What Jeremy Hunt’s Autumn Statement means for house prices

Forecasters delivered disappointing news for homeowners as they are set to lose thousands next year

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.House prices are set to fall by thousands of pounds next year as interest rates remain high, forecasters have said.

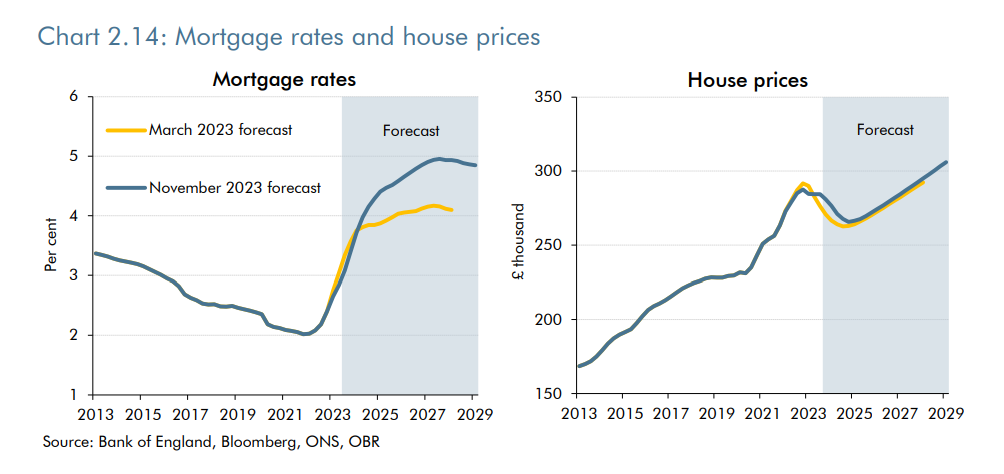

The Office for Budget Responsbility (OBR) said house prices will grow this year by 0.9 per cent, but then plunge by 4.7 per cent in 2024.

“This would be consistent with the price of the average UK home reaching a low of around £266,000 at its trough in the final quarter of 2024,” the OBR said.

This means that overall house prices will be 7.6 per cent lower in the fourth quarter of 2024 compared to their high in the first three months of 2022, which is less than the OBR expected.

The forecaster said they do expect house prices to recover, but they will not reach their 2022 peak until 2027. The OBR added that house prices are particularly sensitive to “changes in interest rates and household income growth”.

It added that economic indicators suggest the market will stay “weak”, for example new buyer inquiries are at their lowest level - excluding the pandemic - since 2008.

It comes after average house prices in the UK rose in October for the first time in six months, but still remain lower than a year ago, according to analysis from Halifax.

In addition to that home-mover completions with a mortgage in the first half of 2023 were a third lower than 2019 levels, while first-time buyer numbers were around a quarter lower, according to Nationwide.

There was disappointment in parts of the housing industry that Jeremy Hunt did not announce more support in his autumn statement for first-time buyers, or a stamp duty holiday to stimulate the market.

Richard Davies, COO of agent agent Chestertons, said: “Aspiring homeowners will feel disappointed about the Autumn Statement not including measures to help property buyers. Many would have welcomed cutting Stamp Duty which would have resulted in house hunters, who previously paused their property search, to re-enter the market.

“A Stamp Duty exemption for downsizers would have also been a crucial step to help those wanting to move to a smaller property. Each year, we meet countless homeowners who are planning to downsize but, due to the Stamp Duty which can be as much as 12%, are put off to do so. A tax exemption would have encouraged downsizing which in turn frees up large, under-occupied family homes.”

“We would have also liked to have seen the Chancellor introduce more initiatives to assist young house hunters get on the property ladder. With the cost of living, many are struggling to save up a sufficient deposit or find a property within their budget.”

And Paula Higgins CEO of HomeOwners Alliance, said there was very little to help homeowners and first time buyers.

“First time buyers need more of a hand up.,” she said. “There are more barriers now than ever and yet we’ve heard nothing today to help give young hardworking Brits to achieve the security and safety of their own home.

“Instead the government continues to turn a blind eye to their plight. The Bank of England’s approach to tackling inflation means homeowners bear the brunt with soaring costs of borrowing.

“To get on the ladder, first time buyers need astronomical deposits, are older than ever and have to spread their mortgage term over 35 years or more.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments