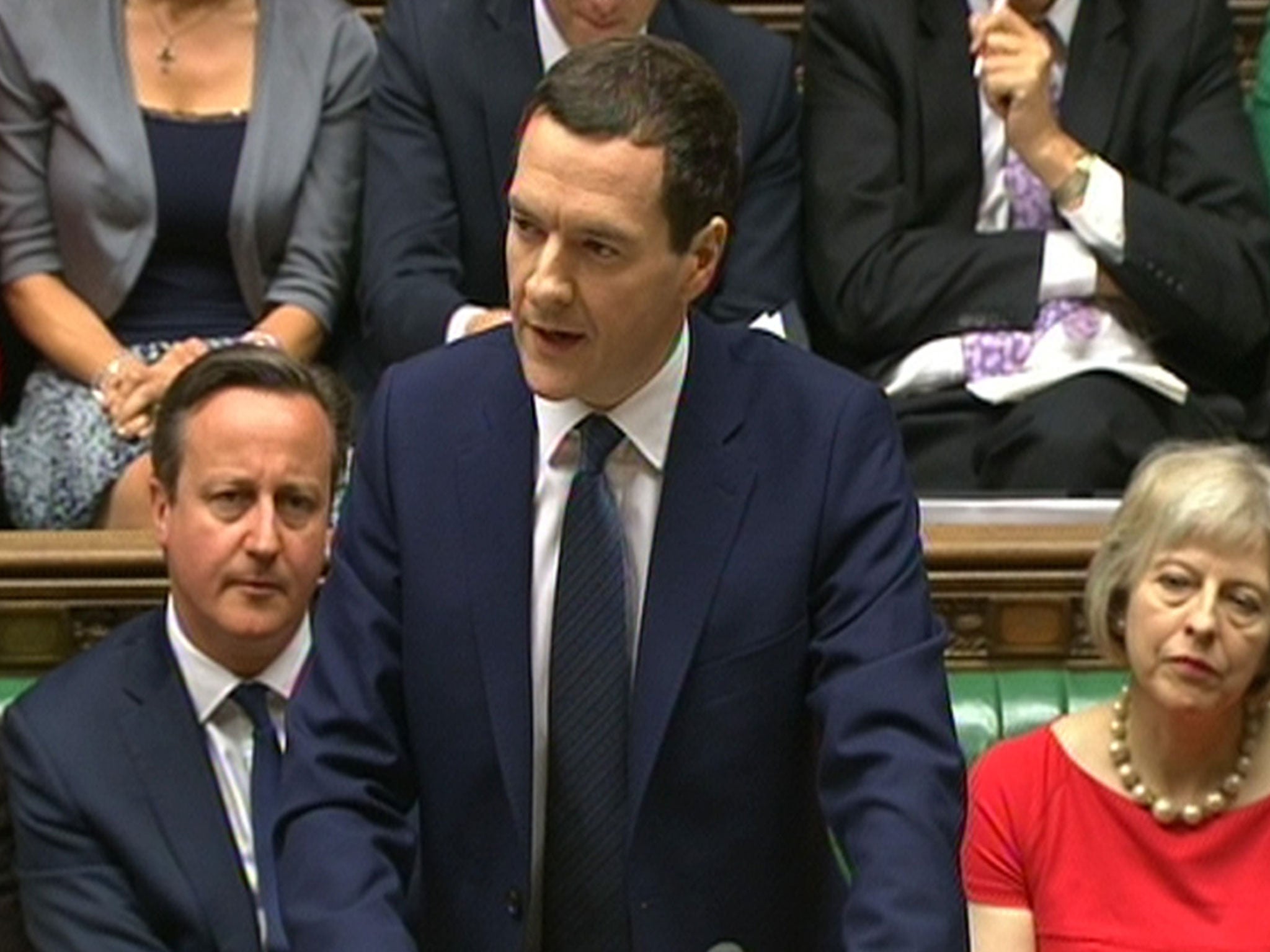

Budget 2015: The key points

From welfare to taxes, find out how this Budget will affect you

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Welfare and pensions

Working-age benefits to be frozen for four years - including tax credits and local housing allowance but not maternity pay.

Rents paid through housing benefit will be reduced by 1 per cent a year for the next four years.

Tax credits and Universal Credit to be restricted to two children, affecting those born after April 2017.

Higher-income households in social housing required to pay rents at the market rate

Most 18-21-year-olds will not be entitled to claim housing benefit with a new so called “earn or learn” obligation

The earnings level at which tax credits will begin to be withdrawn will be reduced from £6,420 to 3,850.

Annual tax relief on pension contributions to be limited to £10,000 a year

Taxation and pay

Introduction of a new so called ‘national living wage’ for all workers aged over 25, starting at £7.20 from April 2016 to reach £9 an hour by 2020

Inheritance tax threshold will be increased to £1m from 2017

Personal tax allowance to rise to £11,000 next year

The level at which people start paying income tax at 40p to rise from £42,385 to £43,000 next year.

Corporation tax to fall to 18 per cent from current level of 20 per cent.

Tax relief on buy to let mortgages to be reduced from 2017 over four years.

Public borrowing and spending

Public sector pay rises to be restricted to 1 per cent for next four years

£37bn of further spending cuts by 2020, including £12bn of welfare cuts and £5bn from tax avoidance.

Defence spending to be ring fenced meeting Nato commitment to spend two per cent of GDP until the end of the decade.

Deficit to be cut at same pace as during last Parliament - securing a budget surplus a year later than planned in 2019-20

Borrowing set to fall from £69.5bn this year to £43.1bn, £24.3bn and £6bn before hitting a £10bn surplus in 2019-20

Transport

No rise in fuel duty with rates continuing to be frozen

Major reform to vehicle excise duties to pay for a new road-building and maintenance fund in England.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments