Budget 2015: Tax credits and housing benefit to be cut for families with more than two children

The move will not affect the 870,000 families with three or more children currently claiming these benefits and child benefit will not be affected

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Families with more than two children will not receive tax credits or housing benefit for their third or subsequent children under a fundamental change to the welfare system.

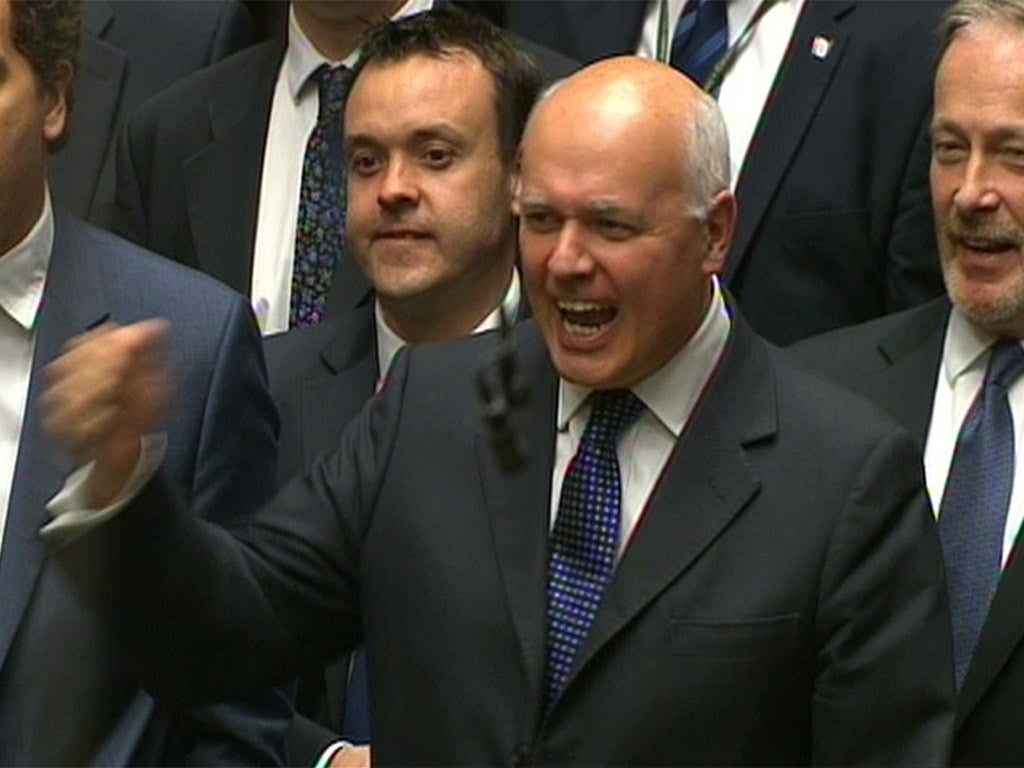

The controversial “two child policy” has been championed by Iain Duncan Smith, the Work and Pensions Secretary, who wanted the Conservatives’ £12bn of welfare savings to change people’s behaviour rather than salami-slice his budget.

The move will be introduced in April 2017 and will save £1.35bn by the 2020-21 financial year. It will not affect the 870,000 families with three or more children currently claiming these benefits and child benefit will not be affected. However, families who have a third child after April 2017 could be caught. Higher tax credit and housing benefit payments for the first child will also be axed in 2017, saving a further £675m by 2020-21.

Treasury officials insisted that George Osborne was not telling parents how many children they should have. His Budget document said: “The Government believes that those in receipt of tax credits should face the same financial choices as those supporting themselves solely through work.” It said an out of work family with five children could currently claim more than £14,000 a year in tax credits alone.

Mr Osborne achieved the £12bn savings target by trimming £9bn off the £30bn annual bill for tax credits for those on low incomes, two thirds of whom are in work. Nine out of 10 families qualified for the state top-ups introduced by Gordon Brown when he was Labour’s Chancellor. The figure has fallen to six in 10 since 2010 and will now drop to five in 10.

From April 2016, the level at which a household’s tax credits are withdrawn for every extra pound earned will be reduced from £6,420 to £3,850. For Universal Credit, which is replacing six working age benefits including tax credits, the figures will be £4,764 for those without housing costs and £2,304 for those with housing costs. State top-ups will also be reduced by larger amounts as people progress in work.

As a result of the cuts, 500,000 households will move off tax credits and 300,000 off Universal Credit.

A two-year freeze on working benefits promised in the Tories’ election manifesto will be extended to four years and last until the 2019-20 financial year. This will save £4bn a year by then. It will not affect payments to the sick and disabled.

However, sick and disabled people on Employment and Support Allowance (ESA) who are likely to be able to return to work will see their payments reduced by about £30 a week to the level of Jobseeker’s Allowance, currently £73.10 a week for those aged 25 and over. The change, predicted by The Independent last week, will affect new claimants from 2017 but not existing ones.

Mark Lever, chief executive of the National Autistic Society, said: "The Government has broken its promise to protect disability benefits. Most autistic people on out-of-work benefits want to work, but struggle due to employers’ misunderstandings and a lack of support. They need ESA to pay for basics like food, heating and clothing.”

Automatic entitlement to housing benefit for jobless 18-21 year-olds will be scrapped. Social housing rents in England will be reduced by 1 per cent for four years to keep down the housing benefit bill.

The benefit cap, the amount one family can claim in a year, will be reduced from £26,000 to £23,000 in London and £20,000 in the rest of the UK.

Single parents criticised the announcement that lone parents would have to look for work when their children reach three and four rather than five as at present. Fiona Weir, chief executive of Gingerbread, said: “Forcing single parents with very young children to work is both impractical and, in many situations, not in the best interests of their children.”

Income tax: Increase in thresholds

Twenty-nine million people were offered a tax cut as the Chancellor raised the point at which people start paying income tax to £11,000 next year and increased the bar before people start getting hit by the 40p rate.

George Osborne labelled the measures a “down payment” on his pledge to increase the personal allowance to £12,500 and the higher rate threshold to £50,000.

The increase in the personal allowance will make a basic rate taxpayer £80 better off next year compared to this year, while raising the higher rate threshold from £42,385 to £43,000 next year will be worth £142 to a typical 40p taxpayer, the Treasury said.

The personal allowance - the amount you can earn before paying income tax - increased by more than 60 per cent under the coalition Government to £10,600 this year and was due to rise to £10,800 in April 2016.

Case study: 'I don’t think we should be punished'

Eddy Wood, 53, is an ex-nightclub owner, living with Parkinson’s disease. He lives in Chelmsford, Essex with his wife and two children, and is currently in the support group for Employment and Support Allowance (ESA).

I think the budget announcement that current claimants won’t receive any less for their ESA is just a sugar coating. Those that are already on it [ESA] aren’t going to complain, but it’s the future claimants that will suffer, and there’s no way to tell if you’ll be affected when the time comes. The amount we get is reasonable enough. We get by with around £350 per week, but the biggest worry is the uncertainty surrounding it all. I don’t think we should be punished. Having an illness isn’t a lifestyle choice. I think any less than what we already get would be worrying for us. I feel for those who’ll receive less in the future.

“They had us waiting for three and a half months before they accepted my ESA claim. The only way we survived was because of borrowing from family and friends. There’s already a problem with the system and I worry about the future.

“Who knows where we’ll be in five years’ time?”

Case study: 'I won’t be housed...'

Shanice Oldcorn is a 19-year-old from Bradford who currently lives in a hostel. Shanice relies on Housing Benefit. She has had various jobs since leaving home, but is currently unemployed and is actively seeking work.

I feel badly about the Budget because they are still going on about cutting the costs of everything. If Housing Benefit gets cut, I won’t be able to stay at [the hostel] anymore; I won’t be able to be housed.

“I wish the Government were a bit more open-minded about people being on Housing Benefits – I wish they’d keep off people’s backs – there’s a lot to think about when you’re sat worrying, ‘What if this happens; what if that happens?’

“I don’t know what my future holds. It’s just a waiting game to see what happens – whether we’re going to have to start paying more, whether Centrepoint itself is going to lose out and they won’t be able to help people like me.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments