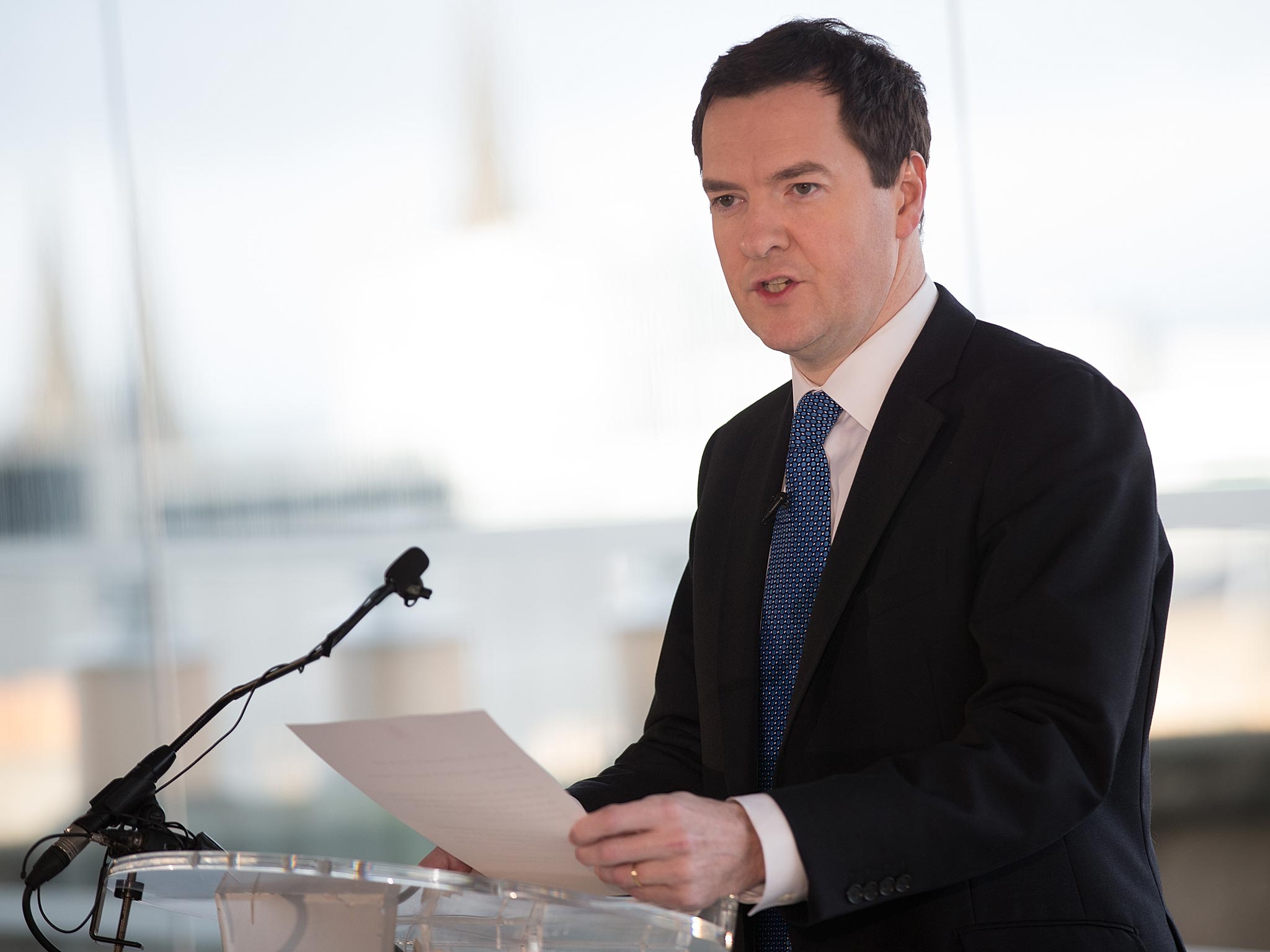

Exclusive: George Osborne's tax and benefits changes hit women almost four times harder than men

Wives and mothers suffer £11.6bn squeeze, while men reap most of benefit from tax cuts

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne’s tax and benefit changes have hit women almost four times as hard as men, according to new research which threatens to compound the Conservative Party’s unpopularity among women.

Analysis by the House of Commons Library shows that the Chancellor’s tax and benefit strategy since 2010 has raised a net £3.047 billion (21 per cent) from men and £11.628 billion (79 per cent) from women.

Labour will mark International Women’s Day today by celebrating the economic, political and social achievements of women and seizing on the figures. It will demand measures to close the “gender gap” and tackle the “cost of living crisis” in the Budget on 19 March.

The analysis suggests that women were hit hard by the cuts to tax credits, which top up the earnings of those on low incomes: the 2010 Budget took £2.7 billion from women and only £750 million from men. Reductions in childcare support through tax credits in the 2010 government-wide spending review saw women lose £343 million and men £47 million.

The Chancellor’s three-year freeze in child benefit, usually paid to the mother, took £1.26 billion from women but only £26 million from men.

Conversely, men reaped the most benefit from Mr Osborne’s controversial decision to reduce the top rate of tax on income over £150,000 a year from 50p to 45p. Some 85 per cent of the gains went to men, and only 15 per cent to women.

Labour will also point to a separate study by HM Revenue & Customs showing that the decision to bring in a £1,000 transferable tax allowance for four million married couples next year will give a £411 million handout to men (84 per cent) and only £84 million to women (16 per cent).

Labour is not promising to reverse all the changes but argues that the gender bias illustrates “the choices” made by Mr Osborne and David Cameron.

Catherine McKinnell, a Labour Treasury spokeswoman, said: “It’s little wonder the Government has made such unfair choices when women are so absent from the top table. After significant progress under Labour, when the gender pay gap fell by over 7 per cent, the pay gap between men and women is now increasing again. The cost of childcare places has risen by an average 30 per cent on David Cameron’s watch – five times faster than pay. The truth is that for women across the country this is no recovery at all.”

She added: “George Osborne’s Budget is one of his final opportunities to turn the tide on this Government’s failure towards women. But after their woeful record of the last four years, I’m not holding my breath.”

However, some experts argue that the apparent bias against women stems from the make-up of those receiving benefits and pensions rather than the result of specific policies targeted at women.

The Treasury insisted the analysis was flawed. A spokesman for Mr Osborne said: “The Government’s long-term plan is working, with 1.6 million new private sector jobs and more women in work than ever before. This means more women and families with the peace of mind and financial security that comes with a regular pay-packet. This is why the biggest risk to the recovery and to women would be abandoning the plan that's providing economic security for hardworking people by going back to the days of more borrowing, more spending and higher taxes."

The spokesman added: “By focusing only on the named beneficiary of tax and benefit measures, this analysis fundamentally misunderstands the way in which families and couples share their income, thereby distorting the impact on men and women. The increase in the personal tax-free allowance, child tax credits and marriage tax allowance have all benefited women and families, while ensuring that the Government can tackle the debt that it has inherited in the fairest possible way”.

Most opinion polls show a gender gap. This week’s ComRes survey for The Independent gave Labour an 11-point lead over the Conservatives among women (39 to 28 per cent) and a four-point advantage among men (36 to 32 per cent).

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments