Benefit uprating and pension increase: The 5 big money changes to know this April

April 2024 brings changes that impact most UK households – here’s everything you need to know

Each year, April brings important changes for UK households as the country enters a new financial year.

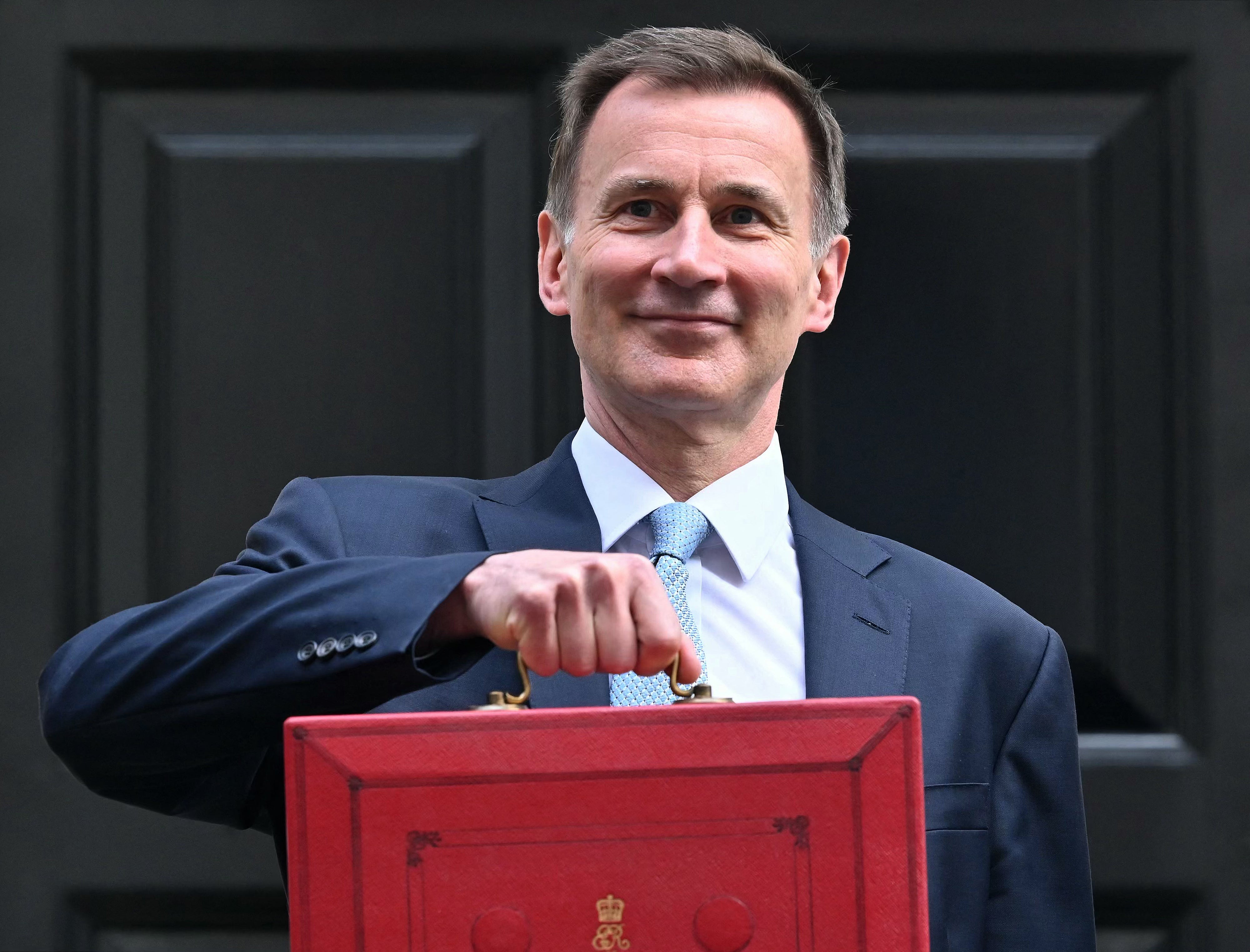

Following on from chancellor Jeremy Hunt’s spring budget, April 2024 will be no different, with several new measures and rates coming into effect.

April will see increases in various sources of income, while household bills are expected to begin levelling out to a more sustainable point than they have been in recent years.

Inflation took a positive turn in March, falling to 3.4 per cent – the lowest level since March 2021. Combined with a summer of strong wage growth, the UK’s economy could be showing early signs of growth.

However, the cost of living crisis continues, with many families still struggling to afford the essentials and stuck with record debt from the past few years. The declining rate of inflation has also yet to reach the Bank of England’s 2 per cent target.

To help you navigate the financial comings and goings UK households face this year, here’s your guide to the five biggest changes that could impact your money from April:

Benefits, pensions and minimum wage are all going up

Every year, benefits rise at least in line with inflation, usually taken from the rate of the previous September. This means benefits will rise by 6.7 per cent in April.

The 2024/25 standard Universal Credit allowances will increase to:

- £311.68 per month for single people aged under 25 (up from £292.11)

- £393.45 per month for single people aged 25 and over (up from £368.74)

- £489.23 per month for joint claimants both aged under 25 (up from £458.51)

- £617.60 per month for joint claimants both aged 25 and over (up from £578.82)

Also rising is the basic and new state pension, which will increase by 8.5 per cent in April. This is in line with average earnings growth last year, as per the triple lock guarantee. It represents the second-ever largest rise in the state pension rate.

The new state pension rates for 2024/25 will be:

- £221.20 per week for the new State Pension (up from £203.85)

- £169.50 per week for the basic State Pension (up from £156.20)

Benefits and pensions payments should arrive in bank accounts on the usual dates in April.

Minimum wage is also set to rise by 9.8 per cent in April, to a new rate of £11.44 for those aged 21 and over. The £1.02 an hour rise is the largest ever cash increase to the minimum wage.

For those under 21, the 2024/25 rates are:

- £8.60 an hour for 18-20-year-olds

- £6.40 an hour for 16-17 year olds

- £6.40 an hour for apprentices

National Insurance cut takes a 2p cut

As part of his spring Budget, Mr Hunt announced a 2p cut to national insurance (NI) contributions, taking effect from 6 April. This brings them down to 8 per cent, as it follows shortly from the other 2p reduction (to 10 per cent) in January.

This means most employees (earning over £242 a week) are now paying 4 per cent less in NI tax.

However, several economic think tanks have pointed out that, due to the freeze on personal tax thresholds introduced in April 2021, many workers are actually now worse off.

This is because, as people’s wages have increased with inflation, the point at which they start paying tax – or higher rates – has not gone up like they usually would. Economists call this ‘fiscal drag’.

Under the new changes, someone on £25,000 will be saving £41.43 from the national insurance changes. However, they will also be paying £62.08 more a month than if the tax thresholds had increased with inflation since April 2021. This is a loss of £20.65 overall.

Things get better at £32,000. Someone on this wage will save £64.77 from NI cuts, and pay £62.06 more after fiscal drag. That means they take £2.71 more home a month.

At £56,000 earners will start to see a net loss again as, while they will save £125.67 from the NI cut, they will lose £128.91 after fiscal drag. This is a £3.24 net loss.

Council tax is rising more than usual

With local councils across the country facing financial difficulty, many are set to increase the council tax rate for residents by the maximum amount permitted.

For councils with social care duties, this is 4.99 per cent, and 2.99 for others. Research by the County Councils Network shows that the vast majority have chosen to meet these upper limits.

But some have gone further. Birmingham City Council has been given permission to hike their council tax by 21 per cent over the next two years. Woking’s will go up by 10 per cent, while Thurrock and Slough’s will both go up by 8.

All of these councils have issued Section 114 notices to the government in recent years, declaring themselves effectively bankrupt.

The annual average tax bill is set to rise by £106, according to government figures. For a full breakdown by council, The Independent has produced a helpful map.

Energy bills go down – water bills go up

Household bills are a mixed picture this April, but should work out cheaper overall for the average household.

The Ofgem energy price cap will fall by £238 to £1,690 from April to June, the lowest it has been for two years. This figure represents the average amount households can expect to pay for ‘typical’ energy consumption.

Analysts at the trusted Cornwall Insight predict this will fall a further £228 in July, to £1,462.

Water bills are heading the opposite way, set to rise 6 per cent on average to add £28 a year on to the typical bill.

However, there are major regional differences. Customers of Wessex Water will see the largest increase of £59 a year, while most of Wales will actually see a £20 annual decrease.

Broadband, mobile and pay TV bills are going up

This spring, pay TV, broadband and mobile prices will rise by up to 8.8 per cent, with most providers making the change from April 1. This varies between providers, so you will need to check with yours directly.

Unfortunately, if you are on a fixed-term contract, providers are able to raise the rate that you pay while you are still locked in. This means that, even if you disagree with the price hike, you will likely have to pay a termination fee to leave the contract.

In more bad news for TV owners, the yearly cost of a TV licence fee is also set to rise from £159 to £169.50 from April 1. This brings the two-year freeze of the fee to an end – so expect more rises in the future.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks