Brexit wine tax sparks call for consumers to pressure MPs

Exclusive: Customers asked to write to MPs ahead of Rachel Reeves’ Budget later this month over reforms

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Customers are being urged to “urgently” pressure MPs over a post-Brexit wine tax dubbed Rishi Sunak’s “sneaky Sauvignon surcharge”.

Major wine companies such as Majestic have asked customers to write to their member of parliament to highlight the issue before Rachel Reeves‘ Budget at the end of this month – to “get this ill-conceived policy stopped before it is too late”.

Many wine drinkers face paying more for their favourite tipple from February, as part of changes brought in after the UK left the European Union.

Experts and industry leaders have also warned the Tory reforms to booze levies could see some of Britain’s favourite bottles disappear from the shelves.

They say the move will raise the price of some red wines by more than 40p a bottle, as the number of tax bands for wine goes from one to 30.

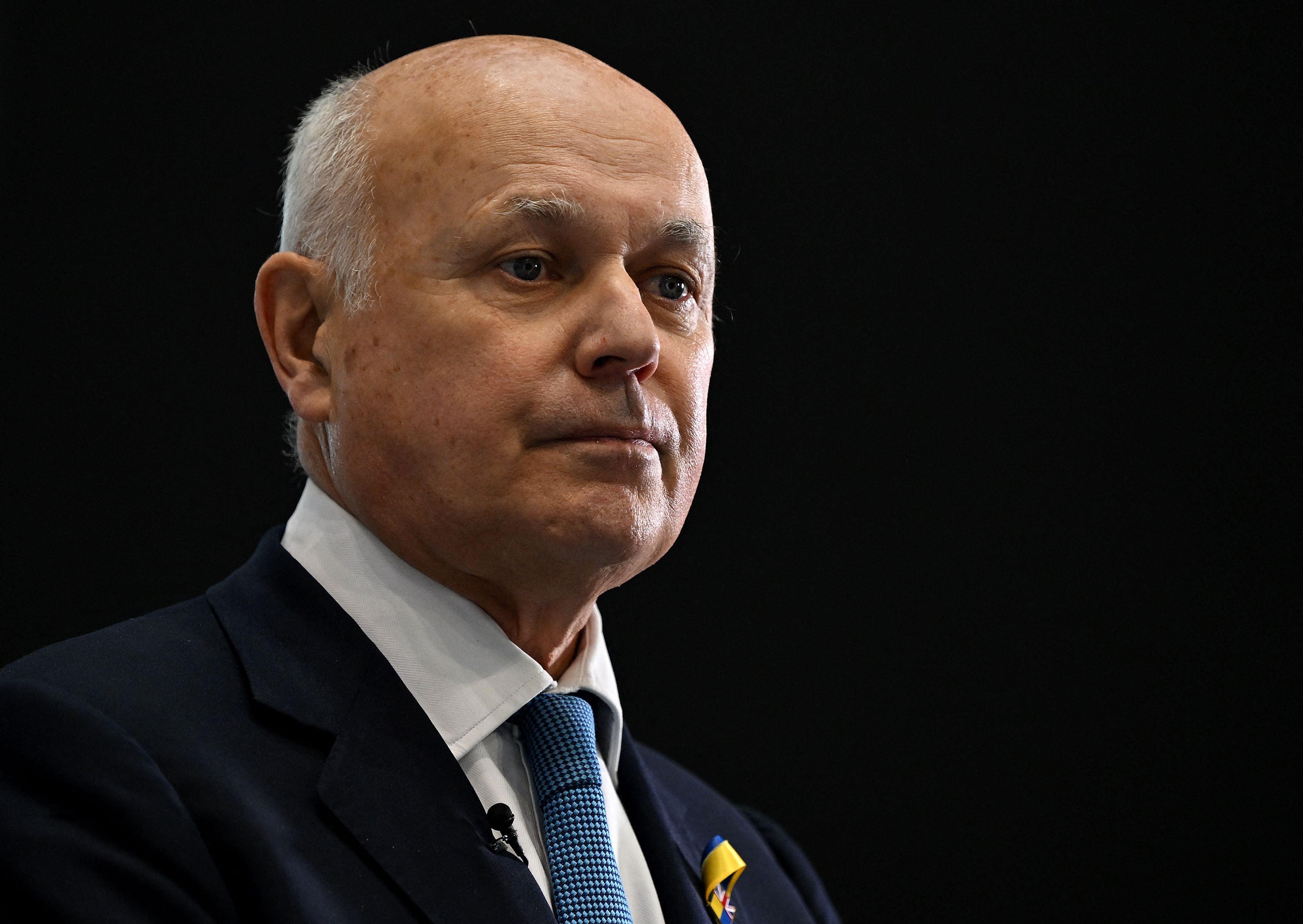

The reform has been opposed even by a number of leading Bexiteers, including the former Tory leader Sir Iain Duncan Smith.

Then prime minister Mr Sunak announced the changes in the 2021 spending review, when he declared them a Brexit benefit and promised they would lead to a system that was “simpler, fairer, and healthier”.

The new regime will tax alcohol based on strength for the first time. Previously, levies were applied based on categories which included wine, beer, spirits and ciders. Experts warn that when it comes to wine alcohol levels can vary, because of a number of factors including the weather.

In the wake of the outcry over the plans, ministers delayed them last year, introducing instead a temporary flat tax for all wines between 11.5 per cent and 14.5 per cent alcohol by volume, a category which makes up 85 per cent of the more than one billion bottles sold each year in the UK. However, the new regime is due to end at the start of February.

A new campaign poster being sent to customers and displayed in shops warns that the new Labour government “has inherited a highly controversial alcohol duty system which is due to be implemented on 1st February 2025…. This change will not only increase costs and complexity for wine retailers, but could result in your favourite wine having to rise in price or potentially being removed from our ranges entirely.”

It adds: “We need your help to urgently raise this important issue to your newly elected local MPs, and get this ill-conceived policy stopped before it is too late.”

Miles Beale, chief executive of the Wine and Spirit Trade Association, said: “With just over two weeks to go until the Budget, the WSTA, its members, and independent wine businesses across the UK have collectively reached 100s of MPs in a bid to raise the issue of wine tax changes which come into play in February. The Prime Minister vowed to rip up red tape at a business conference today - which is exactly what we are asking the Treasury to do at the Budget. The PM and chancellor can avoid further bureaucracy by ripping up the last government’s plan to end the wine easement, which would suffocate growth in our sector.

Keeping the temporary easement for wine stops the last government’s botched reform and ticks all the PM’s pledges. It will help businesses grow, keep prices down for consumers and stabilise Treasury income - but it needs to happen at the Budget this month because businesses are running out of time to plan for next year.”

A Treasury spokesperson said: “The alcohol duty reforms modernise and simplify the system, to prioritise public health and incentivise consumption of lower strength products.

“To help the wine industry adapt to the new duty system, the current temporary duty easement was introduced as a transitional measure, which was intended to allow time for wine producers to adapt to calculating duty based on alcohol by volume.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments