 per cent of those questioned thought the Conservatives "best for business", with only 16 per cent citing Labour and 5 per cent the Liberal Democrats.

Mr Brown's recent statement that his Government is "on the side of small and medium-size business" rang hollow: 10 per cent agree while 81 per cent disagree.

Only 15 per cent of those surveyed believe the Chancellor understands business, while 73 per cent think he is out of his depth.

Asked about the credit crunch, 47 per cent of business leaders believe it will have a modest impact on their company, 28 per cent predict a severe impact, 10 per cent think it will not be noticeable and 15 per cent are unsure. Only 24 per cent have taken no action to protect their firm from the effects of the credit crunch or does not intend to. Of those who have taken or plan to take action, four in 10 (41 per cent) cited steps to ensure they have working capital, 36 per cent investing more in marketing, 28 per cent delaying investment plans and 13 per cent preparing to reduce their wage bill.

Two out of three businessmen believe the pound's slide against the euro will not affect their profits; 26 per cent thought their profits would fall, while 14 per cent said they would rise.

Yesterday, Mr Brown admitted the housing market would need special help but tried to lift some of the gloom by insisting Britain should avoid a recession.

"We are certainly an economy that is continuing to grow," he said during his visit to Washington. "We have relatively low inflation, relatively low interest rates and relatively low debt, so we are able to inject more resources into the economy. We are pretty sure the economy will continue to grow in the year."

George Osborne, the shadow Chancellor, urged the Government to stop "dithering" and unblock the financial system by allowing the Bank of England to accept mortgage-backed securities as collateral in exchange for government-backed bonds. "We are not bailing out the banks because there should be a taxpayer guarantee that they will get their money back for the swap, and there are various ways of ensuring that," he said. "The one thing we don't want is the taxpayer holding the baby."

He added that the Tories would support the Government if it comes forward with a sensible scheme.

Darling's woe

9% Proportion of the 220 business leaders questioned who said that they had confidence in the Chancellor Alistair Darling. 90 per cent were 'not confident'.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments