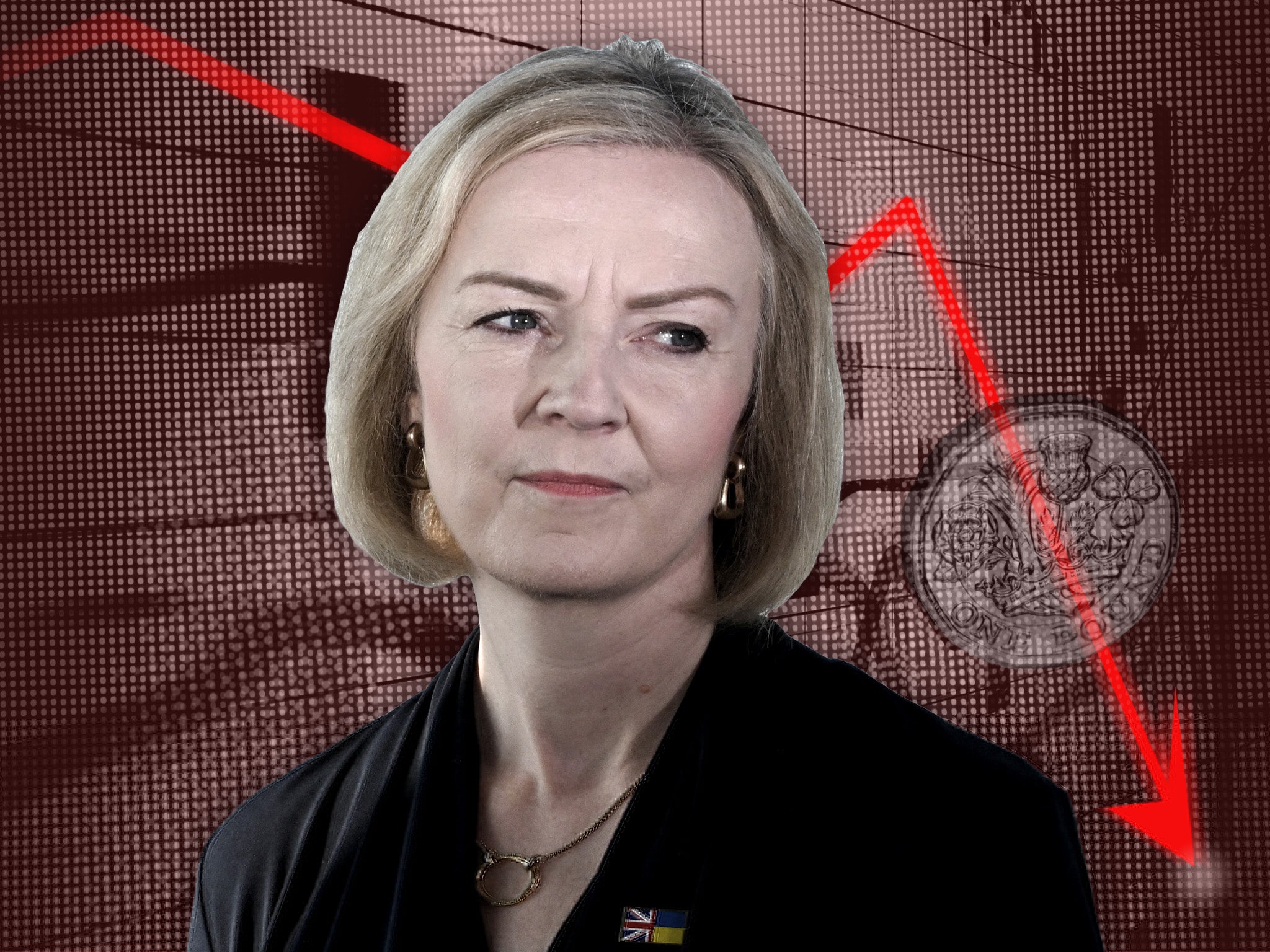

Going for broke: the tragicomedy of Trussonomics

Liz Truss believed she was the keeper of the Thatcher flame, an iron lady who’d deliver ‘growth, growth, growth!’ As she defends her decisions in her new book, Chris Blackhurst looks back on the disaster that followed, which would be funny if its lasting effects were not so serious

Having never been to the downstairs loo of Liz Truss, it’s impossible to vouch for what covers the walls.

If the former prime minister is like many folk and hangs framed press cuttings – the ones she wants to remember – then she could do a lot worse than choose the front page of the Daily Mail from 23 September last year. “At last, a true Tory budget!” proclaimed the paper. To emphasise the point, “true” was underlined.

Or Truss might pick The Daily Telegraph from the same day. “This was the best budget I have ever heard a chancellor deliver, by a massive margin,” declared Allister Heath.

Having spent the summer campaigning for the Tory leadership and highlighting her “true blue” credentials versus the rival Rishi Sunak, Truss swept to power on 6 September. She was determined to make a bang, to show those activists who supported her that their trust was not in vain.

During the contest, she positioned herself as the keeper of the flame, the heir to Margaret Thatcher with a radical agenda and steel to match.

Sunak the squeaky clean – some might say boring – ex-banker, was stressing safety first but Truss was promising something altogether different. She was not a numbers person, she knew what the country needed.

Aided by her chancellor and close friend, Kwasi Kwarteng, she would cancel the rise in national insurance and corporation tax and impose an energy price freeze. That’s what she’d been saying on the hustings; so that’s what she was going to do.

Sunak was not going to cut taxes; he was not going to risk messing with the public purse.

Truss resolved to go further. In her bid for power, she repeatedly stressed her belief in growth. Britain’s economy was lagging; it was not moving forward, not quickly enough, so she, Truss, would fire it up.

In this, she was not wrong. Successive governments and their advisers had struggled with the country’s stalling productivity; but it was never clear where expansion was going to come from. As Truss believed, there was a lack of confidence and self-belief that coursed through all areas, from the high street and consumer spending to construction projects and property, and from factory output to the City and the provision of services. Everything required a lift.

What was holding back Britain, Truss was convinced, was dogma. Whitehall, the Treasury, left-leaning academics and commentators – the “anti-growth coalition” – had imposed upon political leaders a need to always balance the books, to not do anything unless it was properly costed and funded. In theory, the civil servants were just that, servants, but increasingly there was a sense that as occupants of No 10 and No 11 came and went, they remained the one consistent and firmly in charge.

In the eyes of Truss and others, however, that made them responsible for Britain’s slowing. Prime ministers and chancellors had indeed been and gone – but they stayed. Truss was going to show who was boss; she would shake them up, ignore their innate, detached conservatism and galvanise the economy.

Conscious, too, that she did not possess a popular mandate, Truss sought public acclaim. She could not wait for it, she’d seen too many leaders promise jam tomorrow and come unstuck, so she would hit the ground running. From the outset, Truss would prove she meant business.

In the period when her victory was certain but she had yet to be anointed, Truss and Kwarteng consulted a coterie of external economists; they’d compiled a shopping list of items to be attacked.

A date was set for a “mini-Budget” rather than an official Budget statement. It was also billed as a “mini fiscal event”. That word “mini” implied it would be minor, involving a few tweaks here and there, but nothing major and certainly not anything to provoke alarm.

It was not as if Kwarteng was not warned – he was, repeatedly – but he chose to ignore the advice

It was anything but. Instead of staying with the trailed national insurance and corporation tax changes and the energy price freeze, Kwarteng delivered a bumper array of measures.

There were tax cuts galore, including reducing the basic rate and scrapping the higher rate of income tax. The stamp duty threshold was lifted immediately, the maximum limit on share options for employees was raised, 38 “investment zones” were proposed in England, planning laws were liberalised, the bar on bankers’ bonuses was ditched. These, and much more, took everyone – including her closest circle, Whitehall, Treasury, officials, the business community and the markets – by surprise. In all, £45bn worth of tax cuts were unveiled, many of them aimed at benefiting the rich. The right-wing media was ecstatic.

The problem was that Truss and Kwarteng had deliberately bypassed the Office for Budget Responsibility; the independent referee – ironically established by a previous Tory chancellor, George Osborne – was meant to provide reassurance, to run checks over the public finances, to ascertain that all was in order, that what was being claimed held water.

Some Tories, including Truss and Kwarteng, regarded the OBR as part of the problem, an obstacle to progress, a brake on her plans and her mantra of “growth, growth, growth”. But without its objective assessment, they had no proof that the forecasts they were bandying around were realistic. The markets were spooked, and disaster ensued.

It was not as if Kwarteng was not warned – he was, repeatedly – but he chose to ignore the advice. As Sunak had predicted, Truss was reckless, a loose cannon. He was vindicated; she was destroyed, as market jitters turned into a full-blown run on sterling, gilts went into freefall and global investors took fright. The pound plunged to its lowest-ever level against the dollar, gilt prices collapsed and in four days, long-dated government bond yields – which move inversely to prices – climbed by more than the annual increases in 23 of the last 27 years.

The International Monetary Fund issued a stern rebuke, along with organisations such as Bank of America and Goldman Sachs – not normally given to criticising the government and definitely not members of the “anti-growth coalition”.

Kwarteng subsequently maintained he had told Truss to “slow down” and said she would only remain in charge for two months if she pressed ahead with her full smorgasbord of goodies.

The Bank of England was forced to intervene, with a promise to buy up to £65bn of government bonds to save funds responsible for investing money on behalf of Britain’s pensioners from collapse. The City spoke of Britain paying a “moron premium” for the craziness.

Trussonomics drove a £30bn hole in the public purse, forcing yet more austerity measures. The longer-term damage to the economy is more difficult to ascertain.

What is undoubtedly the case is that, pretty much overnight, Britain lost a time-honoured reputation for sound economic management. Coming on the back of Brexit, which left many international commentators scratching their heads as to why Britain was leaving the EU trading bloc, the mini-Budget left Britain’s credibility on the world stage in tatters. A once global economic superpower was likened to an emerging market.

The country that gave the world industrial capitalism was reduced to a laughing stock, bracketed alongside developing nations. It did for the economic might of Britain’s economic brand what the Suez Crisis did for its foreign muscle. After that debacle, in 1956, Britain’s diplomatic authority was severely and seemingly permanently diminished.

Sunak has struggled manfully to restore order. But the harm was done. It cannot be coincidence, for instance, that the City’s standing is slipping, that New York is forging ahead. Other centres in the EU are circling. In such a globally competitive landscape, any slip can prove crucial, possibly fatal. Britain’s position as a byword for prudence may have been dealt an irreparable blow.

The Daily Mail turned, accusing Truss of making a “pig’s ear” of things. Presumably, that article is not in pride of place.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments