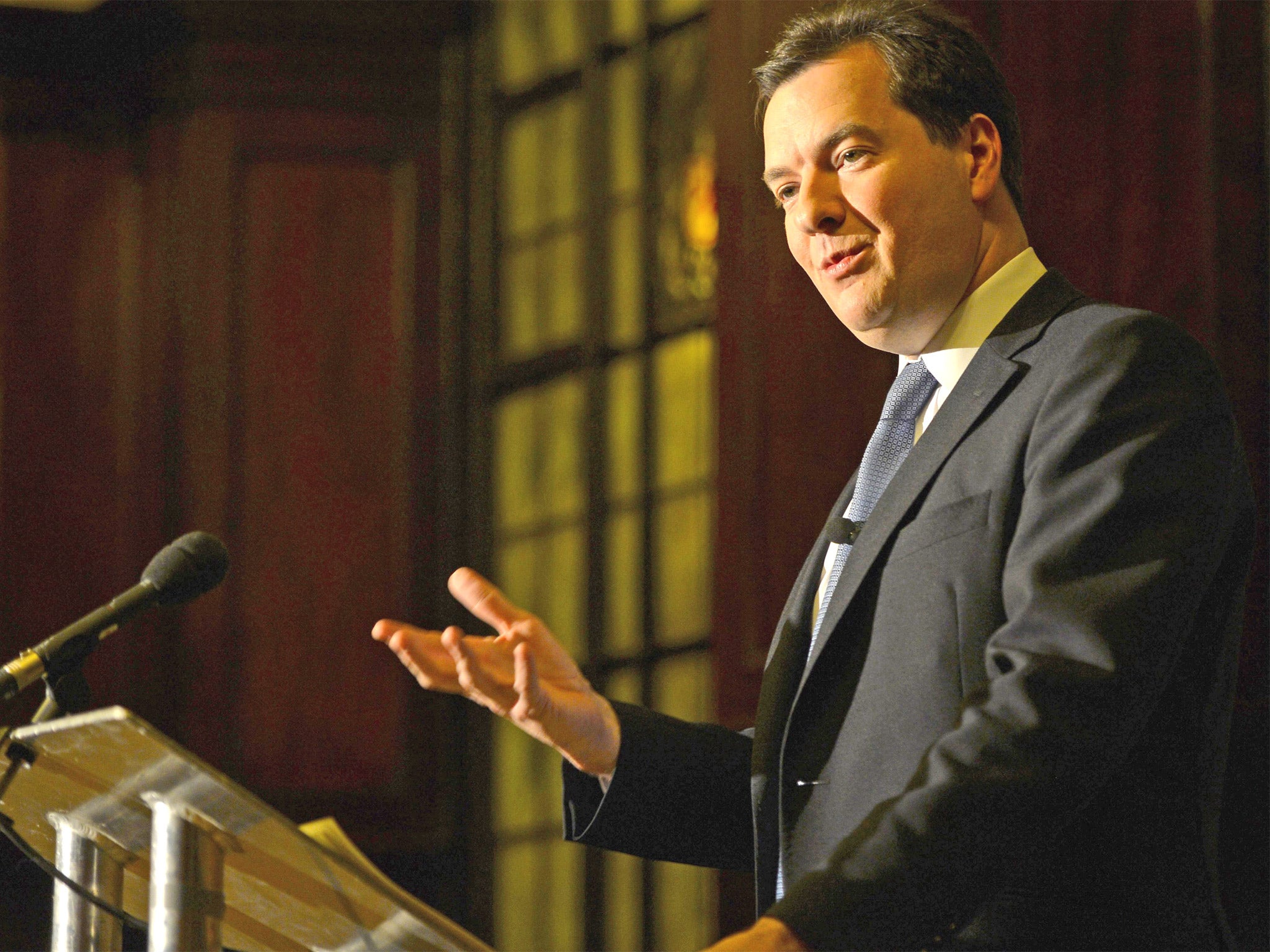

Revealed: George Osborne’s secret veto on fraud inquiries

Chancellor writes SFO cheques - so is there a conflict of interest?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne has a secret veto over large and potentially politically sensitive fraud investigations, The Independent has learnt.

