Liberal Democrats to tax the rich in bid to reduce inequality and steal Labour voters

Big divide between rich and poor is making people unhappy and dragging down the economy, Vince Cable will say

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

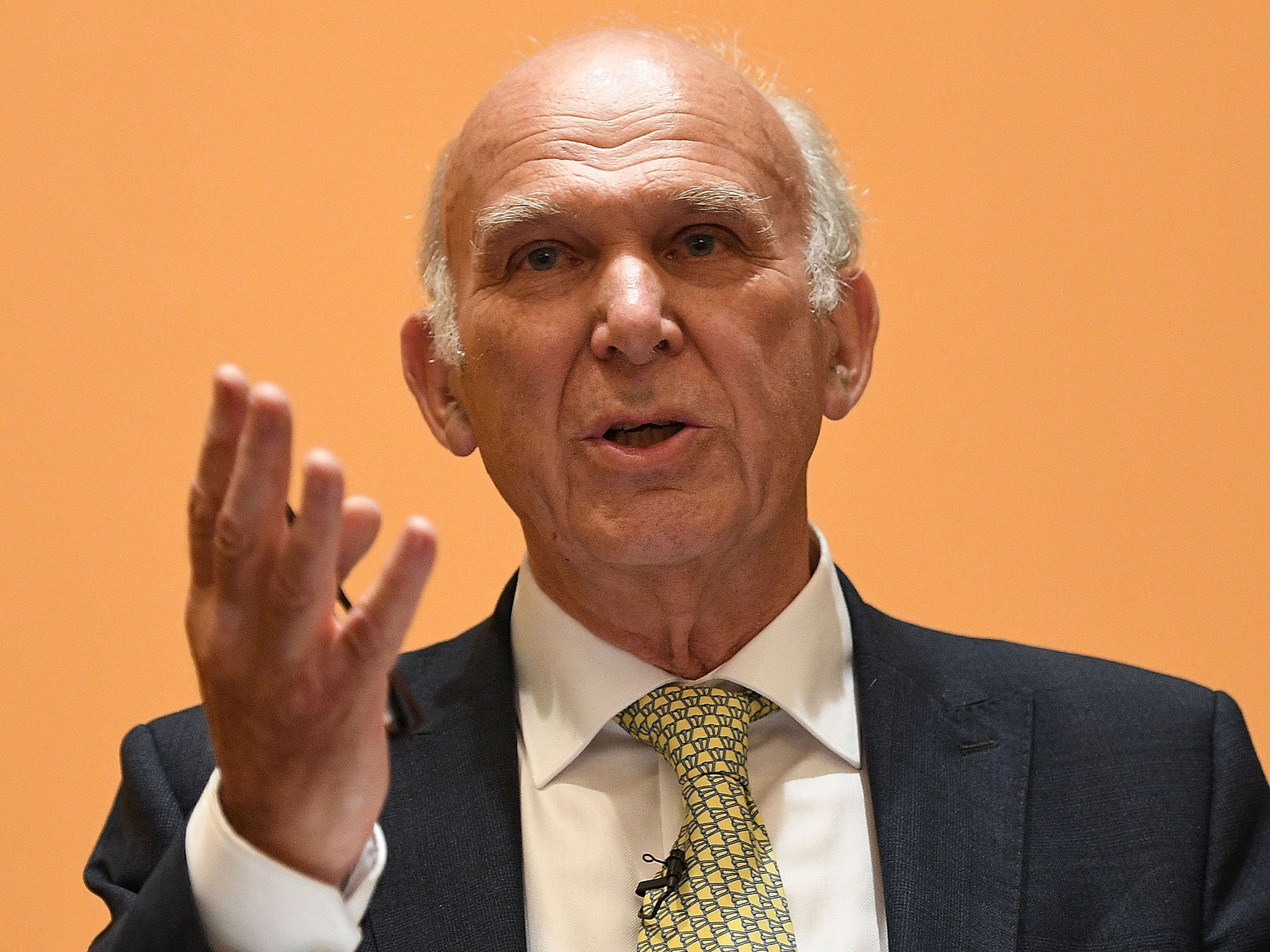

Your support makes all the difference.Vince Cable will commit the Liberal Democrats to higher wealth taxes to woo Labour voters and tackle inequality that risks “tearing” Britain apart.

Owners of big homes must pay more and inheritance tax must rise because the divide between rich and poor is making people unhappy and dragging down the economy, he will say.

Sir Vince, who became Lib Dem leader in July, is also exploring a pledge to hike capital gains tax to put it in line with income tax, to ensure the richest pay more.

The higher rate of capital gains tax, paid on the profit on the sale of an asset, is just 20 per cent, less than half the 45 per cent top rate of tax, after being slashed by George Osborne.

A further idea is a land value tax, which would see an annual levy placed on properties according to the size of their plot.

In a major speech on Wednesday, Sir Vince will highlight the Grenfell Tower fire as a tragedy that had crystallised “something stirring around the idea of inequality”.

It “wasn’t just a horrific accident with severe loss of life, but illustrated in a graphic way how the less well-off are not listened to by those with authority”, he will argue.

“Too much inequality is bad for us all. Growing inequality is linked to poor economic performance, greater instability, more social tension, insecurity and unhappiness,” Sir Vince will tell the Resolution Foundation think tank.

“There should be a broad basis of support for measures which are seen to reduce inequality and contribute to a reduction in economic and social ills.”

However, Sir Vince will reject Labour’s solution of higher taxes on the incomes of the rich, arguing that it has been shown to be “counter-productive”, arguing the target should instead be wealth, including:

* Extra council tax bands, to ensure people living in high-value properties pay more – while those in lower-band homes “would pay less”

* “Effective taxation of inherited wealth”, after the Conservatives allowed up to £850,000 in a family property to be passed on tax-free.

“Genuine meritocrats – like Bill Gates – argue for aggressive taxation of inheritance. Yet policy in the UK has moved in the opposite direction,” Sir Vince will argue.

However, the Lib Dem leader appears to have ruled out reviving his “mansion tax” idea, after accepting it was interpreted as targeting older people on low incomes in big homes.

He will also warn that the upward social mobility enjoyed by his parents, who worked in rival chocolate factories in his hometown of York, would now be impossible.

“In 20 years, my parents progressed from being factory workers in a house with an outside loo to being part of the professional class and living in a detached house.

“Though they both left school at 15, they were able to see me grow up to attend an 'elite' university.”

“My sense today, however, is that big differences in living standards and opportunities have since opened up. Social mobility is not what is was.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments