George Osborne's latest headache: the middle gets squeezed tighter

Number of years it takes for a low-to-middle-income household to save for an average deposit on a first-time buyer property

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

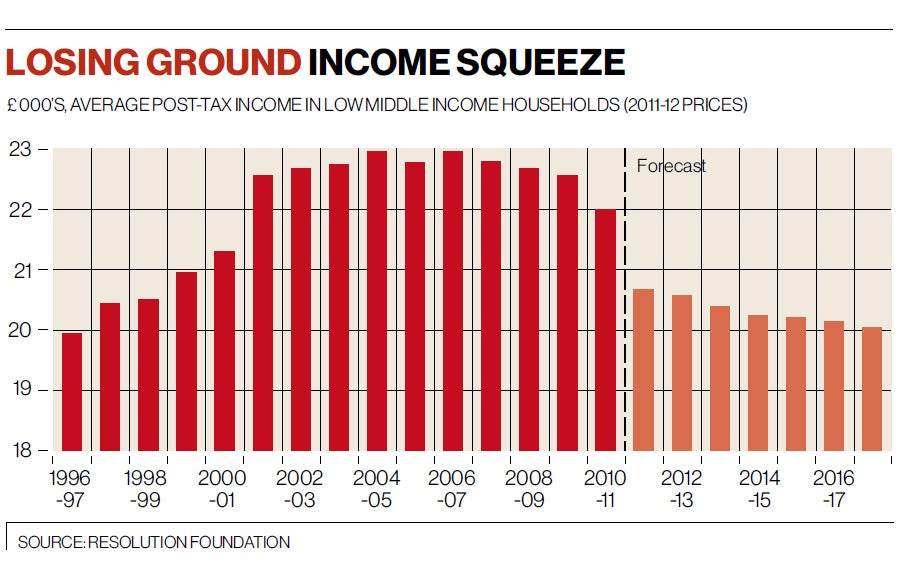

Your support makes all the difference.Ten million people on low-to-middle incomes will have to wait another 10 years before their living standards return to their pre-recession level in 2008, according to a study published today.

The Resolution Foundation, an independent think-tank, said that many of Britain's "squeezed middle" faced a "permanent hit" because it would be hard for them to fully recover the ground they have lost in recent years as earnings have risen by less than inflation.

If a low-to-middle-income family sees its income rise by 1.1 per cent on top of inflation from now on, it would increase to £22,000 after tax by 2023, the equivalent of where it stood in 2008. Without the prolonged downturn since then, they could expect to earn £27,500 today. Their income now stands at about £21,000 but is forecast to fall to £20,000 before rising again.

The findings come amid growing pressure on George Osborne to take more action to help struggling families in his Budget next month. Conservative ministers and backbenchers are urging the Chancellor to recognise that squeezed living standards are the number one political priority. Some Tory MPs want him to restore a headline-grabbing 10p lower rate of income tax on the first slice of taxable income, saying it could be a vote-winner at the 2015 election. The 10p rate was abolished by Gordon Brown in his last Budget in 2007. Mr Osborne faces growing dissent from Tory MPs after deciding to scrap his plans to raise the inheritance tax threshold to fund more state help with social care bills.

The foundation, which defines the low-to-middle-income group as those on between £12,000 and £41,000 before tax, said the squeeze had not been caused only by the Coalition's austerity measures but dated back to the previous Labour Government.

"The struggle with stagnant wages, high levels of debt and a heavy reliance on rising tax credits reaches back before the financial crisis. It represents a major challenge for all parties," said the report.

Polling by Ipsos MORI for the report showed that more than one in three people (36 per cent) do not believe the economy will be growing again by 2015, the year of the next election, while 47 per cent believe it will be growing. Four in 10 do not expect to be better off in 2015 than now, while 42 per cent think they will be. Almost seven out of 10 (68 per cent) are cutting back on spending.

Squeezed Britain 2013 said it now took 22 years for a low-to-middle-income household to save for an average deposit on a first-time buyer property. For the first time in recent history, a majority in this group aged under 35 live in privately-rented property.

Matthew Whittaker, the foundation's senior economist and author of the report, said: "There is a long road to travel just to get back to where living standards stood before the crisis – and the prospects of actually recovering the ground lost over recent years appear vanishingly thin. Every extra month of falling household incomes is harder to take than the last as household budgets get closer to the edge."

Gavin Kelly, its chief executive, said: "The next election will be about living standards yet little is known about what will be on offer. Given that reductions in tax credits and benefits appear likely after 2015 regardless of the election outcome, it is vital that all parties bring forward ideas for supporting wage growth and helping far more people to work."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments