Labour will make it illegal for banks to close high street branches

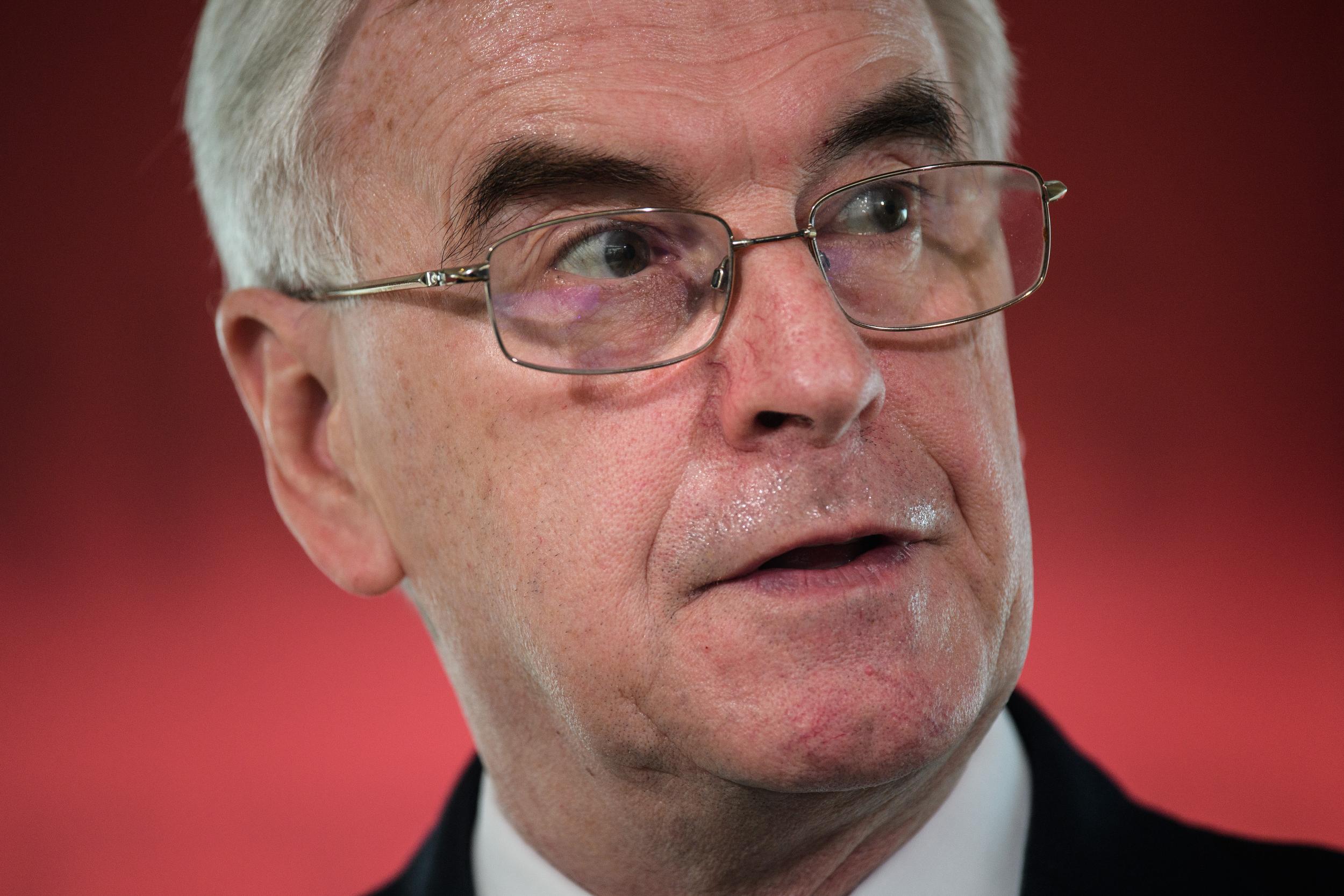

Shadow Chancellor John McDonnell will change the law to keep banks open, a policy that the industry calls 'unsustainable'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Labour would change banking law to stop banks closing high street branches, Shadow Chancellor John McDonnell will announce on Friday.

The Conservative Government introduced its own “Access to Banking Protocol” to prevent closures, but figures form the Consumers Association suggest 1,046 local bank branches closed in the UK between December 2015 and January 2017, with another 486 already scheduled for closure this year.

The Shadow Chancellor thinks changes can be made to bank law to force the big banks to keep their branches open.

Labour’s figures suggest that over two thirds of small businesses have said a local branch is important to them, but the British Banking Association has said that the way people use banks has changed, and forcing unused services to remain in place is “unsustainable.”

Shadow Chancellor John McDonnell, will say: “High street bank closures have become an epidemic in the last few years, blighting our town centres, hurting particularly elderly and more vulnerable customers, and local small businesses whilst making healthy profits for themselves. It’s time our banks recognise instead that they are a utility providing an essential public service.

“Only Labour will put in place the legal obligations needed to bring banks into line and stand up for our high streets, communities and small businesses.”

Eric Leenders, Managing Director for Retail at the BBA said: “Customers want convenient, round-the-clock banking, which has led to a digital revolution in the way they manage their money. This has had an inevitable impact on the use of bank branches, which has led to a number of branch closures. However, the decision to close a branch is never taken lightly.

“Banks want to provide their customers with the service that suits them best. As well as telephone, online and mobile banking, a number of banks have been working closely with the Post Office to make face to face banking facilities available in twice as many places than ever before. Banks will be working with the Post Office to ensure that customers are aware that this option is available to them.”

Emeritus Professor, Prem Sikka, University of Essex, who advised on the policy, said: “Banks receive considerable financial support from the public and in return should be required to provide financial infrastructure that meets the needs of individuals and businesses.”

Responding to Labour’s announcement, Conservative Party Vice-Chairman Stuart Andrew MP said: “Labour’s plan for our high streets would see corporation tax going back up to 28 per cent and £500 billion of extra debt - all under a Labour leader who said that we should not be afraid of debt or borrowing.

“Our support for high streets has seen town centre vacancy rates come back down since Labour were in government. Our support for small businesses has seen start up loans to help people launch new businesses, which has already helped 40,000 smaller firms across the country.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments