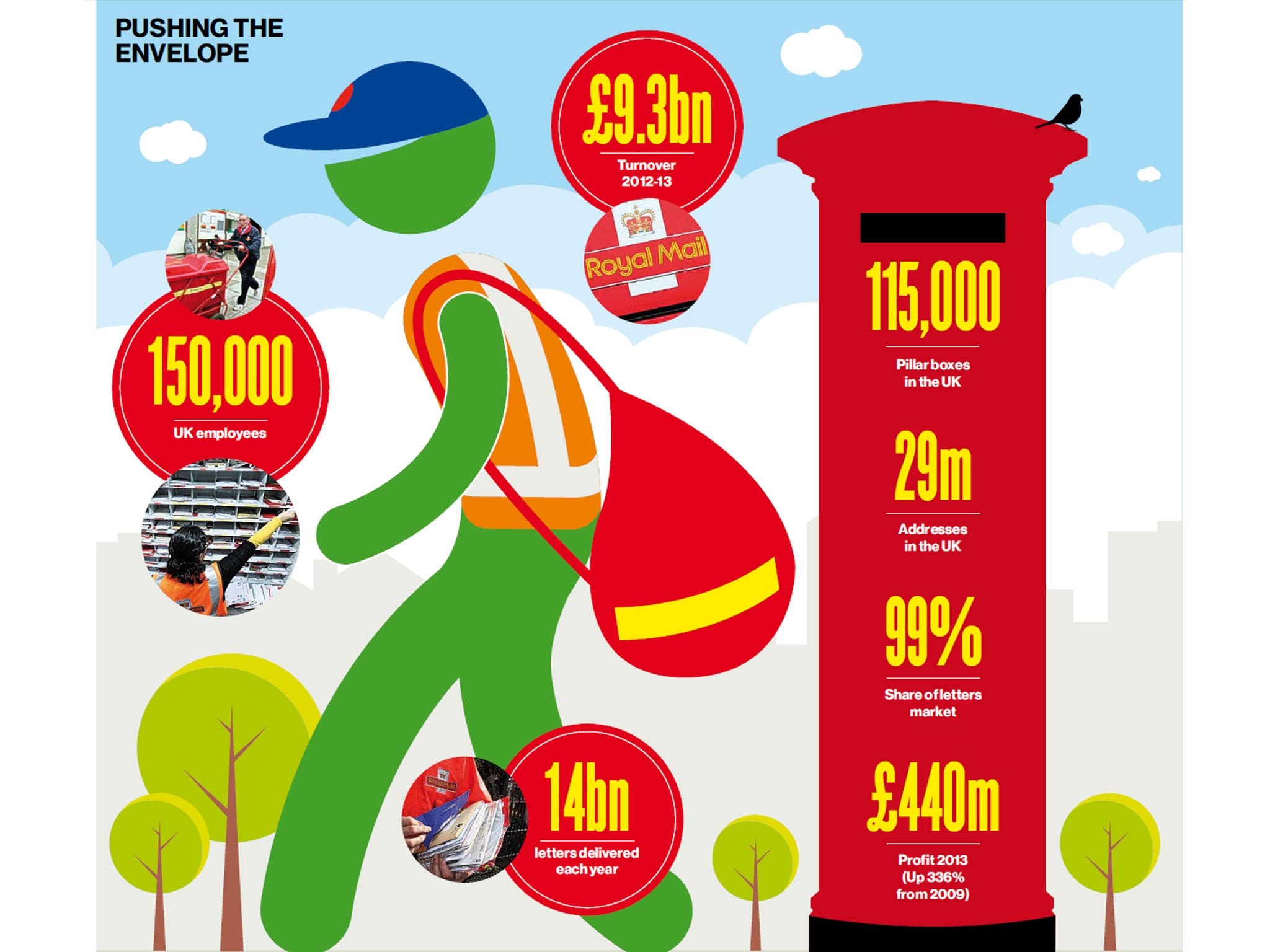

Postal workers to strike as Royal Mail sell-off looms

Ministers press ahead with plan in face of criticism it is a ‘politically motivated fire sale’

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Government is to press ahead with Britain's biggest privatisation for two decades by selling off the Royal Mail - just as tens of thousands of postal workers prepare to walk out on strike.

Ministers say the shares sale, which analysts believe could raise up to £3bn, is essential to enable Royal Mail to compete in the rapidly-growing market for parcels delivery because of the internet shopping boom.

But the moves, which will be launched within weeks, put the Government on a collision course with the unions, which will now ballot on strike action that could begin in mid-October and continue in the run-up to Christmas.

The plans have provoked a bitter political row as Labour accused ministers of a “politically-motivated fire sale”.

Critics protested that the transfer to private hands of the national postal delivery service, which traces its roots back more than 500 years, would ultimately lead to cut-backs in deliveries to remote areas.

The Government will sell a majority stake in the company, which has recently seen an increase in profits. A ten per cent slice of Royal Mail will be distributed to staff, while at least 41 per cent will be sold to private investors.

Members of the public will be able to apply for a minimum £750-worth of shares in an offer that will echo the “Tell Sid” advertisements for British Gas shares in the 1980s. Despite its zeal for privatisation, Margaret Thatcher rejected the sale of postal services as a step too far.

It will be the most ambitious disposal of a state asset since John Major's government privatised the railways in the 1990s - and is expected to be followed within months by an even larger sale of part of the taxpayers' stake in Lloyds Banking Group.

Confirming the moves, Michael Fallon, the Business minister, said: “It is the final step to help modernise the business and allow it to invest in the future.”

He told MPs that the Royal Mail's six-day-a-week universal service was enshrined in law and only an act of Parliament could end it.

Mr Fallon said there was now a “sufficient appetite” from investors to push ahead with the sale - and insisted it would not be derailed if the Communication Workers Union (CWU) calls a strike.

Following a ballot which found 96 per cent of its members opposed privatisation, the union will hold a strike vote next week. It is also in dispute over a pay claim and changes to pension terms.

Billy Hayes, the CWU general secretary, said: “This isn't about what is best for the Royal Mail, it is about vested interests of government ministers' mates in the City. Privatisation is the worst way to access to capital as it's more expensive than borrowing under public ownership.”

The union's hostility was underlined today as the Royal Mail chief executive, Moya Greene, was booed and heckled as she addressed a meeting of more than 1,500 CWU local officials.

Ms Greene told delegates: “I understand our people's concern that they should have protections in place as Royal Mail is privatised, which is why we have proposed a ground-breaking three-year, legally-binding agreement including a highly competitive pay offer of 8.6 per cent. But the company and our customers need protections too… It is because our customers trust us and value the service we provide, that there should not be a strike at this crucial time. If businesses can't rely on us, they will look elsewhere to protect their own business.

”The CWU recognises the need for us to access capital. In government ownership we have had to compete with the NHS, schools, roads and defence. We will also pay less interest on our company debt in the private sector than we do in the public sector. Access to private capital and a successful company is the best way to ensure secure employment for our people, who will be given a meaningful stake in the business.”

Chuka Umunna, the shadow Business Secretary, attacked the “the politically-motivated fire sale to fill the hole left by George Osborne's failed economic plan”.

He added: “The Government has not addressed the huge concerns which remain on the impact the Royal Mail sale will have on consumers, businesses and communities, but ministers are ploughing on regardless.”

In the Commons, the Tory MP Robert Halfon raised concerns over the prospect of massive salaries being paid to Royal Mail's directors coupled with price increases for consumers.

Len McCluskey, the Unite general secretary, said the Government was selling off the family silver, adding: “This move is being driven by blinkered right-wing dogma that has ridden roughshod over public opinion which is strongly opposed to the sell-off of this national institution.”

Q&A: Mail model or broken Post?

Q. Why is this happening now?

Labour and Tory ministers have contemplated privatisation for years and legislation paving the way to the sale was passed in 2011. Ministers believe now is a good time for the controversial move as an increasingly profitable Royal Mail will appeal to investors. They are also making a political calculation: they need to ensure the sale is complete before the next general election.

Q. What does it mean for people who use Royal Mail?

They should notice no difference: universal deliveries six days a week are protected by statute. Stamp prices will also be controlled by a regulator.

Q. What about the staff?

The sale will inevitably raise fears that “efficiencies” – in other words, job cuts – will be demanded by a private investor. The prospect of being awarded Royal Mail shares will prove little consolation. On the other hand, an injection of private capital could boost the business.

Q. And the City?

It will take a close interest – not least because dividend payments are promised next year.

Q. How much will the sale raise?

Although the Government refuses to be drawn, analysts believe a figure of £2.5bn to £3bn is realistic.

Q. Why is a profitable company being privatised? What are the risks?

It is being sold off precisely because it is moving into profit – and is therefore more attractive. The risk is that ministers, politically committed to the move, sell a national asset below its value.

Q. When can I invest in it?

Britons will get the chance to take a punt on Royal Mail shares when they come to market in the next few weeks. You’ll need to be able to stump up at least £750 (or £500 if you’re one of the 150,000 people who work for the company). But it’s unlikely to be a chance to make a quick profit, as was the case with some earlier government sell-offs.

Q. So should I take the plunge?

There will be plenty of interested parties keen to encourage you to buy, such as stockbrokers and ISA providers, that can earn commission on trades or fees for holding shares.

But ignoring marketing hype, the question is: will it grow? Royal Mail’s traditional role as a letter deliverer has declined as people turn to email and texting, but the explosion in online shopping has boosted its parcel business. So its future success depends on how well it can take on international parcel giants such as DHL. It will only be able to do that with the goodwill of staff.

But even the offer of free shares – reckoned to be around £2,000 per worker – may not win them round, with an autumn of strike action in prospect. With that uncertainty in mind, rather than rush to pile in at the initial public offering, investors may be wise to wait a few months until the share price has settled down.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments