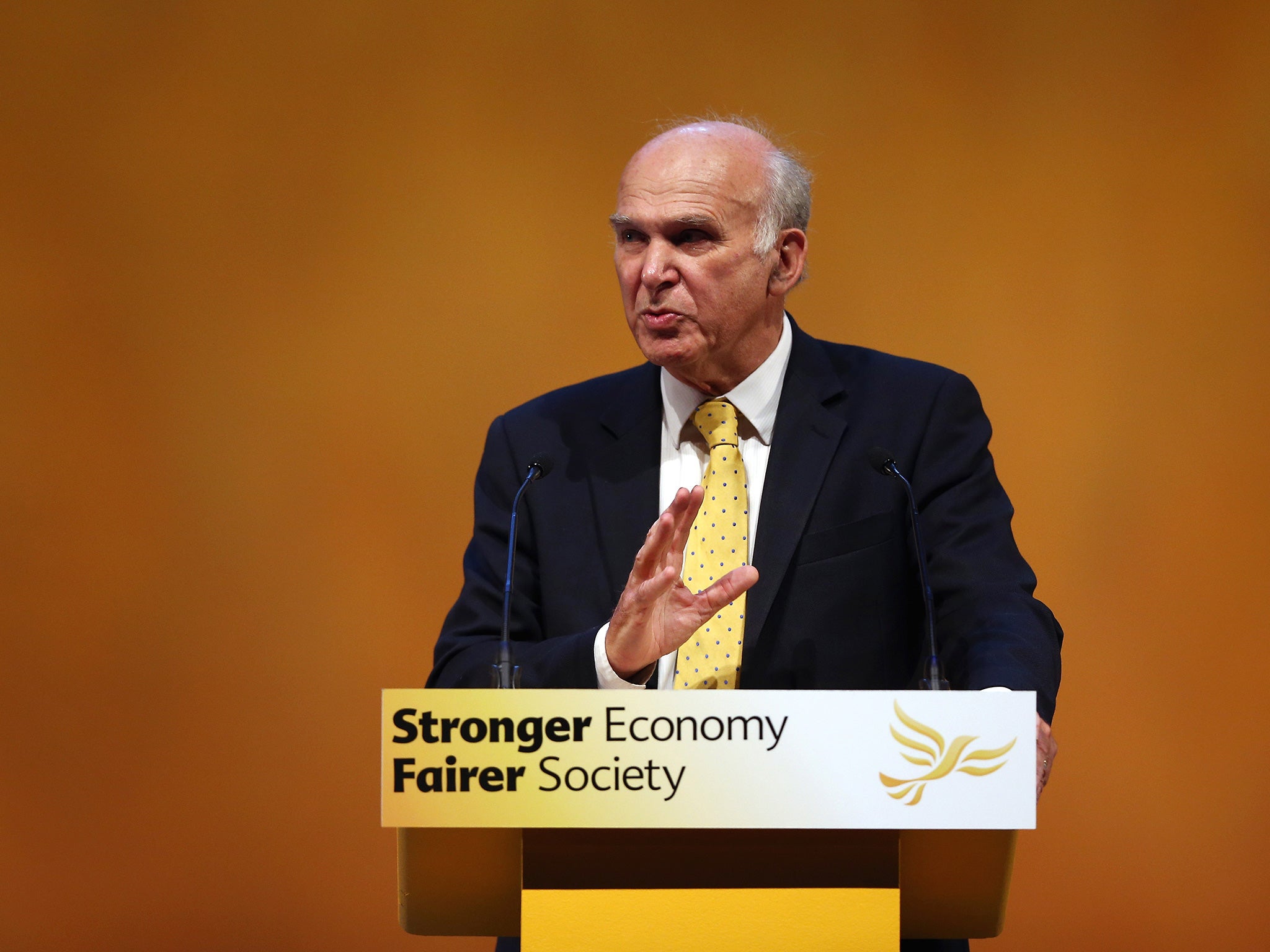

Vince Cable: Former Business Secretary warns that 'severe economic storms' are on the way

Mr Cable says that the UK’s economic recovery is 'precarious and unbalanced' and that a reckoning is coming

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Sir Vince Cable, the former Business Secretary and the only senior politician who sounded the alarm about the fragility of the UK economy in advance of the 2007-9 financial crisis, has warned of another looming ”reality check” for Britain.

Writing exclusively for The Independent Sir Vince, who dramatically lost his Twickenham parliamentary seat at the May general election, argues that the UK’s economic recovery is “precarious and unbalanced” and that a reckoning is coming.

Dismissing the “cheery self-confidence” of George Osborne and other ministers Sir Vince points to the UK’s still-elevated levels of household debt, double-digit house-price inflation and the growing risk of a financial earthquake emanating from China as reasons for serious concern.

Sir Vince’s concerns echo those of Lord Turner, the former chairman of the Financial Services Authority (FSA), who now also argues that the UK’s recovery is “dangerously unbalanced” due to excessive levels of household debt.

Sir Vince’s fears on house prices also find support from a recent report by analysts at the Swiss bank UBS, who last month put London at the top of their global real-estate “bubble index”.

The UK’s household debt to income is currently equivalent to around 145 per cent. But the Office for Budget Responsibility, the Treasury’s official forecaster, is projecting the ratio will shoot back up to the 170 per cent it reached on the eve of the financial crisis over the next five years. “Debt matters since it can have a depressive effect on the willingness to invest and on the willingness of consumers to spend,” explains Sir Vince.

Sir Vince won his reputation for economic prescience when he warned about the easy terms on which banks were extending credit in the years before the financial collapse. In November 2003 Sir Vince publicly challenged the record of the then Chancellor, Gordon Brown, who was at that time highly regarded for his economic acumen.

“Is not the brutal truth that the growth of the British economy is sustained by consumer spending pinned against record levels of personal debt, which is secured, if at all, against house prices that the Bank of England describes as well above equilibrium level?” he asked.

Before the crisis Sir Vince also took an unfashionable position by warning that financial regulation was too light. He publicly warned the FSA was taking a “box-ticking” approach to its regulation of the UK’s banks, rather than thoroughly stress-testing institutions. It was a critique that the FSA subsequently admitted was justified.

Sir Vince says that he does not subscribe to the “extreme disaster scenarios” laid out by some for China. But he argues that even Beijing’s growth slowdown could have damaging knock-on effects for the British economy. “In the short run it will bring economic grief,” he writes.

Sir Vince also notes that there seems little likelihood of any external support for the British economy from the eurozone, which he suggests will “limp along” due to the “unresolved problems” of weaker economies such as Greece, Portugal and Italy.

Sir Vince says the severity of the UK’s economic reality check would depend on the resilience of the domestic financial system. He admits that banks are better capitalised but warns of “unknown unknowns lurking in a new generation of derivatives” which could result in “nasty surprises”.

One of Sir Vince’s concerns is that UK economic policymakers may not have the policy levers to respond to a new slump that they pulled to contain the fallout from the 2007-09 crisis. “Having pushed monetary policy and public debt to the limits of what are regarded as sustainable levels there is no obvious place to go if we hit another recession,” he writes.

The Bank of England’s main policy interest rate has been at a historic low of 0.5 per cent since March 2009, with many economists doubtful of the stimulative effect of pushing rates into negative territory. Meanwhile, the UK’s national debt has doubled from 40 per cent to more than 80 per cent of GDP since the financial crisis as the “automatic stabilisers” of unemployment benefits kicked in when joblessness shot up.

Some fear another similar jump in government indebtedness could prompt a financial market panic about the solvency of the state.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments