House prices rise for the first time in three months

Nationwide said consumer confidence was growing in the housing market due to rises in wages and a fall in inflation

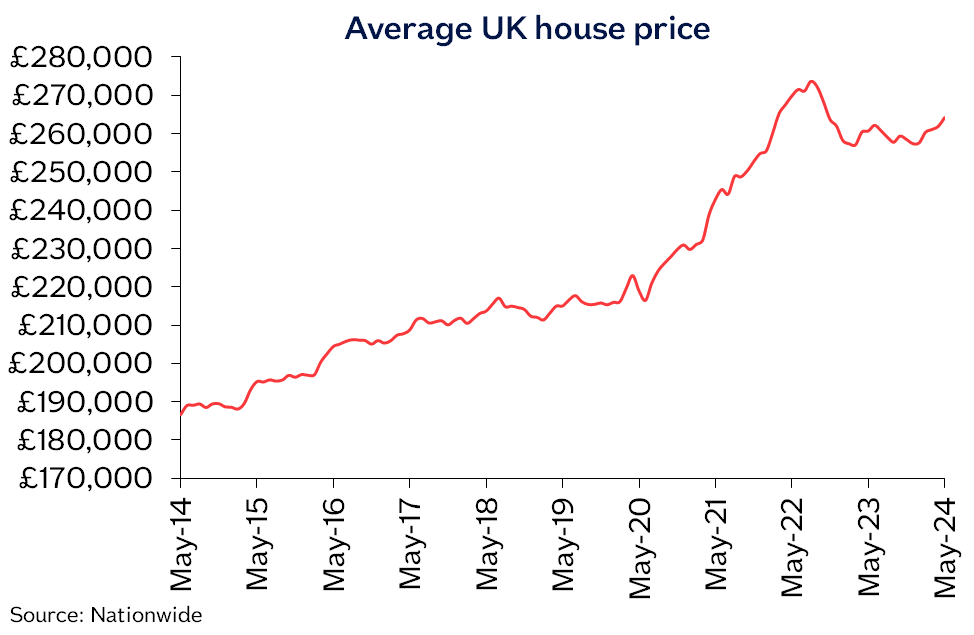

The average UK house price rose slightly in May ending a two-month run of price drops, according to an index.

UK property prices increased by 0.4 per cent month-on-month in May following a 0.4 per cent fall in April, Nationwide Building Society said.

The annual rate of house price growth was 1.6 per cent. The average UK house price in May was £264,249, up from £261,962 the previous month.

Robert Gardner, Nationwide’s chief economist, said consumer confidence was growing due to rises in wages and a fall in inflation.

He said: “UK house prices increased by 0.4% in May, after taking account of seasonal effects. This resulted in a slight pickup in the annual rate of house price growth to 1.3% in April, from 0.6% the previous month.

“The market appears to be showing signs of resilience in the face of ongoing affordability pressures following the rise in longer-term interest rates in recent months.”

The building society also analysed house price movements in the months around previous elections and found that they do not normally have much of an impact on the market.

Mr Gardner said: “Past general elections do not appear to have generated volatility in house prices or resulted in a significant change in house price trends.

“On the whole, prevailing trends have been maintained just before, during and after UK general elections. Broader economic trends appear to dominate any immediate election-related impacts.”

Prices rose in May despite a number of the major mortgage providers hiking their rates in recent months as the Bank of England keeps interest rates at 5.25 per cent.

According to Moneyfacts, at the end of January, the average two-year fixed rate mortgage cost 5.56 per cent, rising to 5.92% by the end of May.

Despite the slight rise in house prices, the broader economic picture is that the country has been suffering from weak economic growth since the financial crash in 2008.

A study by the Institute for Fiscal Studies (IFS) released on Friday, found average incomes grew by just 6 per cent from 2009-10 to 2022-23. Before the financial collapse, the UK would have expected income growth of 30 per cent in the same period.

Mortgage brokers said the slight increase in prices reflected an increase in activity in the market over the last few months.

Michelle Dawson, director at Lawson Financial, said: “A slight tick-up in prices reflects the slight increase in activity we have seen, however the market is a long way off truly sparking.

“Borrowers are still hopeful of interest rates coming down but the ever-cautious Bank of England holds that touch paper.

“With the election looming, we need some stability and a sense of direction. Now is the time to buy, just before the upturn rather than after it.”

Nathan Emerson, chief executive of Propertymark, said: “We are conscious there may be a potential slowdown across the summer as a knock-on effect following the General Election.

“But with inflation firmly on its journey downward and with scope for interest rate cuts, we may soon see a much welcome influx of highly competitive deals from lenders hit the marketplace.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks