Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

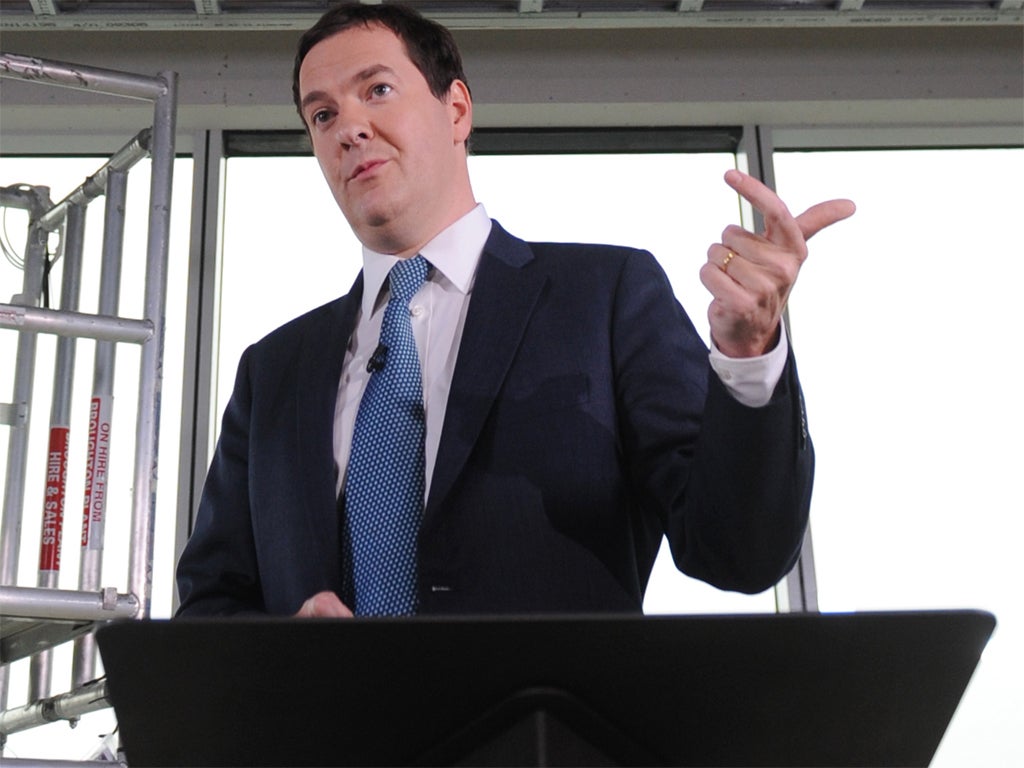

Your support makes all the difference.George Osborne’s claim that his austerity programme has been vindicated has been thrown into doubt by new research which suggests that tax rises and spending cuts have made the economy 3 per cent smaller.

The Chancellor argued earlier this week that the economy’s strong recovery since the beginning of the year had “decisively” ended the debate over whether he had imposed too much austerity too quickly.

But Alan Taylor and Oscar Jorda, two respected and independent US economists, have argued that more than half of the economy’s growth shortfall relative to the Office for Budget Responsibility’s (OBR) forecasts of three years ago can be ascribed to the Coalition’s fiscal measures.

In June 2010 the OBR, the Government’s independent forecaster, estimated that the economy would expand by a healthy 7 per cent by the end of 2013. But, despite this year’s strong pick-up in growth, the UK’s GDP is set to fall well short of this expansion by the end of the year.

Mr Taylor and Mr Jorda argue that the Chancellor’s policies – which include cutting public investment and raising VAT to 20 per cent – are responsible for at least half of the shortfall, equal to around 3 per cent of GDP.

They added that the negative impact of the Chancellor’s austerity could be greater still because, since 2009, the Bank of England has pushed interest rates almost as low as they can go. They said this could have exacerbated the impact of the Chancellor’s spending cuts on the weak economy.

“If so, then the vast majority of the difference between the actual UK recovery and the forecast could be attributed to the Coalition’s austerity policy choices,” they said.

Echoing the words of John Maynard Keynes, the pair, who are both affiliated to the University of California, concluded: “Generally, in the slump, austerity prolongs the pain, much more so than in the boom”.

At the end of the second quarter of 2013, the British economy was still more than 3 per cent smaller than it was before the recession began in early 2008. Other advanced economies, including the United States and Germany, regained their lost ground from the recession some time ago. Between 2011 and the end of last year the economy was stagnant, prompting the Labour Party to accuse the Coalition of choking off growth with its policies.

The Treasury tonight dismissed the Taylor/Jorda research and pointed to the verdict of the OBR last year, which found that the shortfall in growth relative to its 2010 forecast was more likely to be due to a spike in the global oil price and the weakness of the eurozone, rather than the scale and scope of the Coalition’s fiscal consolidation.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments