‘Massive spending cuts will still be needed’ despite Chancellor’s U-turn

Think tank experts said the Government’s mini-budget plans will still leave the UK’s public finances on an unsustainable path.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

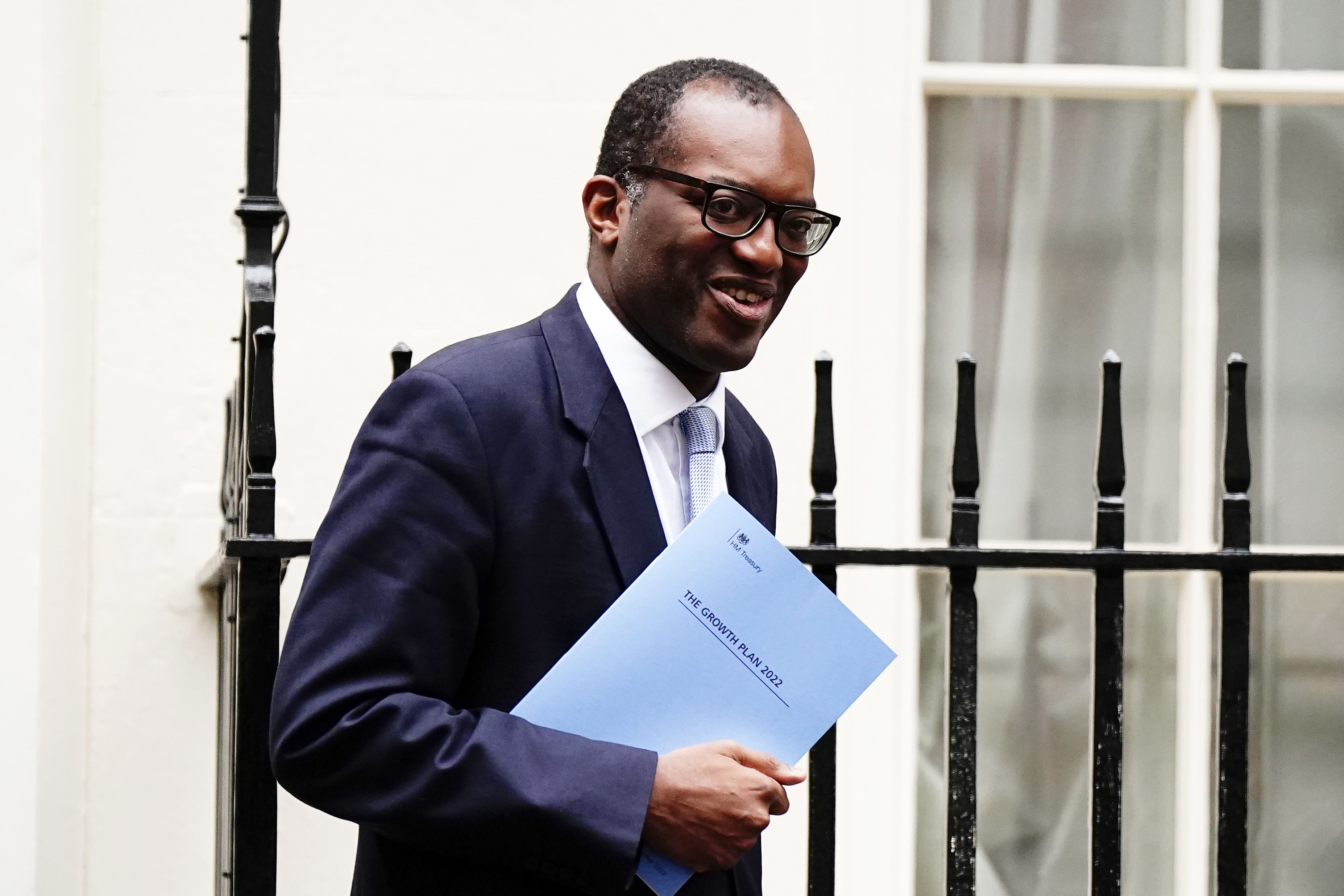

Your support makes all the difference.The Chancellor’s U-turn on his plans to axe the 45p tax rate will do little to ease the pressure on the UK’s public finances and the mini-budget plans will still help the richest households the most, think tank experts have warned.

Paul Johnson, director of the Institute for Fiscal Studies (IFS), said the cut to the 45% rate on earnings over £150,000 was the “smallest part” of the mini-budget, representing around £2 billion of the £45 billion in tax cuts.

He warned the about-turn will not prevent the Government from putting the UK’s already creaking public finances on an “unsustainable footing” and said mammoth spending cuts will still be needed.

He tweeted: “From a fiscal point of view, important to remember cut to 45p rate was just about smallest part of the mini budget.

“What was a £45 billion tax cutting package is now a £43 billion package.

“This U turn has, in itself, essentially no effect on fiscal sustainability.”

He added that while the pound has rebounded after the rethink, underlying worries over the unfunded tax cuts remain and Mr Kwarteng will still have to address these fears in his November fiscal statement or face further market turmoil.

“The Chancellor still has a lot of work to do if he is to display a credible commitment to fiscal sustainability,” said Mr Johnson.

“Unless he also U-turns on some of his other, much larger tax announcements, he will have no option but to consider cuts to public spending: to social security, investment projects, or public services.

“On the latter, the Chancellor has indicated that departments’ cash spending plans that run to 2024-25 will be left unchanged, which amounts to a real-terms cut in their generosity in the face of higher inflation.

“This will squeeze public services, but will not be enough to plug the fiscal hole the Chancellor has created for himself.”

The Resolution Foundation think tank said that the richest 5% of British households are still set to gain £3,500 on average next year from the wider tax cuts announced in the mini-budget.

This is almost 40 times more than the £90 cash gain for the poorest households.

Lalitha Try, researcher at the Resolution Foundation, said: “The top are still the main winners, and the scale of spending cuts required to pay for them is largely unaffected.

“Despite today’s U-turn, the richest 5% of households still stand to gain far more than the entire bottom half of the income distribution combined.”

The think tank’s chief executive Torsten Bell also warned that while the U-turn will help with internal and wider political pressure on the Government, it “doesn’t change the big picture of a £40 billion package of unfunded tax cuts which drove the market reaction” or avoid the “big spending cuts that will follow”.

He called Mr Kwarteng’s mini-budget “the biggest unforced economic policy error of my lifetime” in the wake of the market reaction.

Last week, the Resolution Foundation said the Government may be forced to return to the type of spending cuts not seen since the days when George Osborne was Conservative chancellor.

It predicts that, without the OBR forecasting faster growth in the years ahead, the Government is likely to need to tighten fiscal spending by £37 billion to £47 billion for debt to be falling by 2026-27.