Under a government agreement the Serious Fraud Office must get permission from the Treasury to launch any complex new inquiry which comes on top of its normal budget.

But controversially the Treasury can keep its decisions secret – potentially allowing it to veto politically sensitive fraud inquiries, either before or midway through an investigation, without public scrutiny.

Ministers have now become the final arbiters of which major financial crimes are investigated as a result of 25 per cent cuts to the SFO’s budget over the past three years, Labour warned.

The move is particularly sensitive as the Government has intervened in the past to halt embarrassing fraud investigations.

In 2006 the then Attorney General Lord Goldsmith announced that an SFO investigation into claims that BAE Systems had paid bribes to secure an arms deal with Saudi Arabia was being dropped. The announcement came weeks after reports that the Saudis were threatening to pull out of a deal to buy 72 Eurofighter jets from BAE.

Critics warned that the Government could use the veto to prevent investigations into alleged fraud at RBS in the run-up to the financial crisis – which have the potential to cost the Government millions in compensation.

The bank, now state-owned, is facing a civil action over claims that senior executives must have known about it perilous financial state when it launched a £12bn rights issue months before the financial crisis. If the SFO were to investigate and prove criminal liability it would force the Government to pay out to those who lost money by investing in the rights issue.

The veto came to light in parliamentary answers to the shadow Attorney General, Emily Thornberry.

She asked the Attorney General if he would give public notification of each occasion on which the Serious Fraud Office requests additional funding from the Treasury.

However he declined to do so, claiming it would “not be possible to do this without the risk of prejudice to the success of the Office’s operations”.

Ms Thornberry said the decision effectively amounted to giving the Chancellor a secret say over controversial investigations which might never see the light of day.

“It looks as though George Osborne will have a secret veto over what gets investigated and that’s unacceptable,” she said. “Investigators and prosecutors should not have to go running to politicians for funding case by case. If they do, they are no longer politically independent and the public will lose faith in what they do.”

Robert Barrington, executive director of Transparency International, which campaigns against corruption, pointed out that the SFO had not brought a single prosecution under a new law that allows UK companies to be prosecuted for bribery abroad.

He said there was potentially a “clear conflict of interest” in the Treasury’s role promoting economic growth and deciding whether to investigate a UK company for misdeeds in a foreign country which might damage its reputation and finances. “Either by design or accident you could easily get a situation where egregious corruption is simply not investigated,” he said.

“We have already seen political interference in the case of BAE and it is simply wrong that the Treasury should have the power to withhold exceptional funding to investigate cases of corruption. The SFO should be a properly funded institution with the ability to decide independently which cases it investigates without the suggestion of political motives at play.”

A spokesman for the Attorney General insisted that the director of the Serious Fraud Office “alone” determined which cases the SFO would investigate, based on its case selection criteria.

However the spokesman added: “Where an exceptionally large case needs to be investigated the Treasury will consider SFO’s ability to fund the case from existing resources.” Decisions had to remain private because “to publish such information could prejudice the investigation”, the spokesman said.

SFO investigations

Asil Nadir The former head of Polly Peck was jailed last year for fraud ten years after the SFO began its investigation into the collapse of the company. But it’s estimated the final prosecution alone cost 10 per cent of its £30 million budget.

Al Yamamah The SFO’s long-running investigation into whether British the arms company BAE paid bribes to Saudi officials for lucrative defence the contacts. The investigation was scrapped at the behest of the British Government after the Saudi’s warned them that it could jeopardise future sales.

Libor The Government has already announced an extra £3.5 million for the SFO to investigate the possible criminal rigging of the Libor markets by bankers working in the city. The SFO have arrested three people but no-one has yet been charged.

Vincent Tchenguiz The property tycoon is suing the SFO for £200 million after its failed investigation into the collapse of the Icelandic bank Kaupthing. The probe ended in humiliation after the SFO admitted to blunders, including unlawfully obtaining search warrants.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments