Stamp duty fiasco threatens summer 'property slump'

House sales could collapse over the summer because of confusion over the future of stamp duty, the Chancellor has been told by estate agents and surveyors.

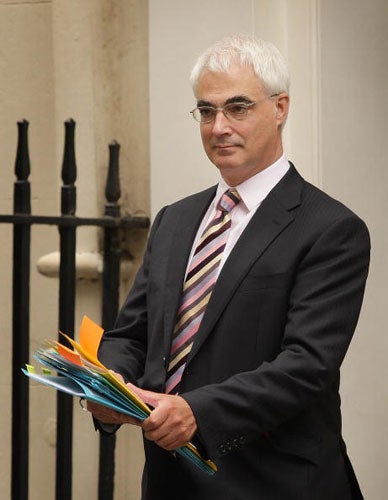

They fear the beleaguered property market could stall for up to three months as potential buyers delay their planned purchases. Alistair Darling has confirmed he is looking at a "range of options" over stamp duty as part of a comprehensive economic revival package. Possible measures include a stamp duty holiday and allowing buyers to defer their payments.

But critics say the signals from the Treasury could backfire in the short-term by paralysing the market as buyers wait for a formal announcement from the Government. The average buyer could save between £5,000 and £9,000 if the levy is suspended.

Mr Darling's decision might not come until late October, when he is due to deliver his pre-Budget report.

Peter Bolton-King, the chief executive of the National Association of Estate Agents, said he backed the suspension of stamp duty. But he added: "If the Government is going to come up with something, then we need to know about it now."

Previous experience showed that buyers would hold off from finalising deals as they waited for an announcement, dealing a further blow to the market, he said. "The danger is that the Government come up with something that is no help to anybody and people who have sat back have lost their dream home."

David Stubbs, senior economist at the Royal Institution of Chartered Surveyors, said: "We urge the Government to get on and make a decision. The uncertainty isn't great."

The Tories wrote to Mr Darling last night, accusing him of playing "damaging short-term games" with home-buyers and urging him to end the uncertainty.

Philip Hammond, the shadow Chief Secretary to the Treasury, said: "The housing market needs certainty and a steady hand. This uncertainty can only undermine the market further."

Vince Cable, the Liberal Democrat Treasury spokesman, said: "With the economy grinding to a halt, we are already likely to see a shortfall in taxation. Suspending stamp duty, even on a temporary basis, will only make this situation worse.

"The falls we are seeing in the housing market are painful, but necessary, if homes are to become affordable once more for those not on the property ladder."

Richard Carroll, head of residential property at the law firm Mills & Reeve, said: "Even if a stamp-duty holiday postponement or rate changes take place, the housing market is still going to be in difficulty."

Numbers of house sales have halved since last year and figures released this week revealed a 40 per cent leap in numbers of repossessions over the past 12 months. Ministers are desperate to staunch the slide in confidence, believing a stable property market is essential to underpin a wider economic recovery.

Mr Darling is considering whether to reintroduce income support for mortgage interest payments for homeowners who lose their jobs. He could also give the go-ahead to councils to step in when families have been refused mortgages by the big lenders.

The Chancellor also looks certain to create a new, tax-free fund to help first-time buyers raise the deposit they need to get on the housing ladder.

Stamp duty is currently levied at 1 per cent on homes over £125,000, rising to 3 per cent on those over £250,000 and 4 per cent on those over £500,000. Last year it brought in £6.5 bn for the Treasury.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks