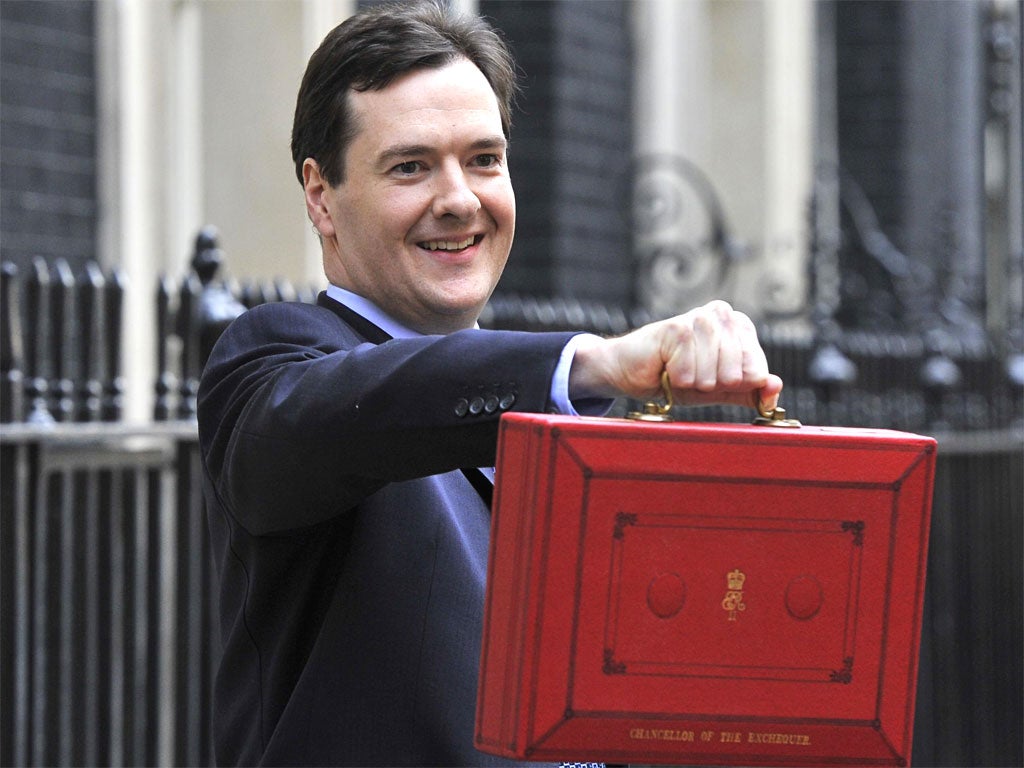

Good for footballers and the City, bad for smokers and the old

Tax allowances for elderly cut and frozen. Further £10bn in welfare cuts signalled. Income tax for rich cut from 50p to 45p

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne gambled on a tax cut for the top 1 per cent of earners, put a surprise squeeze on pensioners, and warned of a new round of public spending cuts in a highly controversial Budget yesterday.

Click here to view the graphic 'Your Money: How they take it and how they spend it'

The Chancellor hopes his three doses of nasty medicine will be outweighed by a tax cut for the 24 million people earning less than £100,000, who will benefit from a rise in the personal tax-free allowance from £8,105 to £9,205 in April next year.

In a package that targeted Britain's "squeezed middle", he bowed to David Cameron's edict to soften the blow from his previous decision to withdraw child benefit from families with at least one taxpayer on the 40p rate of tax from next January. People earning between £43,000 and £50,000 will now keep all their child benefit and it will be withdrawn gradually for people who earn between £50,000 and £60,000, at which point they will lose all of it. About 750,000 families will now keep some or all of their benefit rather than lose it, a partial retreat costing about £500m.

But Mr Osborne risked confirming the Conservatives' image as the "party of the rich" by announcing that the top rate of tax, which bites on incomes above £150,000 a year, would fall from 50p to 45p in April next year. He insisted the 50p band introduced by Labour was raising very little, and the £100m cost would be recouped five times over by a package of measures to hit the rich. They include higher stamp duty on homes worth more than £2m and a levy on such homes held in companies, which the Liberal Democrats hailed as big steps towards their "mansion tax".

The sting in the Budget's tail was for about 4.4 million of Britain's 10.5 million pensioners. Mr Osborne unexpectedly announced plans to freeze their age-related allowances to simplify the tax system and insisted there would be no cash losers.

However, pensioners paying income tax will lose out because their allowances will not keep pace with inflation. Treasury officials confirmed that current pensioners would lose an average £63 a year and people who have not yet reached the age of 65 will lose £197 a year when they do. The move was immediately condemned as a "granny tax" that would raise £3bn for over the next four years.

In another surprise, the Chancellor signalled another squeeze on the welfare budget in the next public spending round, only weeks after the contentious Welfare Reform Act became law. He warned that to avoid deeper cuts in other areas, welfare payments would have to be reduced by more than £10bn a year in 2016-17.

The widely-trailed Budget was the product of a heated negotiation between the two Coalition parties. The Liberal Democrats hailed the rise in personal tax allowances, their signature policy, and claimed they had won the "tycoon tax" they had demanded.

Nick Clegg told party activists: "This is a Budget every Liberal can be proud of. We're proud of the fact that we have delivered the largest increase in the personal allowance ever. We are proud of the fact we have halved the tax bill for people working on the minimum wage. We are very proud that we are taking over two million people out of paying income tax altogether."

Liberal Democrats admitted privately that they could face criticism for allowing Mr Osborne to cut the tax rate paid by the top 1 per cent of earners. But they said they had stopped him abolishing the top rate entirely, which would have left 40p as the highest band, and had vetoed moves backed by Mr Cameron to allow firms to "hire and fire workers at will" by cutting workplace rights.

Mr Osborne disappointed some Tory MPs by failing to outline a timetable for the 45p top rate to be cut to 40p. His aides said the 45p rate was not "temporary" – suggesting that it may prove too controversial to try to remove it before the next election.

The Coalition parties insisted the Budget was "for millions, not millionaires". But Labour is convinced the cut in the 50p rate will backfire on the Government, claiming today's move would result in 14,000 millionaires getting a tax cut of £40,000 a year.

Ed Miliband, the Labour leader, told the Commons: "After today's Budget, millions will be paying more while millionaires pay less. It's a millionaires' Budget that squeezes the middle. All the Chancellor is doing for ordinary families is giving with one hand and taking far more away with the other."

The Resolution Foundation, a think- tank which specialises in the "squeezed middle", said the best way to help this group would have been to reverse £1.6bn of cuts to tax credits taking effect next month rather than raise the personal tax allowance.

"People on low and middle incomes were mostly targeted by the Chancellor's rhetoric," said Gavin Kelly, its chief executive. "It is astonishing that the Coalition has chosen to prioritise a cut in income taxes on the rich at a time when low to middle-income families are seeing their standard of living fall and are struggling to afford day-to-day essentials."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments