Budget 2014 preview: Middle classes to benefit most from raise in personal allowance

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

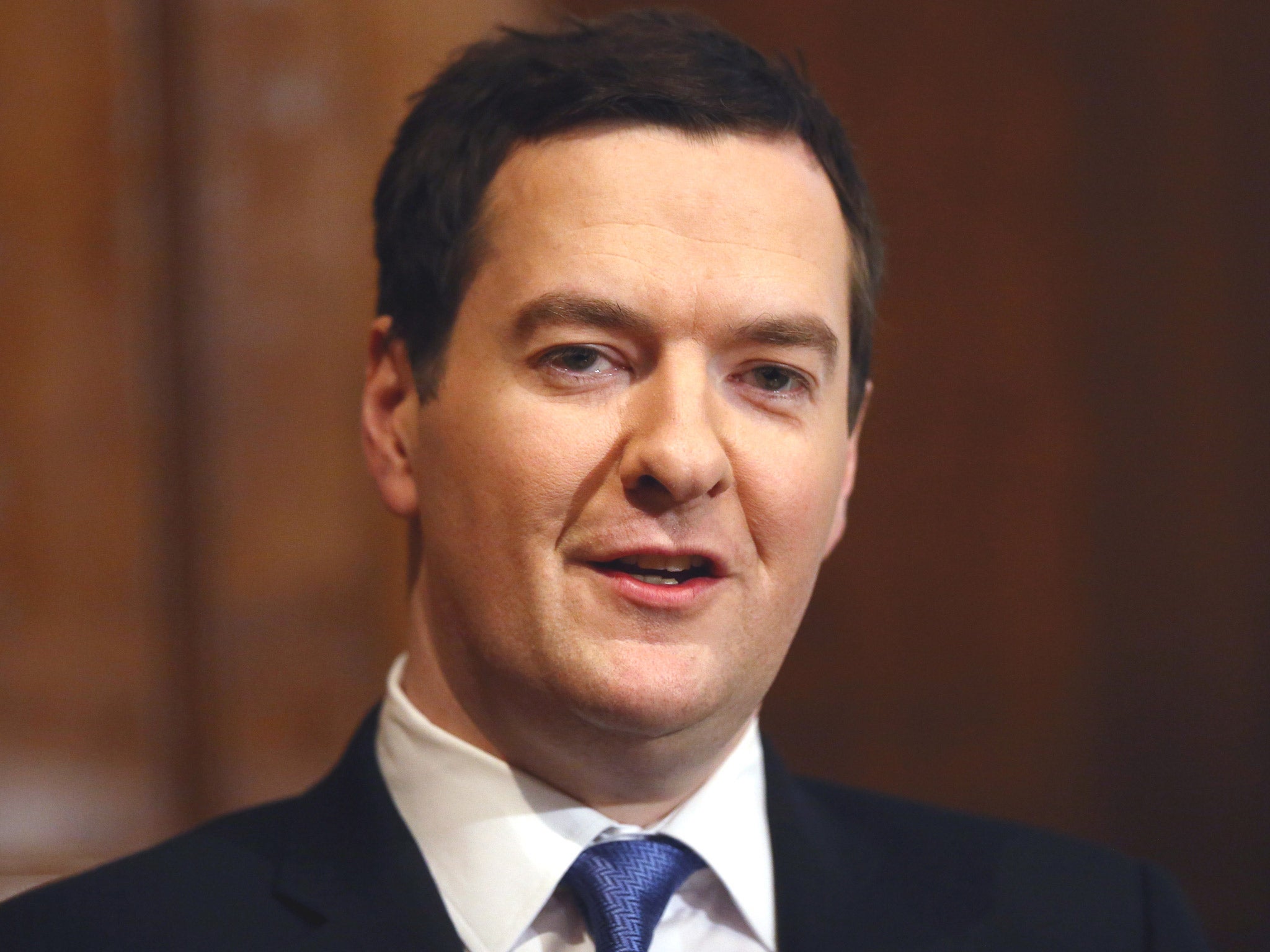

Your support makes all the difference.George Osborne insists that the middle classes have reaped the benefit from his decision to raise the personal allowance from £6,475 in 2010-11 to £10,000 from the financial year starting next month, at a cost of more than £10 billion.

But this tax cut has usually been presented as a way of helping people on low incomes, lifting 2.2 million of them out of the tax net. This suited both the Liberal Democrats, who put a £10,000 allowance on the front page of their 2010 election manifesto, and Conservative ministers, keen to answer Labour claims that they were “balancing the books on the backs of the poor".

The tax reduction was funded partly by reducing the level of income at which the 40p tax band starts to bite from £43,875 to £41,866. This dragged more people into the higher rate, the number rising from just over thee million in 2010-11 to 4.4 million. Conservative MPs have grown increasingly anxious about this tax rise for the party’s natural middle class supporters. They want Mr Osborne to raise the 40p rate threshold in the Budget by more than the planned one per cent, but are likely to be disappointed.

Belatedly, the Chancellor is now repackaging the rise in the personal allowance as a tax cut for 24 million people on incomes up to £100,000 a year – including those on between £40,000 and £45,000 a year. He will be armed with figures showing that a typical 40p rate taxpayer will pay £350.50 less in tax and national insurance contributions in the current financial year than three years ago because they do not pay any tax on a bigger slice of their income. If the 40p threshold had been raised in line with inflation, those in it would have enjoyed a tax cut twice as large as people paying the 20p basic rate, undermining the Coalition’s claim to be “ fair".

Possible measures in today's budget

Tax

- Personal tax allowance to rise from £10,000 next month to at least £10,500 in April next year

- 40p tax band expected to rise by one per cent (less than inflation) from annual incomes of £41,451 in the current financial year to £41,866 next month

Welfare cuts

- More detail on how the Chancellor’s proposed welfare cap would bear down on fast-rising areas of the social security budget after next year’s general election. A possible trap for Labour, which will be challenged to say whether it supports the move

Housing

- Help to Buy equity loan scheme for buyers of new properties to be extended to 2020 at a cost of £6 billion to boost supply of housing, providing an extra 120,000 homes

London property

- Possible further crackdown on rich foreigners living abroad who buy in Central London’s luxury property market to profit from rising prices, amid fears of a housing bubble

Stamp duty

- Tory MPs calling for the tax to be abolished for homes sold for less than £500,000 as thresholds have not changed for more than 10 years. Treasury revenue set to rise from £9bn to £15bn over next five years

Childcare

- Government to provide up to £2,000 per year per child by meeting 20 per cent of childcare costs up to £10,000 a year for children up to age of 12 from autumn 2015

Business

- Possible freeze in carbon price floor, a tax on fossil fuels used to generate electricity, to help manufacturing. Possible rise in investment allowances

Exports

- With little sign of the “export-led recovery” the Chancellor wants, he may offer extra help for medium-sized businesses

Youth unemployment

- Tory MPs hope there could be further reductions in national insurance contributions for companies taking on under-25s

Bingo

- Tory MP Robert Halfon, who campaigned successfully for a freeze in fuel duty, wants the 20 per cent gross profits tax on bingo reduced to the 15 per cent level for other forms of gambling. Would appeal to working class voters (as Mr Osborne’s cut in beer duty did last year)

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments