Warning British rents could surge by 13 per cent over next three years

Renters will also see amount spent on rent grow faster than earnings in years ahead, reveals new report

British rents could surge by as much as 13 per cent over the next three years, a new report has warned.

Renters will also see the amount they spend on rent growing faster than earnings in the years ahead, according to research published on Monday by the Resolution Foundation.

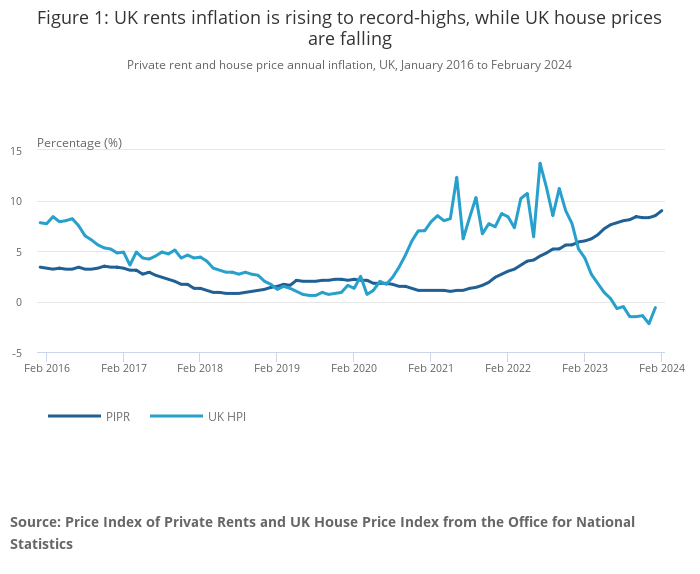

The stark predictions have been made even though the UK’s recent exceptional rise in new tenancy rent levels – up by almost a fifth over the past two years – is coming to an end, as the current high market rates still work their way through existing tenancies.

The report ‘Through the roof: Recent trends in rental price growth’ finds the main causes of Britain’s private rents surge is a bounce-back from the pandemic and more recently fast rising wages. The Foundation notes that rents tend to track wages over the long-term – and that average private rents have remained roughly constant as a proportion of average earnings since 2000.

However, the research finds the disruption caused to the rental market by the pandemic, during which evictions and repossessions were halted, meant that rent levels fell to their lowest level on record relative to earnings, and, by early 2022, were nearly 5 per cent lower than what a long-term trend would suggest. Some of the recent surge in rental prices is therefore a post-pandemic ‘correction’, returning the UK’s rent-to-earnings ratio to its long-term trend.

It adds that this post-pandemic catch-up has been compounded by historically high nominal earnings growth in recent years, with average earnings rising by 13 per cent since the beginning of 2022.

However, the Foundation predicts, with that catch-up now done and pay growth cooling, the surge in rents for new tenancies should come to a close. In fact, it finds market rents for new tenancies have already begun to cool, falling from annual growth of 10.4 per cent in June 2023, to 7.5 per cent by March 2024.

However, the Foundation warns that although growth in rent levels for new tenancies is cooling, it could take years for the burst of growth that has been seen to make its way through the whole private rental sector. New renters will pay these new higher rents, while existing tenants reaching the end of a tenancy or forced to accept within-tenancy price rises, will in future face large rent hikes.

Assuming average rents paid will return to their pre-pandemic level compared to earnings in three years’ time, then the report finds rents (for all tenancies) would see over 13 per cent price growth over that period (or 4.2 per cent a year on average), much faster than the 7.5 per cent growth in average earnings (or 2.4 per cent a year on average) forecast by the OBR over those years.

The Foundation warns this means there are significant housing cost rises yet to come for many renters over the next few years, and estimates of rental price inflation across all rental properties – rather than just new lets – will remain high for some time yet.

Reacting to the warning, Ben Twomey, Chief Executive of Generation Rent, said: “Renters have nowhere to hide from the housing crisis. It doesn’t matter what you’re earning: if your landlord thinks someone else would pay a higher rent, then they can demand more from you, and threaten you with eviction if you push back.

“Rising rents mean we have less to put aside for the future, and less to spend on actually living. As well as building more homes and giving enough support through the benefit system, the government needs to stop landlords raising rent beyond what we as tenants can actually afford.”

The report finds the cost of new tenancies has grown by 18 per cent since January 2022. This has had a big effect on families’ living standards, with the number of families privately renting almost doubling in a generation – from 11 per cent in the late 1990s to nearly 20 per cent today.

Private renting is also no longer the preserve of those in their 20s. The proportion of poorer families headed by someone aged 30-49 that are renting has almost tripled from just 11 per cent in the mid-1990s to nearly 30 per cent in 2021-22.

Calling on ministers to act to develop pro-growth tax measures so that the supply of rented housing meets the demand, Ben Beadle, Chief Executive of the National Residential Landlords Association, said: “As the report highlights, an increasing number of people at all stages of their life now rely on the private rented sector. However, with demand far outstripping available supply, there are an average of 15 prospective tenants chasing every rented property, double the pre-pandemic level.”

The Foundation also refuted popular arguments for what has driven the recent rent surge. The theory that rising interest rates have pushed up the cost of servicing Buy to Let mortgages – forcing landlords to pass on these costs to their tenants – ignores the fact that landlords’ ability to pass on higher costs is ultimately constrained by the wider rental market. If it were so easy for landlords to unilaterally choose to increase rents, they would likely have done so before 2022, says the Foundation.

There have also been scare stories about interest rate rises and tougher regulation sparking a mass exodus of landlords from the Private Rental Sector (PRS), reducing the supply of available homes. However, the Foundation’s analysis of Bank of England research shows that there has only been a very modest shrinking of the PRS since mid-2019, equivalent to just 1 per cent of the sector.

Cara Pacitti, Senior Economist at the Resolution Foundation, said: “Millions of families agreeing new tenancies across Britain have faced surging rents in recent years, as we have emerged from the pandemic. Those rises for new tenancies are starting to slow, but how much renters actually pay will continue to outgrow how much they earn for some years to come as those not yet exposed to higher prices are hit.

“With more families renting privately, and renting for longer too, these rent surges are a bigger problem for Britain, and require bolder solutions from policy makers. Short-term solutions include regular uprating of Local Housing Allowance to support poorer families, and the ultimate longer-term solution is to simply build more homes.”

A UK government spokesperson said: “Our Renters (Reform) Bill will give people more security in their homes and empower them to challenge poor practices. Through our long-term plan for housing, we are investing £11.5 billion in the Affordable Homes Programme and remain on track to build one million over this Parliament.

“We are supporting people with rising costs with £108 billion to help with bills – an average of £3,800 per household, and we have increased the Local Housing Allowance rate so private renters on housing benefit or universal credit are on average nearly £800 a year better off.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks