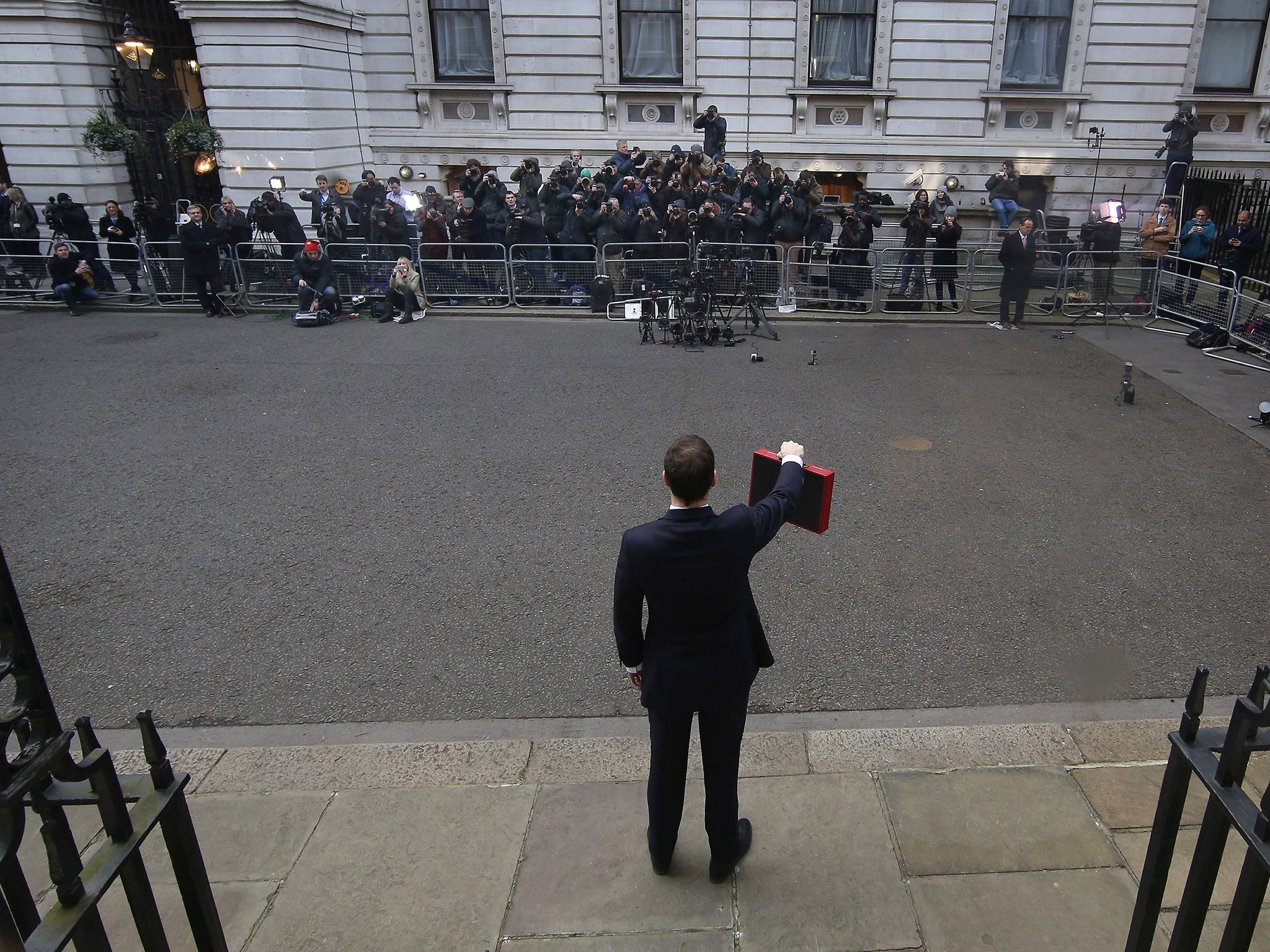

Budget 2015 – devolution: Four regions told they can keep 100% of local business rates from shops and restaurants

A trial will begin in April that could be rolled out across the country

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Four UK regions have been told they can collect and keep 100 per cent of business rates paid by local shops and restaurants, the Chancellor has revealed.

Cambridgeshire, Peterborough, Greater Manchester and Cheshire East will start receiving all the rates paid in their areas from April in a trial that could be rolled out across the country.

Councils currently receive around half of the business rates bill collected in their area with the rest going to central Government in a rule introduced two years ago.

The idea is to encourage councils to help local businesses thrive and benefit from the increased rates collected.

However experts warned while the new rules are welcomed, ministers must make sure local authorities do not abuse their positions.

Jerry Schurder, head of business rates at Gerald Eve said the plan works well when regions are in growth, but in the last few years some poorer regions have declined, meaning should that continue the tax bill the councils receive will shrink.

He added: “Local authorities that have seen a decline have been trying to protect their receipts by becoming more difficult in giving discretionary reliefs.

“I’m a supporter of business rates being retained locally if it is genuinely promotes growth but the Government need to be careful that local authorities don’t abuse their position and become aggressive in trying to increase rates to fill any gaps in their budgets.”

Business rates have shot up the political agenda in recent months with businesses, especially in retail, demanding a major overhaul of the system which sees high street stores pay far more money than online rivals.

Businesses have also pointed out that the bill is based on outdated valuations of their premises from 2008, with those in poorer areas seeing rents fall but rates bills remain artificially high.

Earlier this week the Government reaffirmed plans for a major review into the system after the election, although critics have pointed out that the issues have been raised with them for at least two years.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments