British economy heading for ‘worst of all worlds’, business leaders warn over Labour Budget

After Rachel Reeves’s controversial Budget, the Confederation of British Industry warns the economy is ‘headed for the worst of all worlds’

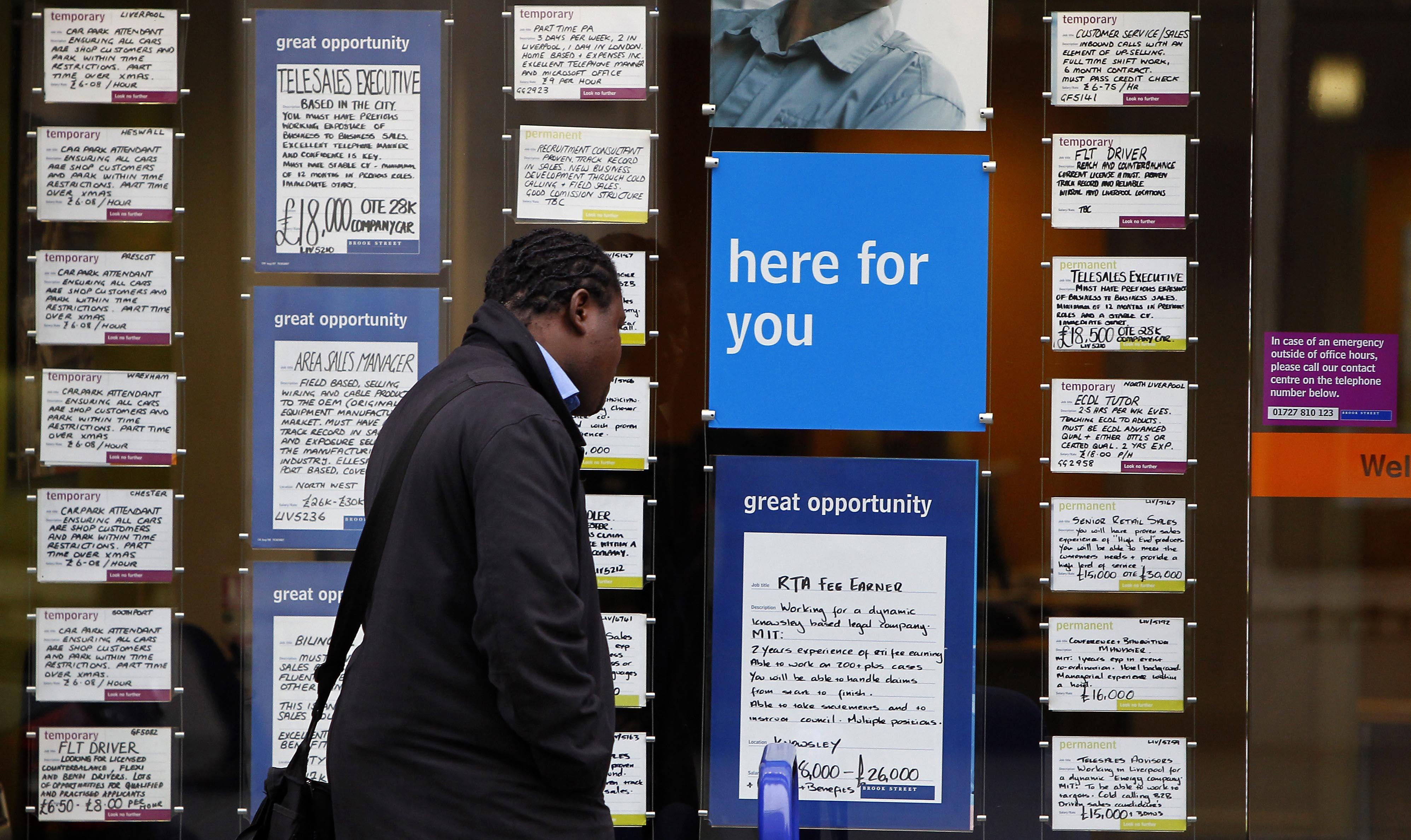

Businesses say they are “battening down the hatches” in fears over economic gloom in the new year as they blame the impact of Rachel Reeves’s Budget.

A major survey by the Confederation of British Industry (CBI) found firms are expecting to reduce both output and hiring, adding to the wider picture of a jittery economy in the second half of the year.

The results, which come on the same day figures from the ONS showed the UK economy was stagnant in the first three months of the new Labour government, will be a blow for Sir Keir Starmer, who has put economic growth at the heart of his mission.

Expectations for growth are now at their weakest since the aftermath of Liz Truss’s chaotic tenure in No 10.

The chancellor’s hike to employers’ national insurance, which was unveiled in October and is expected to rake in around £25bn a year, was highlighted by the CBI as one of the reasons for the gloomy outlook. Alpesh Paleja, the CBI’s interim deputy chief economist, warned the economy is “headed for the worst of all worlds”.

Mr Paleja said: “There is little festive cheer in our latest surveys, which suggest that the economy is headed for the worst of all worlds – firms expect to reduce both output and hiring, and price growth expectations are getting firmer.

“Businesses continue to cite the impact of measures announced in the Budget – particularly the rise in employer NICs – exacerbating an already tepid demand environment.

“As we head into 2025, firms are looking to the government to boost confidence and to give them a reason to invest, whether that’s long overdue moves to reform the apprenticeship levy, supporting the health of the workforce through increased occupational health incentives, or a reform of business rates.”

Rachel Reeves has previously defended her decision to raise taxes at the Budget, insisting her plan provided the stability needed to secure growth.

“Now we have fixed the foundations of our economy, I am going for growth”, the chancellor said after the October fiscal event.

“Because we cannot tax and spend our way to prosperity, nor can we tax and spend our way to better public services. Instead, we need economic growth and we need economic reform.”

Speaking at a CBI event, she also said the government had no alternative but to raise taxes.

“I have heard lots of responses to the government’s first Budget but I have heard no alternatives,” she said. “We have asked businesses and the wealthiest to contribute more. I know those choices will have an impact.

“But I stand by those choices as the right choices for our country: investment to fix the NHS and rebuild Britain while ensuring working people don’t face higher taxes in their payslips.”

The CBI’s growth indicator survey, based on responses from 899 companies between 25 November and 12 December this year, found expectations for growth are now at their weakest since November 2022.

The predicted fall in activity is wide-ranging, with business volumes in the services sector anticipated to decline while distribution sales and manufacturing output are also expected to fall sharply in the three months to March.

Official figures showed the UK economy unexpectedly contracted in October this year, marking two months in a row of negative growth for the first time since the pandemic.

The rate of consumer price index (CPI) inflation rose to 2.6 per cent in November, its highest level since March and the second monthly increase, while the Bank of England held interest rates at 4.75 per cent as it cautioned over “heightened uncertainty in the economy”.

John Longworth, chair of the Independent Business Network, said he is not surprised by the survey’s results, telling The Independent: “Nearly all of the family businesses I speak to in our network are battening down the hatches for a recession and trying to survive this cloth-eared government.

“They are cutting agencies, stopping recruitment, shedding staff, cancelling bonuses. Ms Reeves appears to be enterprise illiterate, relying on the magic money tree of taxes and in so doing, driving the UK from a position of growth to one of stagflation.”

Earlier this month, leading British businessman James Reed, chair of the recruitment giant Reed, warned the Budget has “spooked business” and suggested a recession could be “around the corner”.

The CBI survey found a 24 percentage-point gap between companies that gave negative responses on expected output and those which gave positive responses – a worse position than in November 2024 when there was a 10-point gap.

It is the worst figure since the 27-point gap in November 2022 and the latest blow to Ms Reeves after a series of economic indicators painted a disappointing picture.

Craig Beaumont, executive director at the Federation of Small Businesses, called for the government to introduce more support for small businesses.

“Cash flow is going to be king in 2025,” he told The Independent. “It’s important that small employers are aware they will receive £10,500 off their annual employer national insurance contributions bill from April.

“To improve sentiment and growth, this needs to be followed by further direct SME-related support from the government, such as stopping the blanket use of personal guarantees by the big banks, tilting business rates help for smaller premises, and halting late payments from UK corporates.

“Unlocking this cash flow will turn around sentiment and put rocket boosters on activity and local growth.”

Shadow business secretary Andrew Griffith said: “Since taking office, the chancellor has made this country a hostile climate for aspiration, for investment and for growth.

“Rachel Reeves’s tax-raising spree and trash-talking her economic inheritance are literally killing businesses and jobs.

“If there is a recession – and based on these CBI expectations that seems increasingly likely – it will be one made in Downing Street. Labour needs to urgently change course before the damage they are doing becomes even greater.”

A Treasury spokesperson said: “We had to make difficult decisions at the budget to fix the economy and the £22bn black hole this government inherited. We have wiped the slate clean and delivered the stability businesses so desperately need.

“More than half of employers will either see a cut or no change in their National Insurance bills.

“We have capped corporation tax at the lowest rate in the G7, provided 40 per cent business rates relief next year for 250,000 properties where there were no plans to do so, launched a 10-year infrastructure strategy and are creating pension mega funds to boost investment in British businesses, infrastructure and clean energy. This is alongside establishing a National Wealth Fund to catalyse over £70bn in investment to drive growth in our to boost investment in British businesses.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks